Bill Shorten challenged over accuracy of tax grab claims

Bill Shorten has been challenged over the accuracy of several claims made over scrapping refunds for tax credits on shares.

Bill Shorten has been challenged over the accuracy of several claims he made in defence of Labor’s plan to scrap refunds for tax credits on shares, as economists suggested the shake-up will reduce the value of shares and dividends.

Amid deepening anger over the proposed $59 billion tax grab, the Opposition Leader attempted to further explain the policy but opened himself to criticism he had confused income tax with company tax.

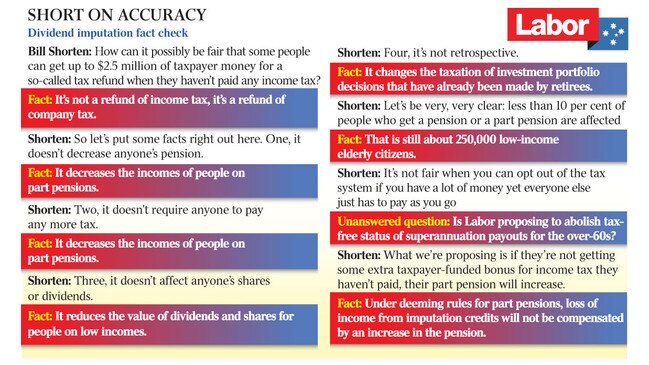

“We’re simply putting a marker in the ground and saying this: how can it possibly be fair that some people can get up to $2.5 million of taxpayer money for a so-called tax refund when they haven’t paid any income tax?” Mr Shorten said.

The cash payments returned to company shareholders with imputation credits do not refund income tax; instead they refund company tax to the individual shareholder in instances where the imputation credit on the dividend is more than the individual’s tax bill.

Sinclair Davidson, a professor of institutional economics at RMIT University, rejected Labor’s proposition the refunds were a form of taxpayer funded largesse. “The notion now that all of a sudden these people are getting money they are not entitled to is just wrong,” he said. “They are getting back their own money. So, in the same way PAYG taxpayers get a refund at the end of the year if they are paying too much, these people also get a refund ... That money actually belongs to the specific person getting the refund.”

Mr Shorten has also argued that individuals who miss out on refunds under the Labor policy would receive an increase in their part pension, but research from National Seniors Australia indicates some part-pensioners will be worse off. National Seniors Australia’s senior officer Basil La Brooy said: “Mr Shorten’s claim … that the part-pension would increase is incorrect.”

Mr Shorten argued the value of shares and dividends would not be affected by the shake-up and that the changes were not retrospective after lobby groups representing seniors and the self-managed super fund sector urged members to write to Labor MPs and vowed to turn the policy into an election issue. Both propositions were challenged by Professor Davidson, who argued the Labor policy would “reduce the tax component of the dividend the individual has received”. He also said it was misleading to say the changes were not retrospective because they changed the taxation of investment-portfolio decisions already made.

‘It’s very misleading because it will impact on decisions people have made in the past and it may also have an impact on share buybacks,” he said.

While Mr Shorten said fewer than 10 per cent of people who received a pension or a part pension would be affected, it means about 250,000 low-income elderly citizens could still be captured by the shake-up.