ALP’s tax hike ‘would strangle economic growth’, experts say

Labor’s proposed $34bn tax hike over two years would drag down economic growth and sap consumer spending, experts claim.

Labor’s proposed $34 billion tax hike over two years would drag down economic growth, sap consumer spending and see the Australian dollar tumble below US65c, two economic experts have claimed.

The combination of Labor’s estimated annual tax increases of $17bn and spending increases of $3bn would slow growth by about 10 per cent over the next couple of years, according to a research note by Capital Economics.

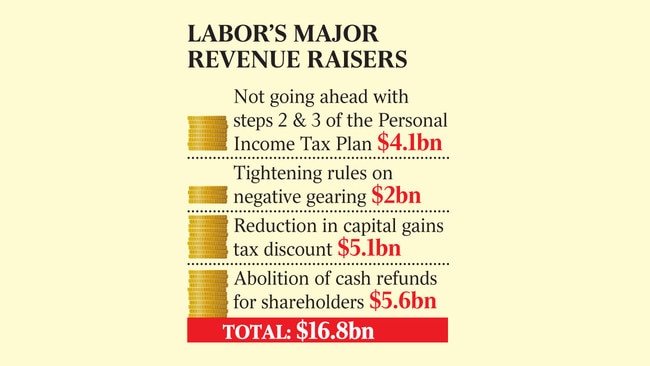

Capital has attempted to quantify the impact from a slew of revenue measures announced by Bill Shorten ahead of the party’s national conference, including the impact of scuppering the second and third stages of the government’s personal income tax plans in favour of its own tax cuts aimed at lower-income workers, grandfathering negative gearing rules, reducing the discount on capital gains tax and banning refunds for shareholders who don’t pay income tax.

The economists said wealthy Australians would bear the brunt of the tax reform package and as a result “may not change their spending behaviour much”.

“Labor’s proposals for a number of regulatory changes could worsen the investment climate and dampen business confidence, but we think their impact on economic growth would be small,” said Marcel Thieliant, Capital’s senior Australian and New Zealand economist.

“All told, a Labor victory would probably lead to weaker economic growth over the next couple of years.”

The research note, which was relayed to investors around the world on Tuesday afternoon, has already been rubbished by Labor Treasury spokesman Chris Bowen, who will write to Capital Economics and demand it corrects the errors and update their note. Capital has said there was a risk Labor could “restrict net migration even more severely” than the Coalition, which is not a Labor policy.

Capital Economics also claims “Labor has proposed a royal commission into the pricing policies of energy companies”, which is false.

It also claims Labor wants to increase spending on TAFE but has not specified the amount, whereas the numbers have been published alongside the announcements.

However, Mr Thieliant predicts a Labor victory at next year’s election and forecasts consumption growth, which has been the mainstay of economic growth in recent years, would fall by 0.3 percentage points in each of 2019 and 2020.

“Adding in the negative wealth effect from falling houses prices and still weak income growth, we expect consumption growth to slow from 2.9 per cent this year to 2 per cent in 2019,” it said.

Australia’s economy grew 3.4 per cent over the year to June, based on strong growth in household consumption.

“The experience from last year’s election in New Zealand suggests that a Labor victory may cause the Australian dollar to weaken even more than our existing forecast of a drop to US65c by the end of next year,” the research note said, adding such a drop would boost trade.

The local currency has fallen about 10 per cent already this year to US72c. House prices have already fallen under the Turnbull-Morrison government, down about 3 per cent across the board since mid-2017. The release of the note came as businesses revealed they were growing more nervous ahead of the election as uncertainties about the housing market, a trade war between the US and China, and volatility in oil prices affect the economic outlook.

IFM chief economist Alex Joiner said falling business confidence suggested “peak sentiment in the current cycle is now potentially behind us”. “Should this trend continue, there’ll be implications for the economic outlook and monetary policy,” Mr Joiner said, suggesting the Reserve Bank would be closely watching any further deterioration in the outlook.

Additional reporting: Michael Roddan