Revenue surge puts Coalition $30bn in the black

An unexpected budget bonanza has doubled the projected surpluses over the next four years to more than $30 billion.

An unexpected budget bonanza has doubled the projected surpluses over the next four years to more than $30 billion in a dramatic improvement to the bottom line in what the Coalition will today claim is the best set of numbers since the final year of the Howard-Costello government.

The Australian understands that next year’s long-awaited return to surplus for 2019-20 will be revised up in today’s budget update from a wafer thin $2.2bn to just over $4bn following significant cuts in spending and higher company tax revenues.

This is forecast to snowball over the current forward estimates to reach accumulated surpluses of $30bn by 2021-22, which is twice the projected aggregate of $15.3bn revealed in the last budget.

The turnaround for the government, which inherited $123bn in cumulative deficits from the previous Labor governments when it came to office in 2013, paves the way for an unexpected and sizeable war chest ahead of the April 2 budget and the May election, which could be used for further tax relief.

The mid-year economic and fiscal outlook will reveal radically lower spending numbers this financial year. which are believed to be worth up to $9bn and include major savings in welfare payments.

The Australian understands this includes $1.1bn in additional savings from fewer dole payments due to high employment growth and people going from welfare and into work. This is on top of the existing savings of $721 million over the forward estimates revealed in the May budget. Josh Frydenberg will confirm that the budget deficit in 2018-19 will be at its lowest level since 2007-08 — the last time a budget surplus was recorded.

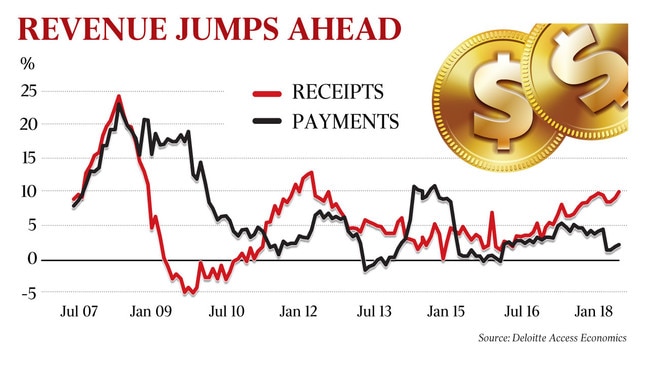

The Treasurer will announce the expected budget deficit for the current 2018-19 year of $14.4bn will be cut by more than half, in line with monthly financial statements that have shown significantly higher revenue and improved spending restraint.

The Australian understands the deficit for the current year could come in as low as $5bn, which will deliver the higher-than-projected return to surplus next year.

The shortfall in welfare spending is likely to cover the cost of new spending announcements since the May budget, including the school funding package, costed at $4.6bn over a decade, and the GST deal for Western Australia, which could cost up to $9bn over a decade. Analysts expect the strength of tax revenue will give the government the latitude to spend up to $9bn a year in tax cuts or new spending programs ahead of next year’s election, although major new commitments are not expected in the budget update.

“As the Prime Minister has made clear, next year we will deliver a budget surplus — the first in a decade,” Mr Frydenberg said ahead of the update.

“This will be achieved without increasing taxes and while providing the essential services that Australians rely on and investing in the critical infrastructure that Australia needs.

“Our economic fundamentals are strong, with the unemployment rate down to 5 per cent, economic growth faster than all G7 nations except the United States, and our AAA credit rating reaffirmed.

“As a result of our disciplined budget management, real growth in government spending under the Coalition government is averaging 1.9 per cent per year — its lowest level for any government in 50 years.

“A strong economy means we can deliver tax relief for individuals as well as small and family businesses. It also means we can deliver the essential services like healthcare, disability support, aged care and schools which Australians rely on.

“We are able to do this without raising taxes. In contrast, Labor plans to slug $200bn in taxes on your income, your property, your savings and your electricity.”

The mid-year update will also show employment grew by 308,100 people over the year to last October, contributing to the lowest proportion of people of working age on welfare in 25 years.

The Department of Finance has been having difficulty costing a range of the most expensive programs, including the National Disability Insurance Scheme, age pensions, family tax benefits and unemployment benefits, which have all cost much less than was estimated in the May budget.

The NDIS has been difficult to cost, because it is a new program that depends on the readiness of third-party providers to deliver the funding. However, a former Finance Department official speaking on background said the errors in costing programs such as the age pension, which was overstated by $900m, were much harder to understand.

Treasury attributed the shortfall to the lift in the retirement age to 67 years by 2023, however the tightening of the age pensions assets test has also been affecting more people than anticipated.

Major over-estimates in the cost of family tax payments ($800m) and unemployment benefits ($330m) are partly explained by improving economic conditions. Only two-thirds of NDIS commitments are being taken up, with figures for the September quarter showing little more than 50 per cent of budgeted funds had been spent.

The final report for 2017-18 showed spending was $2.5bn less than anticipated.

The May budget figures were compiled on the basis of actual spending in the first six months of the 2017-18 financial year, and analysts expect the shortfall which came to light when the final budget outcome was completed in September, will carry through into the current financial year.

Deloitte Access Economics partner Chris Richardson said the government would have the scope to include other planned election commitments that are yet to be announced in the contingency reserve. This would have the effect of making this year’s deficit larger and next year’s surplus smaller, but would keep Labor in the dark about what funds are available.

“Ahead of an election, the contingency reserve has the potential to be a handy refrigerator to keep things fresh,” Mr Richardson said.

Mr Richardson said the budget was about 0.5 per cent of GDP better than expected as a result of a stronger nominal economy, equivalent to $9bn to $10bn, which could be distributed between tax cuts, offers to marginal electorates and improvement in the surplus.

AMP chief economist Shane Oliver said there was a danger that windfall tax revenue from higher commodity prices and strong employment growth might prove temporary.

“A lot of the improvement in the budget has come from higher commodity prices. If China’s economy continues to slow, it is hard to see the iron ore price holding up,” he said.

Dr Oliver noted that employment growth was also starting to slow, while Treasury would be under pressure to lower its forecast for wage growth, which the budget predicted would reach 2.75 per cent this year and 3.25 per cent next year. The latest report shows private sector wage growth remains stuck at 2 per cent.

Former Labor treasurer Wayne Swan said he did not give the government any credit for the surplus, and put down the budget’s improved position to increased revenue.

“The economy has been far weaker than it should have been over the past five years. Revenues have increased since 2013 by $100 billion,” he told ABC radio this morning.

“Revenues have been depressed basically since the end of 2007 ... that’s the impacts of the aftershocks of the global economic crisis.

“It’s not because of the good work of the government at all. It’s not because of expenditure restraint.”

Mr Swan, now national president of the Labor Party, repeatedly projected surpluses when he was Treasurer from 2007 to 2013, but failed to achieve them.

Opposition assistant treasurer Andrew Leigh dismissed the projected surplus and said Mr Frydenberg was “promising” a surplus, not delivering one.

“This is a government which came to office in 2013 promising that there would be surpluses in their first year and every year after that. They haven’t delivered a single surplus,” he told Sky News.

“They castigated Wayne Swan because he promised a surplus which then didn’t materialize because the economy was whacked with the biggest downturn since the Great Depression.

“Now they say they’re delivering a surplus. Well, they’re not. They’re promising a surplus. Yet again, as they did before the election.”

Additional Reporting: David Uren