Shorten policy rewrite to slug self-sufficient

Labor’s revised crackdown on refundable tax credits is set to hit self-funded retirees.

Labor’s revised crackdown on refundable tax credits is set to hit self-funded retirees, with new warnings it will leave some self-sufficient couples thousands of dollars worse off than those who claim a part-pension.

Malcolm Turnbull used question time to attack the Labor backdown, discrediting claims that all pensioners would be carved out from the tax crackdown under Bill Shorten’s revised “pensioner guarantee”.

Labor has overhauled its policy to ensure that 300,000 people with individual shareholdings who receive the Age Pension, disability support pension, carer payment, parenting payment, Newstart and sickness allowance will no longer be hit by its decision to scrap refundable tax credits on shares.

But under the revised policy, only about 13,000 existing pensioners with self-managed funds will be exempt from its tax crackdown. All self-funded retirees who move on to the age pension after today will still be captured.

The Prime Minister seized on the inconsistency in parliament, saying pensioners with self-managed super funds would still have their refunds scrapped.

“They have said that no pensioner will be affected. Completely and utterly untrue,” Mr Turnbull said. “It’s another example of the shambolic policy on the run from an economic team that has one bungle after another.”

Opposition Treasury spokesman Chris Bowen also used an ABC radio interview to confirm the Labor policy would grandfather the existing arrangements in relation to pensioners drawing on self-managed super funds to supplement their income. “Where you have a self-managed super fund with a pensioner recipient, we have grandfathered that,” Mr Bowen told ABC radio.

Mr Shorten argued the revised policy was in keeping with his commitment that pensioners would “always be protected” under Labor, arguing he had listened and responded to criticism.

“I am grateful for some of the pensioner groups that have spoken to us, and so what we have done today has made a good policy better,” he said.

The effect of the changes will see the policy raising $10.7 billion over the forward estimates instead of $11.4bn, and $55.7bn over the decade instead of $59bn.

John Maroney, the chief executive of the Self-Managed Super Fund Association, said the amended policy would exacerbate the effect of the tax crackdown on self-funded retirees.

“There will be no protection for SMSF retirees who may need part government support ... creating an unfair, two-tiered and complex treatment of SMSF members who access the Age Pension,” he said.

He also warned the policy could leave some SMSF members worse off than those with less savings.

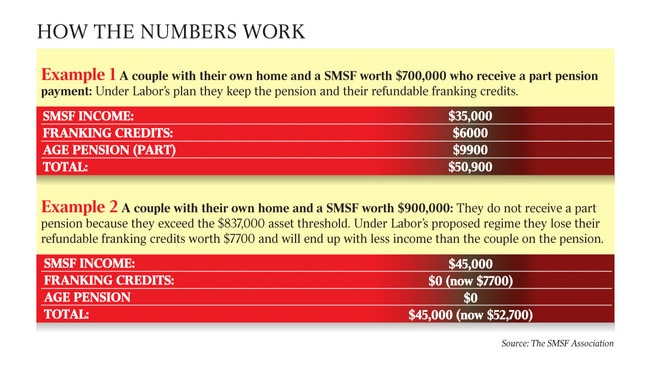

He cited the example of a homeowning couple with a self-managed super fund of $900,000 currently drawing an income of $45,000 a year before receiving their franking credit refund.

He said the revised policy could leave them worse off than a homeowning couple with a self-managed super fund of $700,000 drawing an income of $35,000. This is because the couple with a $900,000 SMSF are ineligible for the part pension, given they hold assets in excess of the cut-off threshold of $837,000.

Under Labor, they would be denied their refundable franking credits worth about $7700 — reducing their income from $52,700 to $45,000. The couple with a $700,000 SMSF are still eligible for a part pension of $9900 and would keep their franking credit refund of $6000 — pushing their income to $50,900.