ATO hunts down multinational companies for $2.7bn owing

A taskforce has clawed back more than $2.7 billion in unpaid taxes from multinational companies operating in Australia.

A taskforce has clawed back more than $2.7 billion in unpaid taxes from multinational companies operating in Australia in just under a year since laws were passed to crack down on large-scale tax avoidance.

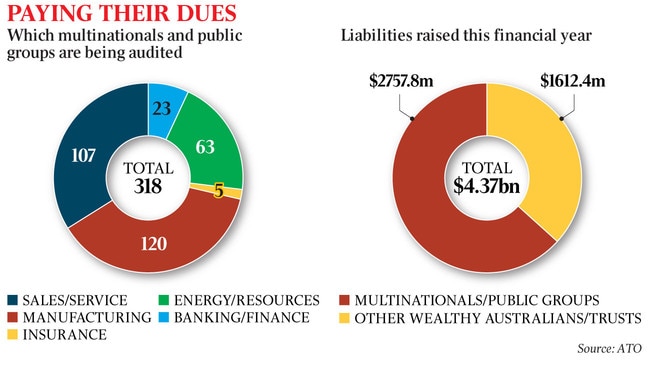

A total of 318 multinational companies are now under active audit or review by the Australian Taxation Office over potential tax avoidance, including banks, energy companies, insurance firms and manufacturers.

The crackdown, confirmed in the latest ATO data, reveals that a further 44 companies have moved their locally based sales revenues back onshore in response to the government’s Multinational Anti-Avoidance Laws passed last year. The ATO estimates the move will eventually return $7bn a year in annual sales income to the tax system.

One Nation leader Pauline Hanson has claimed the government’s failure to crack down on multinational tax avoidance was the primary reason for her change of heart on the government’s company tax cuts, which she has now vowed to block in the Senate when voted on this week.

“The government have said they’re not prepared to go after multinationals, therefore One Nation are no chance of supporting company tax cuts,” Ms Hanson said on Monday when ruling out her support.

The ATO data, revealed to The Australian following a request for official figures on multinational tax avoidance, reveal that the Turnbull government has done more to recover tax liabilities from global firms operating in Australia than any previous government.

The data, which covers the financial year up to May 31, shows $2.758bn in liabilities raised against multinationals and public groups that hadn’t been recovered before.

There were 68 audits covering 63 multinational corporations under way in addition to multinational anti-avoidance law and diverted profits tax reviews.

The states and territories are also reaping dividends from the commonwealth crackdown, with increasing GST revenue from companies forced to restructure to meet the new Australian tax law regime.

Approximately $461 million extra has been raised this year from global entities, almost double the previous year.

The unpaid tax recouped tops almost $4.5bn if high-wealth individuals, trust and complex and aggressive tax-avoidance schemes are included.

Tax commissioner Chris Jordan has claimed significant success in hauling in multinationals’ tax obligations but has argued that the difficulty with cracking down on multinational tax avoidance is securing international agreements.

“Australia is now regarded as leading the way on tax avoidance, having forced the issue of multinationals and the big global digital players onto the G20 economic summit agenda,” Mr Jordan said.

Scott Morrison said countries were now following Australia’s lead.

“The Turnbull government has done more than any previous government to make sure multinationals pay their fair share of tax,” the Treasurer said. “By contrast, not only did Labor look away when they were in government on multinationals paying tax, in opposition they even voted against our new laws to crack down on multinationals avoiding tax.

“Labor actually went into bat for the multinationals and tried to vote our new laws down.

“No thanks to Labor, this year more than $4.5bn in extra revenue from our new multinational laws is helping us to turn the corner on debt and get the budget back into balance.

“It means we can better support the essential services Australians rely on and support tax relief for all Australians into the future.”