Winners and losers in the billionaires’ club

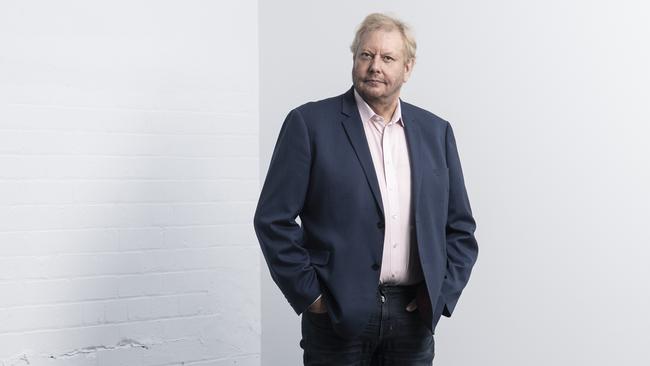

Richard White - whose personal fortune plunged by $100m in a single day this week - encapsulates just how quickly hundreds of millions, even billions, of dollars have been lost. And made again.

Billionaire Richard White encapsulates just how quickly hundreds of millions, even billions, of dollars have been lost on the stockmarkets because of the coronavirus. And even made again.

Mr White, the founder and chief executive of logistics software firm WiseTech Global, saw about $130m wiped from the value of his shares this week. But on Friday, when the ASX plunged as much as 8 per cent before a late rally put the market in positive territory, WiseTech shares rose about 5.18 per cent, or 67c — adding almost $100m to Mr White’s wealth. At one stage mid-morning, his fortune had been down about $100m.

Not that Mr White, a prominent member of The List — Australia’s Richest 250, the 2020 edition of which will be published by The Australian next weekend, is particularly worried.

“Every road has potholes,” he says. “When something like this happens you have to be very resilient, and have people around you who are resilient.”

Mr White was also referring to February 19 when WiseTech had to issue a profit downgrade because of a “once in a generation” hit to the company due to the coronavirus. His wealth fell $1.2bn that day, but he is concentrating on the long term. “Wealth is not something that motivates me, it just allows me to do things,” says the guitar-loving WiseTech boss, who for years tried his hand at being a rock star before turning to a career in technology.

But it has been a bad week on the markets for many of Australia’s richest people, in paper terms at least, though Friday’s late rally added $1.2bn to the wealth of Andrew Forrest for the day. Mr Forrest, the chairman and major shareholder of Fortescue Metals Group, had seen his wealth fall and rise during a tumultuous week. He ended about $850m up for the week thanks to Friday’s late rise.

It was a different story for Australia’s most high-profile young billionaires, Atlassian co-founders Mike Cannon-Brookes and Scott Farquhar.

Shares in their NASDAQ-listed software company fell about 13 per cent from the start of the week (before trading in the US late on Friday night), which represented a cut in each of their share wealth of about $2.3bn.

Kerry Stokes’s shares in Seven Group Holdings, which owns mining services assets and a large chunk of Seven West Media, fell by about $300m over the week, though that stake did rise by about $200m over the course of Friday.

James Packer’s stake in Crown Resorts fell by about $40m on Friday, with the company unable to rally in time to achieve a positive result for the day. His shares were down about $360m for the week.

Solomon Lew’s shares in retailer Premier Investments were down about $80m for the week; Alan Wilson and his family’s stock in plumbing firm Reece lost $275m; and Greg Goodman about $45m in his eponymous property firm. Afterpay co-founders Anthony Eisen and Nick Molnar lost $160m each.

Then there was David Teoh, the boss of TPG Telecom, and his wife, Vicky. The share price of their group had been up recently after the Federal Court gave the green light for its merger with Hutchison Vodafone. TPG fell in the week, but finished up 8 per cent on Friday, meaning they had made up all their losses for the five days in a couple of hours.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout