Unions amass $1.5bn war chest as membership falls

The largest trade unions have amassed a war machine totalling more than $1.5bn in assets, despite declining membership.

The nation’s largest trade unions have amassed a political war machine totalling more than $1.5 billion in assets and a combined income stream estimated at $900 million a year, despite a continuing decline in their membership base.

The first comprehensive analysis of union financial records has revealed the real wealth of the Labor Party’s industrial wing, now largely funded through “rivers of gold” from superannuation funds and workers’ entitlement trusts.

At the same time, official data from 1990 until last year confirms the continuing decline in the number of union members, whose fees unions once relied on to fund their operations. Membership has fallen to just 10 per cent of the private sector workforce.

The stark disparity reflects a trade union movement no longer reliant on its membership base as its chief financing source. Large amounts of income now flow from various industry worker entitlement trusts, which combined are worth more than $2bn.

Financial records lodged with the Fair Work Commission reveal that the asset wealth of many of the leading unions has grown by up to 160 per cent since the mid-2000s. Incomes have more than doubled for many of the larger organisations to reach more than $100m a year.

The figures were compiled by Employment Minister Michaelia Cash, drawing on the unions’ annual returns to the FWC.

The CFMEU, now arguably the most powerful left-wing campaign arm of the Australian Labor Party, has an accumulated asset base of $206m, with a yearly income stream of $123m, putting it well within comparable fortunes of mid-ranking top 500 listed private companies in Australia.

Among the most cashed-up unions after the CFMEU are the Communications Electrical and Plumbing Union, the Shops Distributive and Allied Employees Association, the Australian Workers Union, the Maritime Union, the National Union of Workers, United Voice, and the Australian Metal Workers Union. Combined, those seven unions represent $340m in assets and $587m in total annual income as recorded in the 2015 financial year.

The CFMEU, which has seen its asset value increase from $139m in 2006 to $206m in 2016, financially outperforms the Australian operations of companies such as American Express, Ralph Lauren and Fuji Xerox.

As registered organisations, unions, unlike companies, are exempt under section 50-15 of the Income Tax Assessment Act 1997 from paying income tax. At the same time that unions’ assets are growing, Australian Bureau of Statistics analysis confirms the sinking membership base of the trade union movement, down from 30.8 per cent in 1990 to just 10.4 per cent of the private sector workforce.

Union coverage of the public sector has been cut in half over the same period, from 66.8 per cent in 1990 to 35.8 per cent last year.

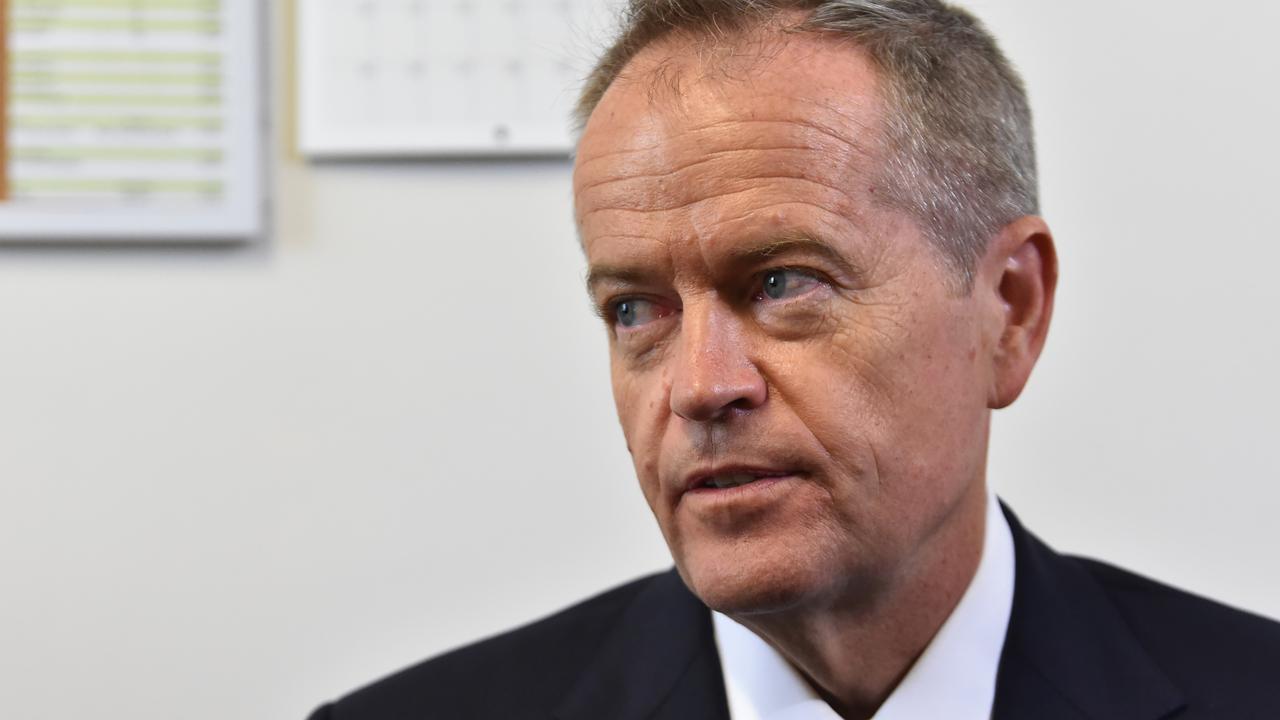

The National Union of Workers, between 2007 and 2015, suffered a decline in its membership of 18 per cent while, according to FWC lodgments, its net assets grew by 32 per cent to $41m in 2015. Similarly, the Australian Workers Union has seen its assets grow by 160 per cent and annual income double since Bill Shorten was national secretary in 2003.

The AWU now earns $47m a year, while over the same period it has suffered a 15 per cent decline in members.

In 2003, the Cole royal commission found that union redundancy funds, which are not governed under the same prudential regulations that cover superannuation funds, were worth $500m.

Since then, the worker benefit funds, which pay income streams to unions as well as a small number of employer groups, have grown to an estimated value of about $2bn.

Senator Cash has signalled possible changes to tighten rules around the operation of unregulated funds that pay income streams to unions.

“The Labor Party and their union masters are fond of attacking the ‘big end of town’,” Senator Cash said.

“It is now quite clear that unions are the big end of town themselves. Large unions have focused their attention on growing the wealth of their organisation rather than representing the best interests of workers.

“This is evidenced by the marked growth in the wealth of these unions, during a period when their membership numbers have decreased significantly.

“Deals brokered by current and former union officials, including Bill Shorten, have delivered large financial benefits to the union at the expense of honest union members. Unions are now substantial money making businesses in their own right.

“Sadly, many unions now seem to view making money for themselves and the Labor Party as more important than honestly representing workers.”

According to the ABS data, the total percentage of workers who are members of a trade union, including both private and public sectors, has fallen from 40.5 per cent in 1990 to 14.5 per cent last year.

ACTU secretary Sally McManus said unions were “regularly under political attack”, fuelling “inequality”.

“It is in the best interests of our members that we plan for the future,” Ms McManus said.

“Currently we are waging a huge campaign to address inequality which has been allowed to reach record levels over decades of failed neo-liberal policies.”