Queensland election: payroll tax relief the key to creating jobs, says LNP

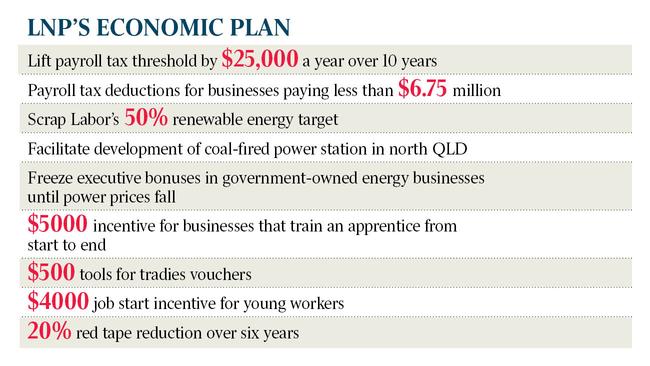

A $25,000 increase in the payroll tax threshold every year for 10 years is at the centre of LNP’s employment policy.

A $25,000 increase in the payroll tax threshold every year for 10 years is at the centre of the Liberal National Party’s bid to tackle unemployment and boost Queensland’s small businesses.

Scrapping Labor’s 50 per cent renewable energy target, facilitating development of a coal-fired power station in north Queensland and providing generous grants to businesses that employ young workers bookend the party’s plan to create 500,000 jobs in a decade.

LNP leader Tim Nicholls wasted no time yesterday releasing the party’s economic blueprint for lowering the cost of living and creating jobs on only the second day of a four-week campaign.

Lifting the payroll tax exemption threshold by $250,000 across 10 years is the centrepiece of the policy, which would ultimately see the limit increase from $1.1 million to $1.35m. Medium-sized businesses with payrolls of up to $6.75m would receive a deduction.

Unveiling the blueprint in a Loganholme hardware store in the marginally Labor seat of Springwood, Mr Nicholls was quick to say large corporations would still pay payroll tax at the full rate.

He said 4000 small businesses would benefit in the first year by being pushed below the threshold, while another 10,000 businesses would qualify for deductions.

“This is about giving confidence to the small-business sector that you can employ someone else and not end up having to pay more tax for employing that person,” he said. “This is about helping … Queensland small business employ more people or maybe give staff a pay rise.”

Mr Nicholls said the policy would cost the budget $100m across the first four years, increasing to about $550m across 10 years.

He would not say where the money would come from but promised more would be revealed during the campaign.

The LNP also pledged to tackle youth unemployment and get 20,000 young Queenslanders into work by giving businesses $4000 grants to employ young workers and $5000 incentives to train apprentices from start to finish.

“We will create jobs and grow the economy by cutting taxes, delivering cheaper electricity, building the infrastructure Queensland needs, getting young people into work and unleashing the potential of the private sector,” he said.

“The LNP will deliver on our 500,000 jobs target through our comprehensive policies for Queensland’s six economic drivers: tourism, agriculture, resources, construction and manufacturing, services, science and technology and education.

“Lowering taxes for families and businesses is at the core of the LNP’s economic plan.”

The blueprint pledges a 20 per cent reduction in red tape over six years. Mr Nicholls appealed to the party’s ideological roots by promising to run a government that would “make decisions and get out of the way and let the private sector do its thing”.

Mr Nicholls said the party’s buy-local program would ensure a price-match guarantee for Queensland businesses based in the regions where work is to be done. He also ruled out changes to vegetation-management laws.

In a bid to drive down electricity prices, the LNP will freeze executive bonuses in government-owned energy businesses until power prices fall.

Labor Health Minister Cameron Dick said Mr Nicholls had broken a similar promise to increase the payroll tax threshold when he was treasurer in the one-term Newman government.

But Mr Nicholls said the commitment was clear. “I don’t pay much attention to Cameron Dick and neither does the Labor Party from what I can gather,” he said. “While I was treasurer I delivered the first increase to the tax-free threshold by $100,000 and it was Labor who cut the program.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout