Banks urged to open home-lending books

Josh Frydenberg calls on banks to reignite “affordable and timely’’ lending after house prices had their worst year since the GFC.

Josh Frydenberg has called on the banks to reignite “affordable and timely” lending after new figures revealed national house prices suffered their worst year since the global financial crisis.

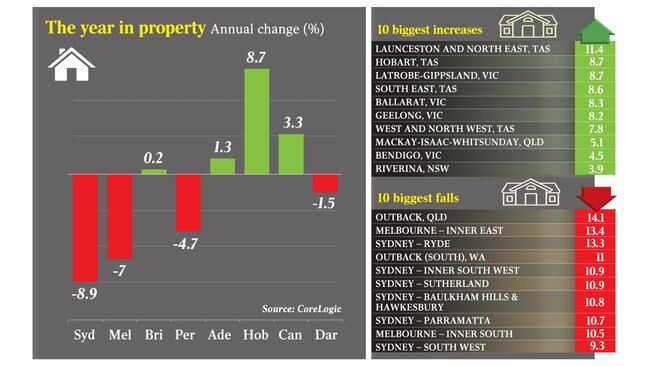

The dramatic slide in Australia’s biggest property markets — Sydney fell by 8.9 per cent, Melbourne by 7 per cent — has prompted warnings from leading economists that the Reserve Bank could cut official interest rates into emergency territory this year, in a bid to reboot economic growth.

The Treasurer seized on the CoreLogic figures released yesterday, showing a national dwelling price decline of 4.8 per cent in 2018, to renew his attack on Labor’s plans to curb negative gearing if it wins office.

Mr Frydenberg warned that the policy would have a “negative impact on confidence, especially among investors” and sharpen the housing market slide.

He also urged the banks to reverse their recent reluctance to lend to would-be home buyers.

“Targeted and short-term interventions from APRA in the housing market has, according to the RBA, ‘increased the resilience of the economy to future shocks’,” Mr Frydenberg said.

“However, now these interventions have been wound back, it is vitally important that the banks continue to provide affordable and timely access to credit. Keeping open their loan books to borrowers will help maintain the strength of the Australian economy.”

Treasury has warned that the property downturn could threaten the economy. Official economic growth forecasts were shaved back in last month’s mid-year economic and fiscal outlook following unexpectedly soft conditions in the second half of 2018.

The global economy is also facing headwinds from a simmering trade dispute between the US and China, the world’s largest economies, and uncertainty created by Britain’s attempts to finalise Brexit arrangements.

The Australian sharemarket slumped 1.5 per cent in its first session of the new year yesterday, having fallen almost 7 per cent over 2018 — the worst annual performance in seven years. And the dollar dropped US0.33c to US70.2c, its lowest level since January 2016.

Prospective home-loan borrowers are being frustrated by extended loan applications and tougher screening processes at the country’s major banks, after they were shamed over lending standards at the financial services royal commission. The Australian Prudential Regulation Authority’s figures for November show annual growth in housing credit slowed to 4.4 per cent, below the 10-year average rate of 8.1 per cent.

APRA last month scrapped its 30 per cent restriction on interest-only loans, declaring it had accomplished its mission of boosting the resilience of the housing market, although experts have questioned whether the removal of the lending cap will help revive a flagging credit environment.

RBA figures this week showed lending to property investors had fallen to its slowest rate since the Reserve Bank began collecting the data in 1990. Lending to owner-occupiers has also slipped to its slowest rate since the end of 2015.

Figures released yesterday showed that the big four banks all but turned the tap off for investor loans over the year ended November 30. Two lenders — the ANZ and Commonwealth Bank — shrank their investor housing exposure. APRA statistics show the total investor loan book of the big four banks was $471.4 billion compared with $471.1bn in the same month of 2017. There are signs banks could be prepared to dip back into the market.

Analysis for The Australian, collated by comparison site Finder, shows in the past two months CBA has reduced the rate on at least one investor loan product at subsidiary Bankwest, while Westpac has cut a raft of investor interest rates across its St George, Bank of Melbourne and BankSA loans.

Analysts warn weakening house prices could result in falling wealth, with a corresponding cut in spending that could dampen growth. “With a federal election likely to be held sometime in May, we may see a further negative impact on confidence, especially among investors who will be impacted by changes to taxation policy should there be a change of government,” CoreLogic head of research Tim Lawless said.

AMP Capital chief economist Shane Oliver said he expected the Sydney and Melbourne house markets, which account for more than half of all houses in the country, to fall a further 10 per cent over the coming year. He said tighter credit standards, more supply of housing after a construction boom, falling foreign demand for apartments and the uncertainty of Labor’s negative gearing and capital gains tax were adding stresses to the housing market.

Mr Oliver said the housing market situation was moving from FOMO (fear of missing out) to FONGO (fear of not getting out) and would force the RBA to cut interest rates to a record low of 1 per cent, down from its current level of 1.5 per cent, by December.

CommSec senior economist Ryan Felsman said he expected the RBA to hold interest rates steady over the coming year.