Iron and coal to deliver surprise budget bonanza

Iron ore alone is likely to boost tax revenue by as much as $2 billion this year.

Soaring commodity markets will enable the government to deliver a much better budget bottom line than forecast in the December budget update, with iron ore alone likely to boost tax revenue by as much as $2 billion this year.

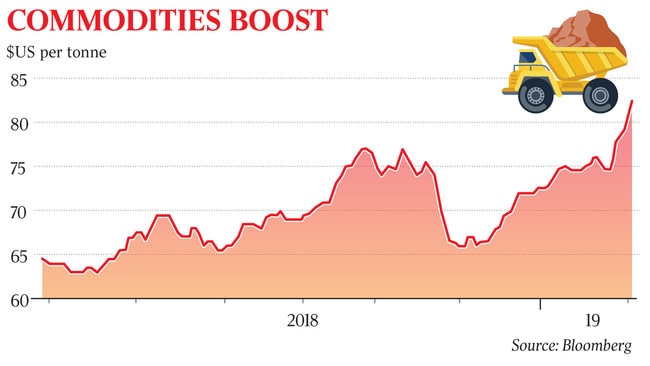

Spot prices for iron ore are expected to hit $US100 a tonne this week, as the closure of Brazilian mines in the wake of the latest tailings dam tragedy leaves the world market short of quality supplies.

Treasury had counted on the iron ore price holding at $US55 a tonne excluding freight costs, which add a further $US6 a tonne.

“Commodities are the happiest story of the last couple of months since the mid-year budget update,” Deloitte Access Economics partner Chris Richardson said.

Mr Richardson said he believed the Coalition government was likely to use some of the gains from the commodity prices surge to finance cash hand-outs ahead of June 30.

“Will there be handouts of some description? I’m comfortable the answer there is ‘yes’, although it remains to be seen exactly what they’ll do,” he said.

“I don’t think they’re going to die wondering, so the budget will be leant on.”

The mid-year budget update included an estimate that every $US10 increase in the iron ore price would add $1.2bn to this year’s company tax receipts and a further $3.6bn in 2019-20.

Commonwealth Bank commodities analyst Vivek Dhar said while the price spike to $US100 would be short-lived, he expected prices would average about $US87 over the six months to June, or $US35 a tonne better than Treasury predicted.

Over a six-month period, that should add about $2bn to Treasury revenue in this financial year. Mr Dhar expects prices to remain elevated at about $US77 over the six months to December, delivering further budget gains in 2019-20.

Prices for coking coal are also far above Treasury forecasts. Treasury anticipated they would be falling through the first half of this year, dropping from the December peak of $US235 a tonne to $US120 a tonne by the September quarter.

Mr Dhar said while the price had dropped to a low of $US189 by late January, it had since recovered to $US204 a tonne.

He said the outlook was uncertain, with the nature of an apparent Chinese ban on Australian metallurgical coal being landed at Chinese ports yet to be clarified, but prices were likely to remain close to $US200 throughout this year.

Treasury estimates that every six-month delay in the fall of metallurgical coal prices to $US120 a tonne is worth $1.2bn to company tax receipts in the next two years.

Mr Richardson said he expected coal would be a bigger boost to the 2018-19 budget receipts than iron ore.

He noted that December company tax receipts were almost $400 million ahead of the forecast.

The mid-year budget update predicted a budget deficit of $5.2bn this year, with a $4.2bn surplus in 2019-20.

The update included a $9.6bn provision for tax cuts over the next four years that are yet to be announced, while there is an expectation government will use some of the commodity price windfall for a one-off cash handout ahead of June 30 this year.