$5bn tax crackdown targets multinational technology giants

The tax commissioner reveals his blitz on multinationals has already reaped a $5bn windfall with billions more to come.

Tax commissioner Chris Jordan will initiate joint forensic tax audits with other countries’ authorities, in an unprecedented escalation of his crusade to ensure the world’s biggest companies, including Amazon, Google and Facebook, pay their fair share of tax in Australia.

In extensive interviews with The Australian, Mr Jordan reveals his blitz on multinationals has already reaped a $5 billion windfall in unpaid taxes for the Australian Taxation Office in just 16 months. He believes many more billions of dollars will come, and warns global giants to pay a proper amount of tax in Australia or face the consequences.

Mr Jordan’s crackdown on multinationals targets those who have used what he dubs “intellectual might” to attempt to intimidate the ATO into giving them lower tax assessments.

He accused some multinationals of attempting to “bamboozle” him with financial “fairytales”, and “trying to intellectually browbeat us” with “literally half a metre high reports” and “spaghetti diagrams” on whiteboards.

“They’d say: ‘Look, the world’s greatest experts say this works. Who are you as the tax office to challenge these experts?’ ” Mr Jordan said. “So they were trying to get us boxed into a technical analysis in a corner.”

He said of his new plan to launch co-ordinated investigations with authorities in Europe and around the world: “It’s a whole new way of doing things. There will be more real-time, multi-country projects and joint audits.

“You must pay the right amount of tax on the profits you earn here.”

Taking aim at the amount of tax that global giants paid in the past, Mr Jordan specifically decried the methods Google had used to structure its business to pay low tax in Australia.

He said the internet giant had previously declared so little income that it had been considered a small business for tax purposes at the time.

“At one point, Google wasn’t even in our large (company) market segment, because it didn’t turn over more than $250m a year (in Australia),” he said. “Absurd. They used to be looked after by the small and medium enterprises group.”

In a series of reports in coming days, The Australian will reveal Mr Jordan’s manifesto on the nation’s most important tax issues, and everything from breakthroughs against organised crime to radical changes at the ATO.

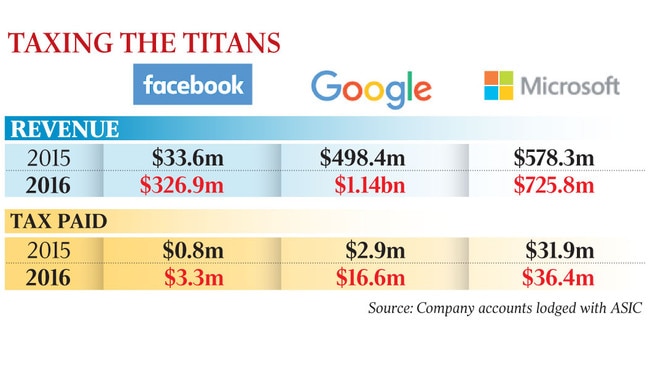

Global giants including Microsoft and Chevron have agreed to massive settlements with the ATO. However, others are continuing to dispute huge tax bills, including Google and Facebook, both of which have seemingly paid low levels of tax in Australia previously. For example, Facebook’s latest annual accounts lodged with ASIC for the 2015 and 2016 calendar years declared tax of just $814,000 and $3.3 million respectively.

Google paid just $2.9m in income tax in Australia in 2015 and $16.6m in 2016.

At the heart of most of the ATO’s disputes with multinationals is where the companies earned their revenues and profits.

Many of the global giants have previously claimed they had limited operations in Australia, using this to argue they should pay only limited tax here.

They instead booked income from their operations in low-tax regimes such as Bermuda or Singapore, even if sales were made in Australia.

Mr Jordan is now assessing sales by multinationals to Australian customers on a comparable basis to sales by Australian-based shopfront retailers, such as Harvey Norman and JB Hi-Fi.

As a result, some tech giants have started to restructure their affairs in line with Mr Jordan’s tough stance, backed by the federal government’s Multinational Anti-Avoidance Law. Microsoft, for example, had previously booked revenue for many of its sales in Australia in low-tax Singapore, but recently reached a settlement with the ATO under which it would book a higher proportion of sales — and therefore tax — in Australia. Mr Jordan said his crackdown on foreign multinationals had quickly achieved results. In the 16 months to the end of October, it had flushed out retrospective tax liabilities of $5.04bn from a swag of global giants operating in Australia. Nearly $1bn of this has been raised in the past four months.

Mr Jordan’s comments come ahead of the imminent launch by fellow internet and retailing giant Amazon in Australia. Tax experts privately believe the ATO is already scrutinising Amazon to ensure it will meet its tax obligations in Australia — with rumours Mr Jordan has dedicated a crack ATO team to investigate the group. Asked if his focus was on Amazon, the commissioner would not comment. But his answer to the question sent a clear message to multinationals, such as Amazon, preparing to set up in Australia.

“We are actively addressing multinational tax avoidance and continue to have real-time engagement with all large taxpayers,” he said. “We have access to a wide range of data, including tax return and accounting records, and third party data.”

There is friction between the ATO and some of the online giants. A copy of Google’s annual Australian accounts lodged with ASIC in April stated that the company had been “issued amended income statements” by the ATO.

“The company will lodge an objection and make a payment to the Commissioner of Taxation to stay recovery action, consistent with the ATO’s practice,” the accounts stated. “This does not change the company’s position.”

Facebook’s vice-president of tax and treasury Ted Price told a Senate economics committee inquiry on corporate tax avoidance in August that it had been audited for most of the eight years it had done business in Australia.

Mr Jordan, who is also chairman of the world’s anti-tax avoidance initiative, the Joint International Taskforce on Shared Intelligence and Collaboration, said multinationals could expect new investigations to ensure they were paying their fair share of tax in Australia. “A number of countries will audit a company at the same time,” he said.

Asked whether joint audits could pose a risk to Australia’s revenue gains from multinationals, given other tax authorities would also want their cut, Mr Jordan replied: “No. Everyone will win.”

Mr Jordan said the ATO had made its big breakthroughs by directly interviewing multinationals’ clients and salespeople, despite the global giants’ protestations.

“They complained that no one ever interviews their clients,” he said. “ ‘Why would you do that?,’ they said. Then I said: ‘Go and look at their salesmen’s requests for a bonus each year because salesmen get a base and a bonus for origination of sales. When we asked for it, they said no one has ever asked for this information. But we can ask what we like.”

Mr Jordan said this relentless approach was paying dividends. Even Google and Facebook, while still in dispute with the ATO, were now restructuring to book some of their sales in Australia. The Australian understands that as of the end of October, 36 multinational entities have restructured or intend to restructure their affairs to be compliant with the MAAL, including Google and Facebook.