Labor ridiculed for throwing gender bias into tax battle

Labor’s new political battle against the income tax cuts — claiming gender bias — has been dismissed by Treasury.

Labor’s new political battle against the government’s income tax cuts — claiming gender bias because men will benefit more than women — has been dismissed by Treasury, ridiculed by leading business figures and blasted by Scott Morrison as “nonsense”.

Treasury deputy secretary Maryanne Mrakovcic told the Senate’s economics committee yesterday her department had not undertaken a gender analysis of the tax cuts because “we do actually see the tax system as gender-neutral”.

Small Business Ombudsman and former Australian Chamber of Commerce and Industry chief Kate Carnell said the gender pay gap was a serious issue, “but the tax system isn’t the way to deal with it”.

Businesswoman and former NRMA director Wendy Machin also warned against bringing gender into the tax debate: “Broadly, tax should be gender-neutral.”

Former BCA chief Tony Shepherd said raising gender in the context of tax cuts was “a red herring” and “just crazy”.

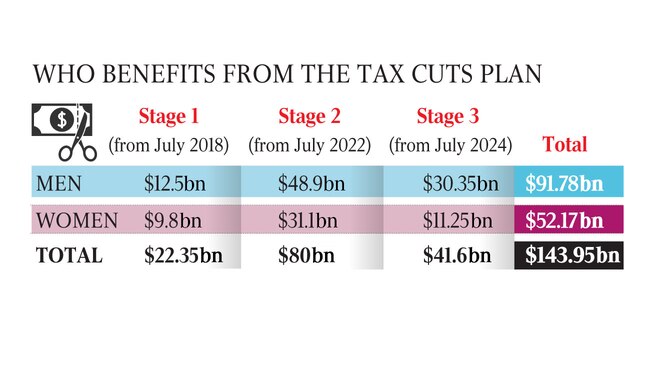

Parliamentary Budget Office figures released by Labor yesterday showed the benefits of the third phase of the government’s $143.9 billion tax plan would flow by a 3-1 ratio to men after taking effect in July 2024.

Opposition Treasury spokesman Chris Bowen said the package’s third phase would “overwhelmingly” benefit men, who would reap $30bn of the $41.6bn in savings from flattening the tax brackets at 32.5 per cent for incomes between $41,000 and $200,000.

The Treasurer said critiquing the government’s tax cuts on their gender impact was “an absolutely ridiculous proposition”.

“The tax system doesn’t discriminate by gender,” Mr Morrison said. “You don’t get pink forms and blue forms to fill out your tax return. That’s not how it works. They’re one colour, they assess one thing: what you earn, and you pay tax on what you earn.

“It’s just a nonsense of an argument.”

He said the more women moved into higher-paying jobs, the more tax they would pay.

Mr Bowen said Labor, which has vowed to close the gender pay gap if elected, asked the PBO to model the gender impact of the tax plan after Treasury revealed it had not done so.

“The Parliamentary Budget Office analysis shows the financial benefits of stage three of the package overwhelmingly flow towards men instead of women,” he said. “Now of course tax rates are not set on a gender basis. But of course we should be having regard to the impact of tax cuts on the economy and on women for whom the gender pay gap is already very significant.”

Labor assistant Treasury spokesman Andrew Leigh said: “As the party of equity, Labor knows this isn’t nonsense.”

Labor is also campaigning to remove the GST on sanitary products and has instituted a budget-in-reply speech for women.

Economics committee chairwoman Jane Hume, a Liberal senator, said 86 per cent of women earned less than $90,000, “which is where the government’s tax relief is focused the most”.

Economist Saul Eslake said a tax change that lowered tax on higher-income earners would favour men because they earned more. “Equally, you could say that Labor’s proposal to increase the top marginal tax rate discriminates against men,” he said. “All this simply reflects is the fact that women earn less than men, and we have progressive tax system,” he said.

Mr Shepherd said: “There is an issue with the disparity of wages between males and females in Australia, and there are many reasons, both historic and current, that contribute to that.

“But fundamentally the tax system and the tax rates are agnostic to the gender of the person they are taxing.”

Ms Carnell said the gender pay gap remained a problem. “The issue still is we have more men at the top of organisations, especially in the private sector, as well as in upper middle management,” she said.

Mr Bowen yesterday reiterated Labor support for phase one of the income tax cuts, urging the government to split its tax bill to allow tax relief for low and middle income earners from July 1. Mr Morrison said the government was committed to introducing the bill in its entirety.