$4.1bn GST hit to state coffers

THE Victorian budget has sustained a savage $4.1 billion cut in GST revenue from the commonwealth government, leading to soaring debt.

THE Victorian budget has sustained a savage $4.1 billion cut in GST revenue from the commonwealth government, leading to soaring debt, and it has no plan to address the structural problem in the longer term.

The downward revision to the operating surplus reflects the deterioration in Victoria's revenue forecasts, primarily driven by a reduction in GST revenue.

The budget papers say the GST "shock is similar to that observed during the global financial crisis".

The papers also reveal that the budget position continues to rely on temporary grants from the commonwealth to generate operating surpluses.

"Over the medium term there will be a need to rebuild surpluses to fund necessary infrastructure and provide a buffer for future economic and fiscal shocks," the budget papers say.

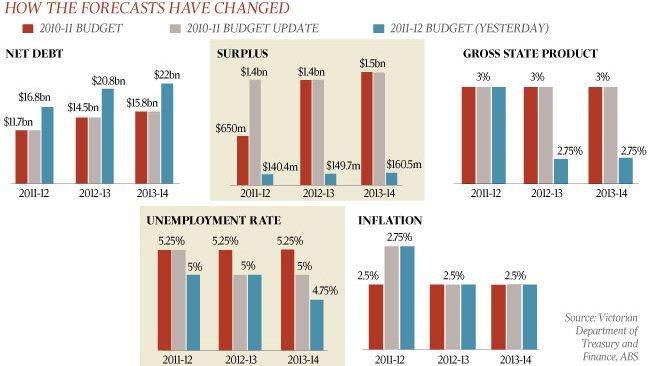

The Coalition's first budget revealed net debt would jump by $7.5bn, higher than previously forecast.

The budget exposes the underlying vulnerabilities in the government's fiscal position.

The new Coalition government said it would deliver a surplus each year of a minimum of $100 million, with average surpluses of $164m over the forward estimates.

But Treasurer Kim Wells conceded that for 2011, the debt would be $11.9bn, rising to $16.8bn in 2012 and massively soaring to $23.1bn by 2015.

Mr Wells said the government would have to borrow to pay for its expensive election promises, with debt set to grow from 2.6 per cent to 5.9 per cent in the next two years.

GST revenues have been reduced by $4.1bn over five years as a result of the Commonwealth Grants Commission's assessment to cut Victoria's share of the GST, and a slowing national economy.

Forecast expenditure growth has been lowered, with spending over the forward estimates period now expected to grow by an average 3.2 per cent a year, compared with 8 per cent a year over the past decade.

The government said the final report of the Independent Review of State Finances would provide advice to the government on a strategy to deliver surpluses over the medium term.

There is some good news for the government, with payroll tax revenue estimated to be $4.7bn, an increase of $320m, or 7.2 per cent, over the revised 2010-11 estimate.

The budget papers reveal that both job advertisements and vacancies suggest a strong labour market with continuing increases in employment and wages. The Labor opposition said the budget had failed many of the tests Premier Ted Baillieu and Treasurer Kim Wells set themselves following the Vertigan review of the state's finances.

Labor's Treasury spokesman, Tim Holding, said the report recommended zero debt over 10 years, but debt was set to rise in the budget. He said the Vertigan report recommended the surplus be used to fund future infrastructure investments. "Under this budget, the state surplus is actually going to fall to precariously low levels: $160m in the next financial year. That is a dangerously low level," he said.

"In fact, a 1 per cent rise in interest rates would see not just the surplus eliminated but it would see the budget actually go into deficit."

The Australian Industry Group yesterday said it welcomed the commitment of the new government to running operational surpluses over the forward estimates and "we support the modest increase in debt to finance productivity-enhancing, inter-generational infrastructure that will boost capacity and amenity in the state".