Subsidised coal part of market overhaul: Energy Security Board

Special payments will be needed to keep ageing coal-fired and gas power stations in business to avoid spikes in electricity prices, under a plan to shore up the energy grid.

Special payments will be needed to keep ageing coal-fired and gas power stations in business to avoid future spikes in electricity prices, under a national plan to shore up the energy grid.

A new capacity mechanism recommended by the Energy Security Board will put incentives in place to stop the early closure of power plants and create long-term signals for investment in dispatchable generation.

The ESB’s post-2025 market design recommends four reforms of the electricity network to replace and secure baseload power, avoid price hikes and ensure long-term grid reliability.

Signalling the end of the nation’s coal-fired power fleet, the country’s energy ministers have also backed a revamp of the electricity market that transitions from traditional coal and gas assets to pumped-hydro, battery, wind and gas generation.

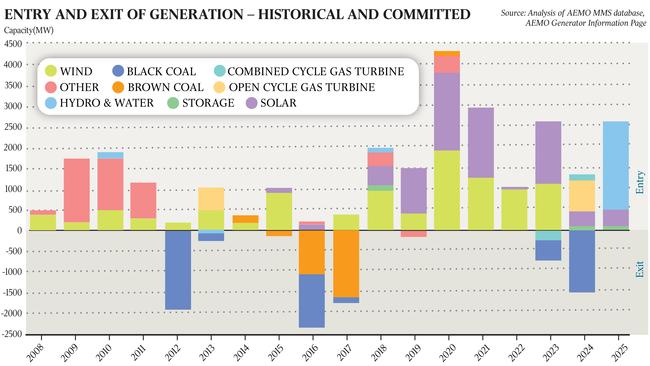

With half of the nation’s coal generation expected to exit the market around 2030, a shift to “fast and flexible” dispatchable power options will be accelerated under the proposed technology-neutral capacity mechanism.

The mechanism allows energy retailers to purchase certificates from generators to lock in supply and prevent the retirements of coal and gas plants, avoiding a repeat of blackouts and price spikes that occurred when the Northern and Hazelwood power stations shut.

The ESB report said beyond 2025, “the types of resources that are expected to be best incentivised by a certificate scheme are those resources that are flexible, reliable and economically competitive when operating at low-capacity factors”.

In Britain, the system operator buys power capacity and allocates the costs to energy retailers.

Energy Minister Angus Taylor said according to the ESB’s advice, the proposal would be “a net benefit to customers, not a net cost”.

“If you had to provide an incentive in the current market to ensure we get enough dispatchable generation, you’d have to allow the price to go up to as much as $60,000 a megawatt hour,” Mr Taylor said. “That is a monstrous price to reward that flexible dispatchable generation. We don’t want to do that because that would be extra costs to consumers. The ESB has been very clear that this will actually reduce costs to consumers, not increase them.”

The Australian understands the Australian Energy Market Operator has issued a record number of warnings about a lack of supply in NSW this year, at a rate of almost one every four days. The notices are issued when AEMO considers there is not enough capacity available in the system.

ESB chair Kerry Schott said if the system’s needs could not be assured, governments would have to “intervene” and build gas peakers and pumped hydro as thermal coal exited the market.

The Morrison government in May announced it would construct a $600m gas-fired power plant in the Hunter Valley to offset the closure of the Liddell coal-fired power station in 2023 in an attempt to avoid a 30 per cent power price hike for consumers.

The ESB, which began work on the reforms in 2019, recommended governments protect the delivery of essential system services, improve transmission and access to the grid by renewables, and better integrate Australia’s world-leading rooftop solar network.

Dr Schott, who led the ESB post-2025 market design alongside the nation’s energy regulators, said “this is not one big-bang reform for the redesign of the electricity market … It is a set of interrelated measures to be implemented and considered over time. The reforms aim to deliver reliable, affordable, lower emissions electricity for consumers and to keep the lights on as the system decarbonises. “The job is to get firm and flexible supply that is affordable,” Dr Schott said.

“To achieve that, we need improved information, harmonised jurisdictional schemes, orderly generator exit and timely entry of investment in new resources.”

The post-2025 energy market framework was approved by energy ministers on Friday. They will meet again in September to sign off on the final reform package before national cabinet considers the plan in October.

With limited investment support for coal-fired power stations and the AEMO warning that Australia needed up to 19GW in new flexible dispatchable power, Mr Taylor said coal-fired generators were “battling because they need to be more flexible”.

“We need a market that rewards flexible, dispatchable generation like gas, like hydro. And to the extent that coal could be more flexible. That’s good for affordability and reliability and it’s good for emissions, too. If they can be more flexible, it brings emissions down,” he said.

“Coal is having to adapt to be more flexible in the market. It’s a challenge. Gas is, too, particularly the baseload gas generators. That is the change that’s happening.”

Mr Taylor said despite record investment in renewable energy – with 7000MW added last year – “we have not seen investment in the dispatchable capacity needed to support renewables and ensure a reliable and affordable grid”.

Dr Schott said it was critical to have a capacity mechanism alongside the energy-only market to “bring forward the right mix of firm, flexible and variable resources when needed”. “That capacity might come from pumped hydro, batteries, wind, gas or coal, with those most able to be fast and flexible most likely to be relied upon and most likely to receive revenue,” she said. “Participants need sufficient incentives and confidence to invest in new capacity.”

EnergyAustralia head of markets Ross Edwards said while the transition to renewable energy took place, “there needs to be a mechanism that provides confidence and ensures there is always adequate capacity … to meet consumer demand”.

“Our current market frameworks need to be enhanced so that adequate, flexible dispatchable capacity is in the system, as ageing thermal baseload generation retires and Australia transitions to a low-emissions future,” he said.

“Once a capacity market is in place and customers have assurances that their lights will stay on, we can and should push for even more clean and cheap wind and solar power to come online.”

ENGIE chief executive Augustin Honorat said it supported a capacity mechanism that backed “an orderly transition to renewable energy”. “With the retirement of more coal-fired generation in coming years, exploring well-structured capacity mechanisms is a legitimate policy approach. A capacity mechanism does not need to undermine the investment incentives for new renewables or viability of existing renewable assets,” h said.

Dr Schott said building new transmission projects was key under the post-2025 plan but cautioned that an “efficient grid network will have some congestion”.

She said the energy reforms favoured “long-term operators over short-term speculators”.

Alinta Energy chief executive Jeff Dimery said he supported reforms that encouraged “investment in new replacement capacity” and prevented premature loss of generation.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout