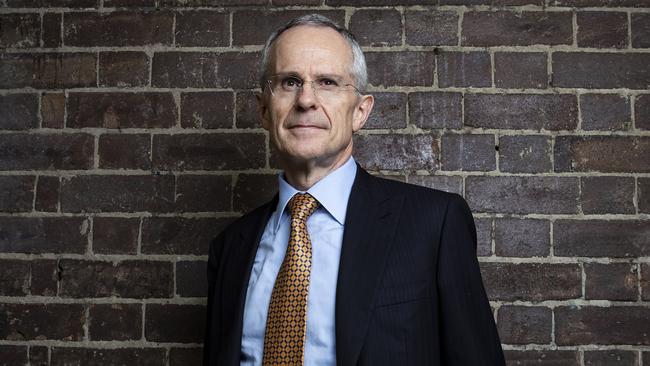

ACCC boss Rod Sims to fight for tougher laws to shield consumers

Competition tsar Rod Sims has signalled he will lobby government for new laws cracking down on unfair treatment of consumers.

Competition tsar Rod Sims has signalled he will lobby government for new laws cracking down on the harsh and unfair treatment of consumers by big business after losing a case against health insurer Medibank.

In an article published by The Australian today, Mr Sims also blasts the nation’s finance sector, which has spent the past year under fierce scrutiny by the Hayne royal commission, as a “cosy banking oligopoly” and takes aim at the courts for giving too much weight to the “self-interested evidence of company executives” during cases involving corporate misconduct.

Mr Sims says the Australian Competition & Consumer Commission would “continue the debate about the adequacy of laws against companies engaging in ‘harsh and unfair conduct’ towards consumers”.

His pledge follows a decision by the full bench of the Federal Court just before Christmas refusing the ACCC’s appeal in a case it lost against Medibank.

In the case, the ACCC accused Medibank of making false, misleading and deceptive statements to customers by failing to tell them of limits to payouts for some pathology and radiology services.

The court found this was harsh and unfair but said it was not bad enough conduct to breach the consumer law by being unconscionable.

“The federal and state ministers responsible for consumer law have recently discussed whether, as in the United States, Australia needs a law against ‘unfair’ behaviour by companies,” Mr Sims writes.

“The ACCC will be an active participant in this vital debate.”

He said the ACCC played an active part in regulating the financial sector, which is headed for a large-scale overhaul following last week’s findings of the Hayne commission, which exposed banks for rorting and ripping off customers.

“A cosy banking oligopoly is surely at the heart of recent problems, so we must and will find ways to get more effective competition in banking,” he said.

However, he said more was needed, including a more sceptical approach to the evidence companies put forward when they defend mergers or anti-competitive deals.

The ACCC’s recent merger defeats include a hard-fought case before the Competition Tribunal and the Federal Court in 2017 where it was unable to stop Tabcorp taking over fellow gaming giant Tatts.

“There is, for example, too much faith in the capacity of market forces to overcome concentrated market structures, and too much weight given to the self-interested evidence of company executives involved in the conduct,” Mr Sims said.