Treasurer’s budget appeal: ‘Be realistic’

Jim Chalmers rules out a return to surplus in this term of parliament, warning of an austere budget next month.

Jim Chalmers has ruled out a return to surplus in this term of parliament, as he urged Australians to “be realistic” about the nation’s fiscal position ahead of an austere budget next month.

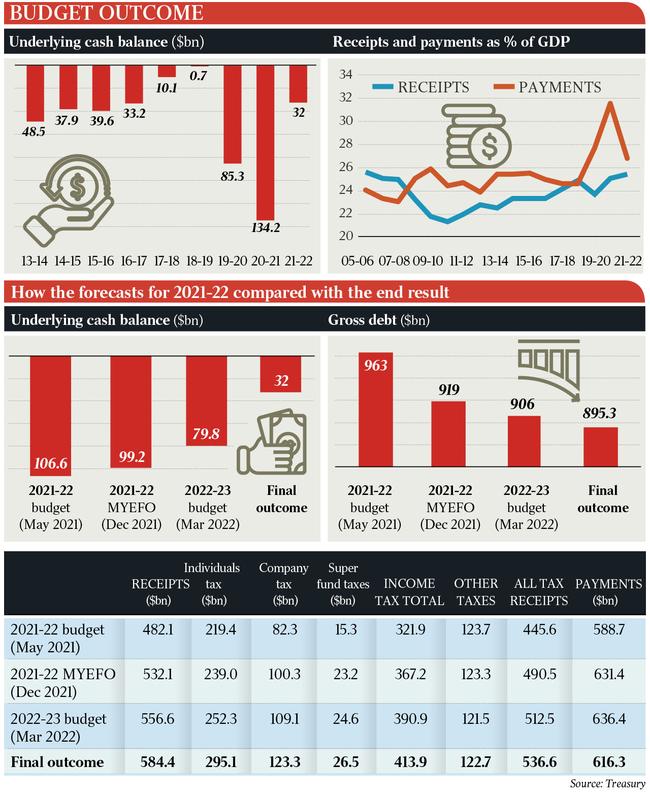

The Treasurer’s comments came as the final budget outcome for 2021-22 showed a $32bn deficit, a $47.9bn improvement on what Treasury projected in May thanks to record commodity prices and the strongest labour market in decades – the largest ever variation between a final budget outcome (FBO) and the preceding fiscal projections.

New Australian Bureau of Statistics figures also released on Wednesday show Australians shrugged off sharply higher interest rates, plunging real wages and intense cost-of-living pressures and spent a record $35bn in stores, cafes and restaurants in August – nearly 20 per cent more than a year earlier.

While the Australian Retailers Association hailed another “outstanding result” leading up to the critical Christmas period, economists warned that the data suggested there was further work for the Reserve Bank to do in its efforts to slow demand and curb inflation.

Analysts believe the RBA board will likely deliver a fifth consecutive 0.5 percentage point hike when it meets next Tuesday, and ANZ senior economist Adelaide Timbrell said “the longer household spending stays solid, the bigger the upside risk for inflation and the peak cash rate”.

With the economy remaining resilient through the June quarter, the Finance Department figures for 2021-22 show government receipts ballooned to $584.4bn, and at 25.4 per cent of GDP represented the highest as a share of the economy since the mid-2000s.

Payments were $616.3bn, 10 per cent down on a year earlier. The underlying cash deficit was more than $100bn better than 2020-21.

Despite the dramatic improvement, Dr Chalmers said “when it comes to a surplus in this term of the parliament, I think we need to be realistic about the fiscal situation”.

“We need to recognise that the pressures on the budget are intensifying rather than easing,” he said.

“And I don’t think that Australians should expect that the budget that I hand down in October will have a surplus in any of the forward years.

“I think Australians understand that given the fiscal budget circumstances that we’ve inherited, it will take much more than one budget to turn that around.”

S&P Global Ratings lead sovereign analyst Anthony Walker said the Commonwealth’s financial position had “recovered dramatically” since January, when S&P had predicted a $60bn deficit for 2021-22.

Still, Mr Walker agreed with Dr Chalmer’s warning of rolling deficits out to the middle of the decade.

“Getting back to surplus will be extremely difficult within the forwards,” Mr Walker said.

“There are growing economic headwinds globally, and even with extremely high commodity prices there was still a slight deficit.

“Do commodity prices remain where they are, and unemployment remain where it is?

“It’s difficult to see those two things happening over the medium to long term.”

Mr Walker said the latest figures provided the new government with “a solid base for their next budget”.

“The fiscal recovery is significantly quicker than it was post-GFC, and that was critical for the sovereign remaining on the AAA credit rating,” he said.

The most recent budget projected an $80bn deficit in this financial year, but S&P anticipated only a “slightly wider” deficit in 2022-23 than in 2021-22.

Mr Walker said Covid-related spending should have ended by mid-2023, leaving an ongoing structural deficit equivalent to about 1.5 per cent of GDP.

“If you want a surplus at the federal level, you are going to have to find $30bn-$40bn in savings per annum,” he said.

AMP Capital chief economist Shane Oliver said while not all of the windfalls of the recent financial year would carry into future years, the 2022-23 deficit could still realistically come in at half the $80bn projected in the last budget.

“Today’s news does raise the possibility the budget will achieve a surplus at some time in the next five to seven years,” he said.

High tax receipts accounted for $27.7bn of the $47.9bn improvement in the bottom line against the March budget forecasts.

“Company and personal taxation receipts were higher than expected, driven by stronger-than-expected commodity prices and employment outcomes, and lower-than-expected utilisation of Covid-19 business support measures,” the FBO documents say.

Payments in 2021-22 were $20.1bn below what had been predicted.

“This was due to delays in the contracting of Covid-19 spending, temporarily lower-than-expected demand for some health and NDIS services, and the impact of supply chain disruptions and capacity constraints on road and rail infrastructure projects and other spending,” the FBO said.

A smaller-than-anticipated deficit meant that gross debt was $10.7bn lower, but still at $895.3bn, or 39 per cent of GDP. Net debt was $515.6bn (22.5 per cent of GDP), or $115.8bn lower than estimated in the most recent budget.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout