Unexpected property rebound may trigger another RBA rate hike

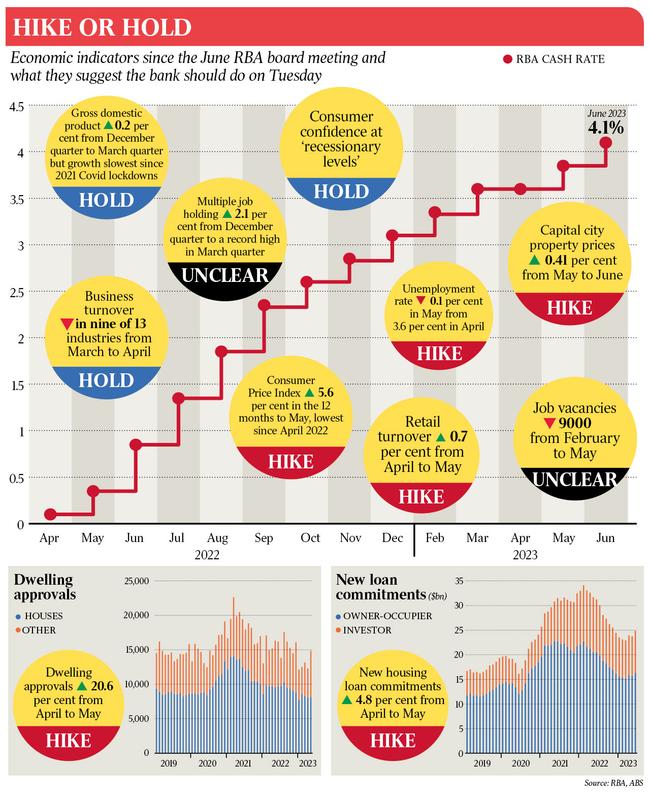

New mortgage lending and home building approvals jumped in May, underlining an unexpected rebound in the property sector that could tip the RBA into hiking rates again on Tuesday.

New mortgage lending and home building approvals lifted solidly in May, underscoring an unexpected rebound in the property sector that could tip the Reserve Bank into hiking rates for a 13th time at its board meeting on Tuesday.

Latest figures from the Australian Bureau of Statistics showed new housing loan commitments climbed by nearly 5 per cent in May to $24.9bn, well above the consensus forecast for a 1.4 per cent rise.

Separate ABS figures also revealed a 20 per cent jump in the number of dwellings approved in May versus the previous month, albeit driven by a nearly 60 per cent spike in the volatile multi-dwelling segment, led by a large number of apartment developments approved in NSW.

CBA economist Harry Ottley said soft consumer price growth data for May “should be enough for the RBA to pause its hiking cycle” this week, with markets pricing in a one-in-three chance of a 0.25 percentage-point increase to 4.35 per cent.

Mr Ottley said “today’s stronger housing-related data could, together with a tight labour market and lingering inflation concerns, tip the decision the other way”.

Despite a nearly unbroken run of interest rate hikes, total new mortgage lending, excluding refinancing, is now up by 9 per cent since February.

The lift in new lending has tracked the recent rise in property prices, which CoreLogic figures on Monday revealed had extended into a 3.4 per cent rebound over the four months to June.

While new house lending to owner-occupiers at $15.3bn in May was $6bn below the January 2022 peak that accompanied the frenzied Covid property boom, new homebuyers were borrowing in total 17 per cent more a month than immediately before the pandemic, the ABS said.

The ABS figures also showed Australians were refinancing at a rate close to the recent March peak, which ANZ senior economist Adelaide Timbrell said “may signal that borrowers are shopping around on mortgage rates, reducing the impact of monetary tightening on interest payments”.

The RBA has lifted its cash rate from 0.1 per cent in April last year to 4.1 per cent, sending mortgage repayments soaring and smashing the borrowing capacity of would-be homebuyers.

With the threat of potentially two more rate hikes and a predicted economic slowdown that will push unemployment higher, the ABS figures also showed the average new mortgage size was on the decline, but remained well above pre-pandemic levels.

The national average new loan size for an owner-occupier was $585,000 in May, which at a 5.4 per cent interest rate over 25 years would cost $3560 a month to service.

This average loan size was $30,000 less than a year earlier, but 20 per cent, or $100,000, more than in February 2020.

The highest average new home loan was still in NSW, at more than $720,000, versus $781,000 in May 2022 and $580,000 pre-Covid. The next largest average mortgage sizes for owner-occupiers were in Victoria and the ACT, at roughly $600,000 and $590,000 in May, respectively.

With the lack of housing supply and rapidly rising rents a key concern across Australia, Housing Industry Association chief economist Tim Reardon said multi-unit approvals were down 10 per cent on a year earlier despite the recent uptick.

Approvals to build stand-alone houses were subdued, the ABS said, lifting by 0.9 per cent in May after having dropped by 3 per cent in April and continuing to show a downward trend.

JP Morgan economist Tom Kennedy similarly described the latest housing data as “strong”, but said the outlook for building approvals remained weak.

NAB head of market economics Tapas Strickland said the lending figures were “consistent with the stabilisation seen in the housing market most recently, though expectations of further rate rises will hamper borrowing capacity and is likely to challenge the sustainability of the recent rebound in dwelling prices”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout