Stimulus creates oversupply of homes

The $3bn in taxpayer money pumped into the home-building sector has created a construction boom that is now just 12 months away from swinging to a bust

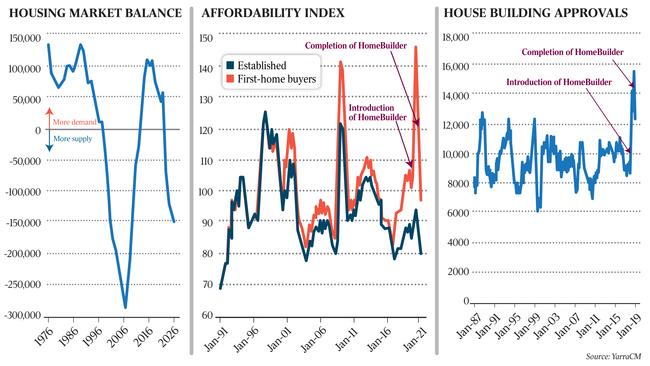

The $3bn in taxpayer money pumped into the home-building sector has created a construction boom that is now just 12 months away from swinging to a bust, according to new modelling which predicts an overstimulated sector will build 150,000 more homes than needed by 2023.

Yarra Capital head of macroeconomic strategy Tim Toohey said the HomeBuilder grant scheme, alongside similar state incentives, had triggered a “truly massive” lift in construction.

“Taxpayers have effectively handed out almost $3bn in ‘free money’ to people to build or renovate their home,” Mr Toohey said.

Mr Toohey, a former chief economist at Goldman Sachs, said historic building approval levels for stand-alone houses, matched with the “unprecedented” fall in population growth – largely due to closed borders – would create the biggest overbuilding of new houses since 2008.

“Going into Covid-19 we had a little bit of a shortage, but that will turn into significant oversupply,” Mr Toohey said.

“The penny hasn’t dropped, but when it does it will take the heat out of house prices.”

He said while record low borrowing rates would likely stop a sharp property market correction, those expecting “ongoing house price gains over the next two years may be disappointed”.

“Contrary to the current fervour of house buying, the risk of lower house prices over the next two years is at least as high as further house price increases,” he said, adding: “More importantly, the boom in new single house construction will be followed by a deep downturn.”

The modelling assumed a 30 per cent decline in building approvals by the end of 2022.

The 15 per cent surge in house prices has weighed on affordability and will contribute to the sharp fall in new construction.

If there was only a 10 per cent fall in housing starts, then the oversupply would lift from 150,000 to closer to 280,000, he said.

Mr Toohey warned that the super profits going into the construction industry would end in about 12 months time, with building approval figures having already rolled over and set to fall by 30 per cent by this time next year.

“It has been a great ride up for the building material companies, but we are past the peak and the outlook today looks increasingly gloomy,” he said.

Treasury had initially expected Covid to slash housing starts from 171,000 to 111,000, and estimated the Commonwealth HomeBuilder grants – worth at first $25,000 and then $15,000 – would halve that predicted reduction to leave around 140,000 starts in the year. Instead, over the year to June, some 200,400 dwellings were approved.

About 99,300 HomeBuilder applications were received by the government to build a new home, and a further 22,100 for a substantial renovation. Mr Toohey said the take-up of HomeBuilder was more than four times as much as expected.

He said there was “no issue” with developing large tracts of land in the “growth corridors” of the major cities, such as in Werribee in Melbourne’s southwest.

“The trouble is when we pull forward this enormous amount of activity, you have to acknowledge what comes next,” he said

“The RBA will not be tempted to raise interest rates while the housing construction sector … transitions from boom to bust.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout