Beijing denies coal ban, steel source disagrees

China has denied banning Australian coal from entering its ports but Chinese steel sources say the exports are being singled out.

China has denied banning Australian coal from entering five of its ports but Chinese steel sources say Australian coal exports are being singled out even as rival supplies are allowed to pass through.

A source at a major Chinese steel consultancy told The Weekend Australian the ban specifically related to Australian coal and would not affect supplies from competitors, including Russia or Indonesia.

But Trade Minister Simon Birmingham last night welcomed “confirmation from China’s Ministry of Foreign Affairs that reports of a ban or country discrimination are false’’. “We look forward to continuing to co-operate and work together to maintain our strong and mutually beneficial trading relationship,’’ Senator Birmingham said.

His comments came after Chinese Ministry of Foreign Affairs spokesman Geng Shuang said the report of a ban on Australian coal clearing Dalian ports by the Reuters news agency was false.

He said Chinese Customs was monitoring the import of foreign coal into China for environmental purposes but there was no specific ban on Australian coal.

Mr Geng said Customs in ports across China was accepting clearance of Australian coal “as usual”.

“But in recent years, China has found a problem with some imported coal in relation to environmental safety and quality.

“China’s Customs inspections departments are reinforcing the measures to ensure that the imported coals meet China’s standard of environmental protection and to protect the interests of Chinese importers.”

Major Australian producers noted similar clampdowns had been made before but largely reflected temporary tweaks to supply rather than a broader move to shun certain types of coal.

“There is a long history here of China looking at particular elements of coal quality with regards to its coal imports and also its testing regime,” said Shane Stephan, the chief executive of Australian coal producer New Hope Group. “There are ongoing issues of discussion between the coal suppliers and the coal customers in China.”

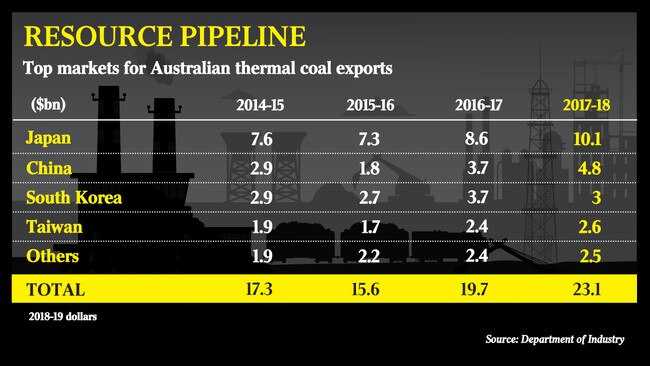

The issue affects about 15 per cent of Australia’s exports to China, according to Macquarie analysis, and could lead to an earnings hit of $US2.02 billion ($2.84bn) at current spot prices.

If a ban was extended beyond Dalian, both the global trade of coal and prices would be squeezed.

Senator Birmingham said it was “unhelpful” to conflate other issues with the slowdown — a reference to speculation that the issue was related to Australia’s ban of Chinese company’s Huawei’s participation in the 5G network.

Scott Morrison also cautioned against “leaping to conclusions”, while warning that any weakening in the coal market would have a “very serious impact”.

Reserve Bank governor Phil Lowe said it would be a “concerning” development if Chinese bans on Australian coal exports were a sign of a deteriorating political relationship.

Labor said the apparent ban was “a very concerning development”, just days after an opposition frontbencher said it would be “good” if the thermal coal market collapsed. “This would be, if it came to pass, in relation to other ports in China, a very significant and negative economic development for Australia,” Labor’s Treasury spokesman Chris Bowen said.

“(The government) would have of course our support on any sensible measures to remedy this situation because this is very important to our economy.”

Additional reporting: Perry Williams