CEOs’ pitch to senators: cut will lift wages

The nation’s biggest employers have formally pledged to invest in creating jobs if the Senate backs Malcolm Turnbull’s tax cuts.

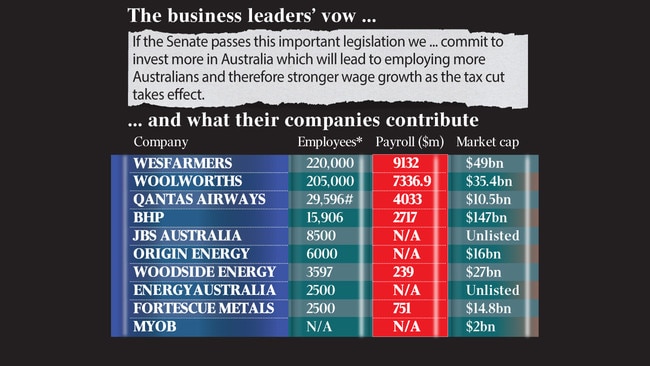

The nation’s biggest employers, including Woolworths, Wesfarmers, Qantas and BHP, have formally pledged to invest in creating Australian jobs and delivering stronger wage growth if the Senate crossbench backs in Malcolm Turnbull’s $35.6 billion company tax cuts.

As Finance Minister Mathias Cormann last night moved closer to winning the final five crossbench votes the government needs to legislate its enterprise tax plan, 10 of Australia’s biggest companies issued a “Commitment to the Senate”.

Business leaders — including BHP chief executive Andrew Mackenzie, EnergyAustralia managing director Catherine Tanna, Fortescue Metals chairman Andrew Forrest and Qantas chief executive Alan Joyce — said they would “invest more in Australia” if the tax cuts became law.

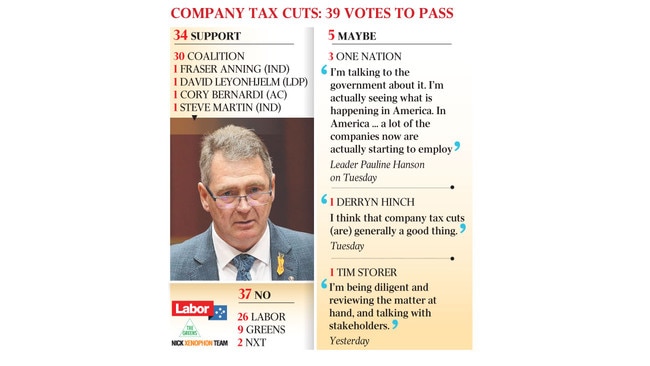

The commitment, released through the Business Council of Australia, came as the government won support from Tasmanian independent senator Steve Martin. New senator Tim Storer looms as the key to pushing through the bill, after Pauline Hanson and Derryn Hinch signalled they could support the tax cuts for companies with a turnover of more than $50 million.

The BCA letter said the government’s proposed cut to corporate taxes, which will reduce the company rate from 30 to 25 per cent over 10 years, was “urgent and vital to keep Australia competitive”.

“If the Senate passes this important legislation we, as some of the nation’s largest employers, commit to invest more in Australia which will lead to employing more Australians and therefore stronger wage growth as the tax cut takes effect,” the letter said.

The Australian understands the heads of several major companies conveyed a similar message directly to Senator Storer in a series of phone calls yesterday.

The independent South Australian senator, who was sworn in on Monday, was keeping his cards close to his chest, as the Enterprise Tax Plan Bill was introduced into the Senate.

“I’m being diligent and reviewing the matter at hand, and talking with stakeholders,” Senator Storer told The Australian.

Government insiders acknowledged it was a “tough assignment” for the senator to come to a position on the tax cuts in his first week in parliament. A vote on the legislation is likely to take place next week if the government wins crossbench support.

The Australian has in recent weeks revealed a growing movement in the business community in support of the company tax cuts, with BHP, Woolworths and former BCA chief Tony Shepherd supporting the key budget reform, to ensure growth in investment, employment and wages.

Other signatories to the BCA letter included Wesfarmers managing director Rob Scott, Woolworths chief executive Brad Banducci, MYOB chief executive Tim Reed, Origin Energy managing director Frank Calabria, JBS Australia chief executive Brent Eastwood, and Woodside managing director Peter Coleman.

Senator Hinch yesterday told Sky News that Senator Cormann had offered some concessions, after he had called for a firm commitment that the proceeds of tax cuts would be passed on to employees via wage increases.

Senator Martin, who replaced Jacqui Lambie, explained his decision to support the bill in his first speech to the Senate yesterday.

He said Tasmania’s agricultural sector had huge potential, but needed to be competitive in overseas markets. “If you’ve ever had a Cape Grim steak, you’ve literally tasted the potential,” he said. “We need an internationally competitive tax rate for all businesses. One that will provide industry with every opportunity to underpin our economic growth.”

The government needs to secure the support of nine of the 11 crossbench senators to pass the bill.

One Nation leader Pauline Hanson, who controls three Senate votes, revealed on Tuesday she was considering supporting the bill. “I’m actually talking to the government. I’ve got an open mind about this,” Senator Hanson said.

Nick Xenophon Team senators Stirling Griff and Rex Patrick remain opposed to the bill, while Cory Bernardi, David Leyonhjelm and Fraser Anning are on the record as supporting it.

The Prime Minister said the tax cuts were “vitally important” to provide an incentive for small, medium and large businesses to invest in Australia and employ people.

“The fact is, we have to have a competitive tax rate,” Mr Turnbull said.

“The US have gone to 21 per cent. We have to have a competitive company tax rate to attract investment, which will drive jobs.”

Labor said the tax cuts were a massive unfunded hit on the budget, which would be paid for by everyday taxpayers.

“Malcolm Turnbull’s message is clear: big businesses get a company tax cut, while millions of working and middle-income Australians pay higher income tax,” opposition Treasury spokesman Chris Bowen said.

As debate commenced on the bill, Labor senator Doug Cameron said the government was looking after its corporate backers rather than everyday voters.

“This is a government that only cares about the big end of town, handing money to the rich and the wealthy at the expense of working-class Australians,” Senator Cameron said.

The corporate tax push came as a report revealed services exports rose by 8.3 per cent to $81.6 billion in 2016-17. Tourism exports increased 7.6 per cent to $37.2bn, and education exports increased 15.8 per cent to $28.6bn.

Exports of business services rose 3.7 per cent to $19.4bn, while transport services increased 8.7 per cent to $7.5bn.