Productivity slowdown costs workers $25,000 a year

The average Australian would be earning $25,000 more a year if the nation’s productivity performance had not slumped since the mid-1990s, a new Productivity Commission report says.

The average Australian would be earning $25,000 more a year if the nation’s productivity performance had not slumped since the mid-1990s, with a new Productivity Commission report rubbishing union claims that corporate greed has been responsible for workers’ slow pay growth leading into the pandemic.

The new insights from the PC come as updated figures revealed the jobs market remained tight in August, with the number of employed Australians jumping by nearly 65,000 in the month, or about twice the level predicted by economists.

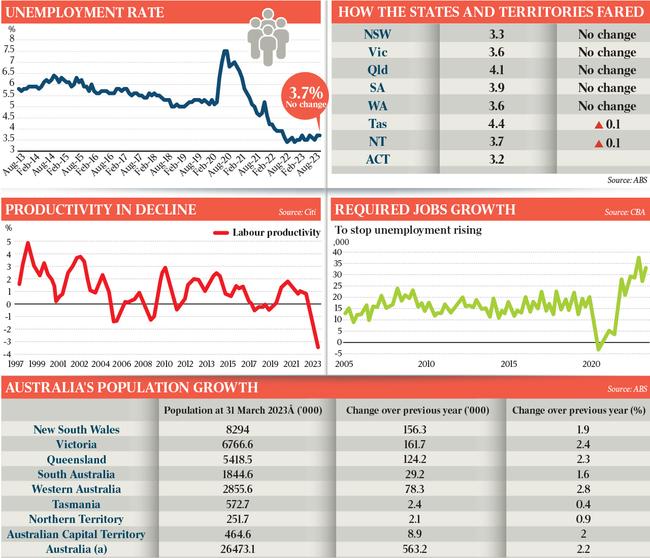

The unemployment rate, however, remained steady at 3.7 per cent, the Australian Bureau of Statistics data showed, as the ongoing surge in net migration swelled the pool of available labour and workforce participation ticked up to a record high.

Ahead of the release of the Albanese government’s employment white paper, PC deputy commissioner Alex Robson said the new report showed that lifting the country’s productivity performance would be of far greater benefit to workers’ prosperity than interventions to redirect more national income into employees’ pockets, as demanded by workers’ groups such as the ACTU.

“Over the long term, for most workers productivity growth and real wages have grown together in Australia,” the report concludes.

Reserve Bank governor Philip Lowe, whose last day at the bank is on Friday, in his final speech last week urged politicians and the public to embrace reform to lift the country’s flagging productivity performance, saying it was “central to our future prosperity”.

“This is, fundamentally, a political problem, and it is a major problem. If we can’t build a consensus for change, the economy will drift and there is a material risk that our living standards will stagnate,” Dr Lowe said.

The PC report showed that claims by left-wing think tank The Australia Institute that the profit share of workers had plunged over recent years was based on flawed analysis that failed to account for the impact of the low-employing but high-earning mining and agriculture sectors.

Mr Robson said the highly lucrative and capital-intensive mining and agriculture sectors employed only 5 per cent of the labour force, and including them created a skewed impression that workers had claimed a shrinking share of productivity gains over recent years.

“If you want to do this properly, and you want to look at profit shares, you’d want to disaggregate by sector to get the full picture. We have this mining boom starting in the 2010s, and without taking that into account you are really missing a key piece of the story,” Mr Robson said.

Excluding those two segments, the PC found that the share of the productivity growth dividend going to the remaining 95 per cent of workers had declined by less than 1 percentage point over the past 27 years.

Were it not for this so-called “negative wage decoupling” over the past three decades, the average annual income for the 95 per cent of workers outside the mining and farming sectors would be $3000 higher today, the PC estimated.

“But compare that to a world where you had maintained productivity growth since the mid-90s (of 2.2 per cent); the income gains are $25,000, or eight times more than if you can do these other things,” Mr Robson said.

The June quarter national accounts revealed that productivity is going backwards at the fastest pace in at least three decades, undermining hopes of a return to the even modest annual growth of 1.2 per cent assumed by Treasury’s long-term budget forecasts and the Intergenerational Report.

“The policy conclusion, then, is that productivity is really, in the long run, the key to real wages growth. The Treasurer (Jim Chalmers) has said that the government has got a laser-like focus on productivity, and that would be one of our messages as well,” Mr Robson said.

The ABS jobs figures showed that the number of full-time employed Australians rose by 2800 people in August, eclipsed by a 62,100 surge in part-time employment.

The underemployment rate, which measures those who have jobs but who are trying to get more hours, lifted from 6.4 per cent in July to 6.6 per cent, the seasonally adjusted data showed.

ANZ head of Australian economics Adam Boyton said the predominance of part-time jobs and the falling number of hours worked “took the gloss off” the latest employment figures.

He aid it was a “fairly consensus view” that “the moderation in GDP growth suggests jobs growth should ease over the rest of this year”. “The risks around that view could be starting to become more skewed to a stronger labour market, however,” he said.

Analysts agreed that the latest jobs report would not shift incoming RBA governor Michele Bullock’s view on interest rates, with the central bank board seeing a “credible path” to bringing inflation back under control without the need for further hikes.

The participation rate, which is the share of working-age Australians who are either in work or looking for jobs, ticked up to reach a record 67 per cent. The employment-to-population ratio also rose by 0.1 percentage point to around historical highs of 64.5pc.

A steady unemployment rate despite a booming month for jobs growth was explained both by the higher participation rate and the blockbuster growth in the working-age population.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout