Board fees for unionists cost super funds $5.4m

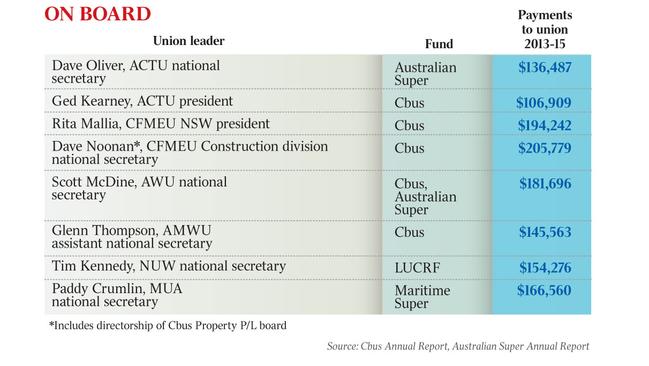

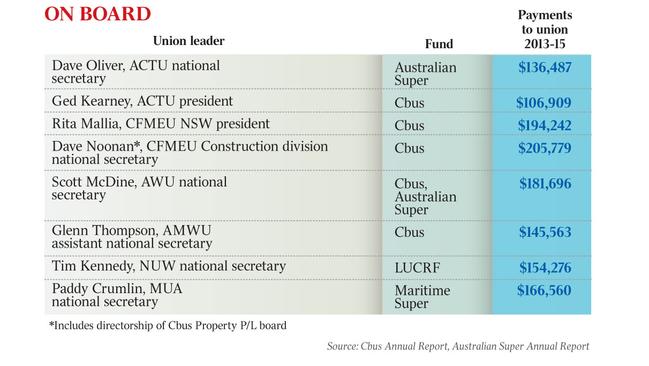

Unions have reaped $5.4m from super funds over the past two years through board spots for officials.

Unions have reaped $5.4 million from industry super funds over the past two years by giving high-ranking officials spots on governance boards, in a practice slammed as “undesirable” by one of the nation’s leading financial experts.

The ACTU, Construction Forestry Mining and Energy Union, Australian Workers Union and the Maritime Union of Australia were among those paid by Australia’s biggest industry super funds through non-executive directorships for prominent officials, fund records revealed.

Construction industry fund CBUS delivered the biggest payday of $927,940 to the CFMEU, the AMWU manufacturing workers union, the CEPU communications union and the ACTU in 2014-15.

Coalition plans to bolster independence on the boards of industry super funds were defeated this month after an ACTU campaign swayed key crossbenchers ahead of a Senate vote.

But The Australian’s analysis of fund records shows CBUS paid the ACTU $106,909 from members’ funds for president Ged Kearney to attend board meetings. The nation’s biggest super fund, Australian Super, paid $800,000 to five unions, including $136,487 to the ACTU for Dave Oliver’s spot on the board.

CBUS also paid $205,779 to the CFMEU for construction union national secretary Dave Noonan to attend board meetings over the past two years.

The payments to unions by super funds were not disclosed during calls to 50,000 voters in marginal seats, paid by the ACTU, urging them to lobby senators and MPs against the government’s proposals.

Former Future Fund chairman David Murray, who chaired the federal government’s Financial System Inquiry, said there were concerns about the suitability of union officials acting as non-executive directors on the boards of multi-billion-dollar funds.

“Investment is complex stuff and if they’re to supervise the management of the board people have to be of sufficient calibre. If they’re appointed on representative grounds, you can’t guarantee that is the case,” he said.

“The reason the Future Fund’s board is independent of the government is because people would be resistant to the idea that the government would seek to influence the commercial sector.”

He added that, despite recent disclosure rules compelling industry super funds to disclose who receives payment for directorships, members might not know that the directors were union officials and fees paid for their service went back to the unions.

“The governing body is not appointed by the members,” he said. “The members have no say in anything … It’s not desirable at all.”

Mr Murray also said the practice of paying fees to employers — which employer groups such as Ai Group and Master Builders Australia also benefit from — could cause problems with liability for investment risk.

Assistant Treasurer and Small Business Minister Kelly O’Dwyer said the payments to the ACTU cast a shadow about the ACTU’s campaign against the measures to bolster the independence of super fund directors.

“It would be concerning if pecuniary self-interest had been put ahead of members’ interests in the recent campaign by industry funds to derail minimum governance standards across retail, corporate, industry and public sector superannuation funds,” Ms O’Dwyer told The Australian.

The ACTU said fees were “compensation for (directors’) time and work”, adding that the “unrivalled record” of industry fund performance was the “most appropriate test for the skills of the board”.

“To the best of our knowledge, APRA has never raised a problem with the manner in which skills are fulfilled on an industry fund board,” it said. It added that it did not disclose to voters that it received payments because “there is no conflict of interest and the information is made public in annual reports for members to access”.

CBUS paid a comparatively small $179,545 to building industry employer group Master Builders Australia for its chief executive, Wilhem Harnisch, to act as a director. Independent directors, including CBUS chairman and former Victorian premier Steve Bracks, were paid personally.

Maritime Super, one of the smaller industry super funds, pays some of the biggest fees to union officials, with $347,65 paid to the MUA in the two years to 2015, including $166,560 for the directorship of national secretary Paddy Crumlin. It also paid $128,254 directly to employers DP World Australia and $98,624 to Asciano Executive Services.

Unisuper, whose assets vastly exceed those of the MUA, with $12 billion in super savings, paid a comparatively small $194,114 to the National Tertiary Education Union and the Community and Public Sector Union.

Mr Noonan said the government’s proposed reforms were spurred by the banking industry, which wanted to “get their snouts into the troughs of workers’ retirement incomes”.

“The funds they’ve overseen have underwhelmingly underperformed industry super funds,” he said. The AMWU, which earns directorship fees from officials including assistant national secretary Glenn Thompson, said board members “take their roles very seriously” and all proceeds went to member services.

Last week, Ms O’Dwyer flagged measures to restrict unions from diverting workers’ savings to industry super funds through workplace agreements.

The ACTU said it “noted the government’s announcement” and referred the proposal to a review of industry super to be carried out next year by former Reserve Bank governor Bernie Fraser.