$1bn increase in company tax take boosts the case for reform

New figures show booming tax revenue is helping to curb the hit to the budget from planned company tax cuts.

The government has seized on new figures that show booming tax revenue, especially from businesses, is helping to curb the hit to the budget from the final leg of its plan to cut company tax.

Finance Minister Mathias Cormann brought forward the release of the figures, showing $1.1 billion more in company tax collections this year than forecast in the May budget, in a bid to convince crossbench senators to pass the government’s 10-year enterprise tax plan.

The latest monthly account figures, released by the Finance Department, showed company tax collections were $9.2bn higher than forecast back in late 2016. “We’ve now generated $9.2bn in additional revenue since the budget update after the 2016-17 election, which takes a big chunk out of the cost of the $35.6bn for the remaining unlegislated business tax cuts,” Senator Cormann said.

The government is making heightened efforts to persuade Pauline Hanson and other holdout senators to pass the government’s plan to cut the company tax rate to 25 per cent for all businesses, a policy blocked by the Senate since it was proposed in the 2016 budget.

The government is confident that corporate tax revenues will reach $87.8bn this financial year, compared with the $78.6bn forecast in late 2016.

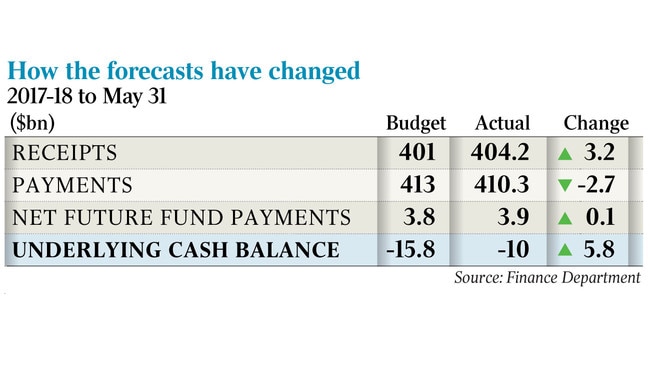

The new figures also showed the budget was on track for a smaller overall deficit than the $18.2bn pencilled in for this year in the May budget. Over the 11 months to the end of May, the deficit was only $10bn. “This shows the importance of stronger growth, more jobs and strong anti-avoidance measures to the budget bottom line and to help us pay for important social, health and other services,” Senator Cormann said.

Total government receipts in the first 11 months of this financial year were about $3bn higher (including $2.2bn more in personal income tax), and payments about $3bn lower, the latest in a series of upward revisions to government finances that began in late December.

Senator Cormann told parliament the ATO’s tax-avoidance taskforce had clawed back $2.7bn in unpaid taxes from multinational companies in Australia. He revealed $460m in extra GST revenue would be collected this year as a result of multinational firms’ restructuring in response to a series of crackdowns on corporate tax avoidance which began in late 2015.

“The extra tax is mainly coming from big business on the back of stronger economic growth than had been assumed, and the on the back of strong anti-avoidance measures,” Senator Cormann said. “It proves being serious about going after multinationals is good for revenue.”

The Institute of Public Affairs yesterday ramped up its criticism of Labor’s new policy to reverse legislated company tax cuts for businesses with $2m to $10m. It released analysis based on ABS data showing businesses with turnovers of between $10m and $50m employed 1.57 million workers.

“The United States corporate tax rate is now 21 per cent, Britain is at 19 per cent, and, in our region, Singapore’s rate is 17 per cent, and Hong Kong is 16.5 per cent,” said IPA research fellow Matthew Lesh.

“It’s no coincidence that the Australian economy is stagnating while the rest of the world is growing.Higher corporate tax means less investment, lower wages, and fewer jobs.”