Water barons accused over prices

Investors are allegedly hoarding billions of litres of water creating a massive artificial price spike that is crippling agriculture.

Investors are allegedly hoarding billions of litres of water, ratcheting up the cost and cruelling food growers who claim they face a massive artificial price spike that is crippling agriculture.

Representatives from about a dozen horticultural industries have written to Water Resources Minister David Littleproud claiming the non-farm water investors are playing the market.

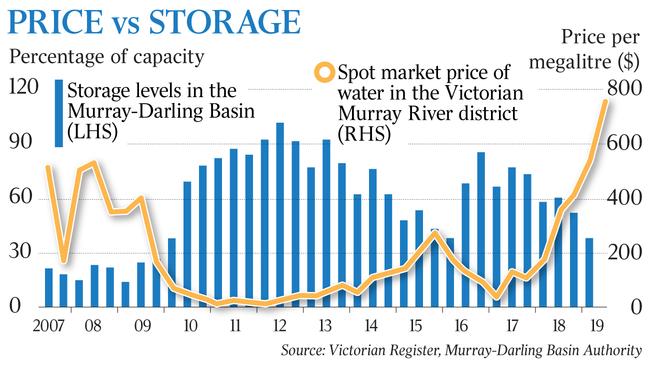

They say the result is a market “squeeze”, pushing up the price of water for irrigation from a long-term average of about $135 a megalitre to $800.

At those prices, farmers say, many crops are no longer profitable, with growers suffering severe financial and emotional hardship that may ultimately force them to “turn off”, or not water, grape vines and nut and citrus trees.

Darren Minter, who farms citrus, almonds and asparagus south of the Victorian city of Mildura, said he would lose money this year, and next year might have to cut off water to his almond trees and not grow asparagus, resulting in no work for 150 employees.

“We want action today because if we keep going this way, it’s going to drive a lot of farmers bust,” Mr Minter said. “Water barons who own water, who don’t own land, should be stopped immediately.”

One of the signatories to the letter to Mr Littleproud, Australian Grape and Wine chief executive Tony Battaglene, said “We have become far more vulnerable to the water trading system”.

Mr Battaglene said at current prices, grape growers were at a “tipping point” on deciding whether it was worth irrigating.

“Once the water price increases up towards $800, it means that it is very hard to produce a crop that can be made into wine that can sell,” he said.

It is understood that among other requests, the letter from the agricultural groups calls for a temporary ban on non-landowning water investors from buying water, and from “carrying over” water from one year to the next.

Sources familiar with the letter said it did not name names but the greatest concern was South Australian company Duxton Water Ltd.

Over three years since it listed on the stock exchange, Duxton Water has amassed water rights worth $256m, giving it control over 74 billion litres of water entitlements, equivalent to the capacity of the Woronora Dam near Sydney.

Rather than sell or lease all its annual water allocations each year, Duxton has “carried over” some water and increased its entitlements by 12.5 billion litres in the six months to June.

While irrigation farmers are fearful of speaking out about Duxton, the head of the largest olive-growing enterprise in Australia, Rob McGavin, was prepared to express a view to The Australian.

“My concern about Duxton is the amount of allocation water they have reportedly purchased over the last 18 months compared to their annual consumptive use or need, and the material impact this could be having on the price all irrigators are having to pay for allocation water,” Mr McGavin, the chief executive of Boundary Bend Ltd, said.

Duxton Water says its shareholders enjoyed a total return of nearly 30 per cent in the year to June.

In the six months ended June 30, during a severe drought now officially classed as the worst ever, Duxton more than doubled its half-year profit compared with the corresponding period last year, to $2.5m.

Mr McGavin said non-farm water traders and brokers were “driving Maseratis” at a time when farmers were going broke.

He criticised the decision over recent years to change the system in which water entitlements were tied to land ownership to allow non-land-owning investors to purchase water and trade it.

In one example, since the water market in northern Victoria was opened to non-land owners, they have acquired 12 per cent of the volume, while government environmental water holders account for 28 per cent and 57 per cent remains tied to land.

Mr McGavin said the 12 per cent owned by non-farm investors had a disproportionate effect on the market because most of that owned by farmers was used on their farms rather than traded.

Mr McGavin noted that California, among other jurisdictions, banned non-farmers from owning agricultural water precisely to avoid speculation.

“Australian farmers are being used as a real-life guinea pig test case to let the free market rule, but nobody else thinks it’s a good idea,” Mr McGavin said.

“The problem is that one person with a big chequebook can own so much water, working in an office, not slashing the vines and so on. It seems to me that it becomes unfair.”

In a statement to The Australian, Duxton Water said it was a long-term investor in water, not a speculator. It said just over half its water entitlements were let out on long-term lease to irrigators.

“The company will continue to actively manage its allocation holding in order to meet its obligations to its farming partners both short and long term,” it said.

“Our goal is to be a long-term partner with the farming community and to make it easy for farmers to access water over shorter and longer-term periods.”

Duxton said it carried more than $8m worth of water to meet its future commitments to farmers, saying such an amount was “not material”.

It denied its activities had pushed up the price of agricultural water, saying the spike was the result of huge amounts of planting of permanent crops, the government buy-back of water entitlements for environmental flows and drought.

Earlier this year, Mr Littleproud announced that he had asked the Australian Competition & Consumer Commission to investigate the water trading market, and The Australian is aware of at least one letter to the ACCC from an agricultural business listing concerns about Duxton and other non-farm water owners.

In a statement to The Australian, Mr Littleproud encouraged all water users to make a submission to the ACCC. “I want to be sure the water market isn’t being distorted,” he said, adding: “There is a lack of transparency”.

“I want to make sure that family farming businesses are not locked out of the water market,” he said. “I do not want to see traders, brokers or any major market players pushing up water prices as water is a critical resource.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout