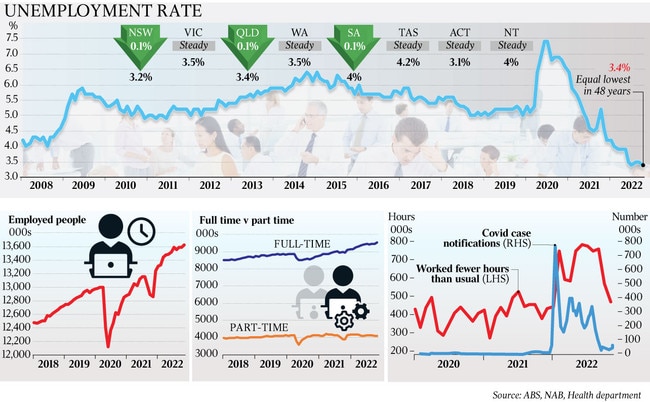

Eighth rate hike likely before Xmas as unemployment slips to 3.4pc in October

Australians face an eighth straight rate rise next month after stronger-than-expected jobs growth in October.

Australians face an eighth straight rate rise next month from the Reserve Bank after stronger-than-expected jobs growth in October showed unemployment dropped back to its 48-year low of 3.4 per cent.

Despite the Reserve Bank’s aggressive efforts to slow the economy to tame this year’s inflationary surge, the number of workers rose by 32,000 in the month – or twice what had been anticipated, according to the Australian Bureau of Statistics.

That helped push the key jobless measure down by

0.1 percentage points to 3.4 per cent, where it was in July and the lowest since 1974.

As the share of part-time employment dropped to 30 per cent and the lowest since 2013 – outside the national lockdown – ABS head of labour statistics Bjorn Jarvis said “the working-age population in Australia is more employed than it has ever been”.

Evidence that the labour market remained at its tightest in decades comes amid a bitter dispute between employers and unions over the Albanese government’s proposed workplace reforms that are set to be debated in the Senate after parliament reconvenes next week.

Master Builders Association (MBA) said the solid jobs growth in October and accelerating private sector wages strengthened the case against changes to the industrial relations system.

“Making it easier for businesses to attract talent in a competitive economy is done by reducing regulation, improving the bargaining process at the individual-enterprise level, and allowing more flexibility when competing for talent,” MBA chief executive Denita Wawn said.

“Scooping employers up in multi-employer bargaining arrangements will not achieve this. The building and construction sector has consistently had wages growth exceed other industries, pay above-award rates and have high levels of full-time employment,” she said.

But Employment Minister Tony Burke said despite the near 50-year lows in unemployment, “we’re still in a position where Australian workers are going backwards and where real wages today are lower than what they were a decade ago”.

Mr Burke said pay should be growing faster than official pace of 3.1 per cent, and “that won’t happen unless we change the law”. “The key way to get flexibility and productivity outcomes from business, while at the same time getting better wage outcomes for workers, is to get bargaining moving. That means simplifying the situation for single enterprise bargaining and opening up pathways for multi-enterprise bargaining,” he said.

The ABS data showed underemployment, which measures those with jobs who would like to work more hours but are unable to find them – inched lower to 5.9 per cent, from 6 per cent.

The labour under-utilisation rate, which combines the unemployment and underemployment measures, fell 0.2 percentage points to 9.3 per cent – 4.6 percentage points lower than before the pandemic and the lowest since March 1982, the ABS said.

With the number of job vacancies essentially matching the number of people looking for a job, employment growth has slowed over recent months to below the pre-Covid trend as the labour market reaches capacity and employers struggle to fill advertised roles.

But the solid latest jobs report gave no evidence that labour market pressures were easing, and with a record number of people in work and hundreds of thousands fewer unemployed than before the start of the pandemic, analysts said workers had leverage to demand further pay rises.

CBA head of Australian economics Gareth Aird said the latest numbers “rubber stamped” a rate hike to 3.1 per cent when the RBA board next meets on December 6.

“The message from the labour force survey has been remarkably consistent over the past five months – the unemployment rate has essentially hit a floor and the labour market is very tight,” Mr Aird said. “As a result, wages growth has finally accelerated in a meaningful way. The challenge now for the RBA is to cool demand in the economy such that the labour market loosens a little, but not too much,” he said.

AMP Capital chief economist Shane Oliver agreed. “While the jobs market is showing some signs of cooling, the strength in jobs in October and the further fall in labour under-utilisation, which points to a further acceleration in wages growth, makes it hard to see the RBA pausing next month,” he said.

The ABS data showed there were about 236,000 fewer unemployed Australians than immediately before the pandemic, and 365,000 fewer underemployed workers – in both cases around a third lower than before the health crisis. The latest numbers remained in line with the RBA’s forecasts for unemployment to hold at about the mid-3s until June next year, but combined with Wednesday’s similarly slightly stronger than anticipated wage growth figures, suggested little evidence that 2.75 percentage points in rate hikes was as yet dampening demand for labour.

The consensus forecast among economists ahead of Thursday’s release had been that an additional 15,000 would find work in October, and for the key jobless measure to remain unchanged.

The labour force participation rate remained at 66.5 per cent, the seasonally adjusted figures revealed. The ABS figures also showed that while employment increased by 0.2 per cent, the number of hours worked in the month jumped by 2.3 per cent, with about 10 per cent fewer people taking holidays than was usual for that time of year, the ABS said.

“Some of this difference may reflect people who would normally have taken annual leave being sick instead, with around 30 per cent more people than usual working reduced hours in October due to sickness,” Mr Jarvis said. “While the number of people working fewer hours due to sickness was around a third higher than we’d usually see in October, it was no longer two-to-three times higher, as it was earlier in 2022,” he said.

October was the first month this year when the number of people off work sick during the month was under half a million. The data showed the number of people working reduced hours because of floods was 100,000 in October, up from 66,000 the month before.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout