Steely resolve: Whyalla owner Sanjeev Gupta funnels multimillions offshore

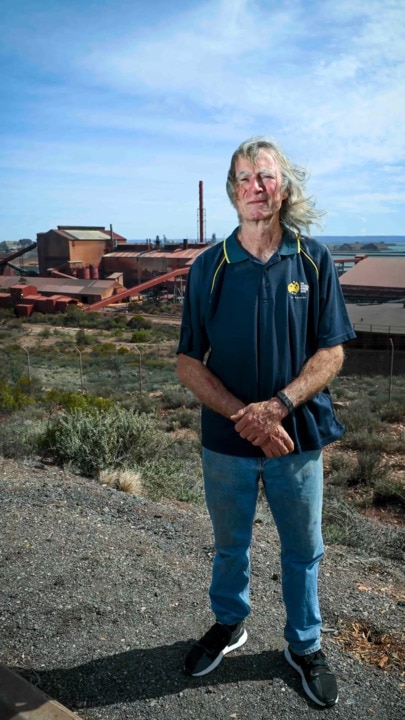

Contractors at GFG’s Whyalla steelworks in South Australia’s Iron Triangle have been waiting months to be paid and dozens of workers have been laid off in the past 12 months.

Embattled steel and mining giant GFG Alliance has been pulling hundreds of millions of dollars from its Australian operations and sending the money offshore to prop up its ailing international business.

The revelation comes as contractors at GFG’s Whyalla steelworks in South Australia’s Iron Triangle have been waiting months to be paid and dozens of workers have been laid off over the past 12 months.

It has prompted an explosive warning from the South Australian government that any state and federal taxpayer support to GFG will be contingent on guarantees that the company spends all of the money in Australia.

GFG has strongly defended the transfer of funds out of Australia as routine for any international company with worldwide operations and said its financial commitment to Whyalla had been well demonstrated.

“GFG has invested more than $1.3bn in Whyalla Steelworks business since 2017,” a GFG spokesperson said.

“In the last two years, the combined Whyalla steel and iron ore mining business lost over $400m funded by the group.

“A further injection will come this year once the current fundraising initiative is completed to provide critical capital to support suppliers, employees and the ongoing maintenance work at the blast furnace.

“The Australian operations are part of a global business and repayment of bank loans and group loans is normal practice.”

Other sources have told The Australian the scale of the transfer of funds from GFG’s Australia operations to its cash-strapped international operations is “extraordinary”.

The Australian has seen evidence that GFG has already extracted $430m from its Mining and Primary Steel business in Australia – which includes its struggling Whyalla plant – to service intracompany loans across its global GFG Alliance group.

While there is no suggestion the practice is illegal, the revelation has angered the Whyalla community where contractors have gone unpaid and workers have been stood down amid growing concern over the viability of GFG.

The Australian has sighted internal GFG financial documents showing that in 2022-23, GFG took out $156m from its Australian operations to cover the final payment to a Credit Suisse loan.

In 2023-24, that amount rose to $274m taken from Australia to fund other intracompany loans.

The amount set to be extracted from Australia in this 2024-25 financial year is $342m, $10m of which was paid this August, according to GFG financial statements seen by The Australian.

The documents suggest that as the international debt woes become worse for GFG Alliance and its owner, Sanjeev Gupta, the company is moving more and more money out of Australia to keep itself afloat internationally.

At the same time, the company has been angling for taxpayer assistance from the SA government to support Australian operations.

SA Energy Minister Tom Koutsantonis has now said current and future support from both SA and Canberra to GFG will be linked to guarantees that the company only spend the money here.

Mr Koutsantonis said he was not surprised by The Australian’s revelations about the company’s use of Australian money to offset its international financial woes.

“It is no shock to us or indeed the SA public that there are concerns about GFG’s finances internationally,” he said. “It is a private company and as such has the capacity to allocate its finances as it determines.

“Our priority as a government is ensuring SA businesses are being paid – and being paid in a timely manner.

“We know the Australian arm of the business has been profitable, and local contractors shouldn’t be left in the lurch for recompense for their contribution.”

Mr Koutsantonis, who made an urgent visit to Whyalla to meet GFG and its cash-strapped contractors on Wednesday, said while the steelworks had to remain operational, GFG could not expect endless support without giving guarantees.

“Our priority is to Whyalla,” he said. “We are absolutely committed to ensuring the steelworks remain open and operating, employing South Australians for the sake of the nation’s economic sovereignty.

“While there is state and federal money on the table to underpin the clean energy transition, none of that money has yet been handed over and is explicitly earmarked – once the requisite conditions are satisfied – to be spent on building for the future of the Whyalla steelworks.

“This government is 100 per cent committed to ensuring Whyalla remains as our industrial hub – our commitment has always been to the steelworks, its workers and the maintenance of iron and steelmaking in this country.”

The Malinauskas government has been liaising with the federal government about the threats to the future of GFG’s steelworks.

The Australian understands it has come up with several plan B options involving the potential involvement of companies such as BlueScope Steel in the event GFG pulls out of Whyalla because of its financial woes.

GFG Alliance is facing challenges on multiple fronts abroad with creditors for collapsed former GFG financier Greensill Capital pursuing Mr Gupta for $800m.

Britain’s corporate registry Companies House is also prosecuting Mr Gupta for allegedly failing to file accounts for 76 of his British companies, a claim Mr Gupta denies and is fighting in the courts.

Over the past five years, GFG claim that the Whyalla steelworks, which GFG took over in 2017, has been making a loss of around $1m a day with its blast furnace offline since March and still unable to be properly repaired.

However, GFG’s non-steelwork businesses in Australia have been profitable with positive cashflows and have been supporting GFG.

The Labor member for Whyalla, Eddie Hughes, said the community had long suspected that money was being taken out of Australia.

“It’s one of the things about GFG because it’s not a listed company – their finances are murky so it is complicated to work out what’s going on,” Mr Hughes told The Australian.

“Clearly there has been money leaving Australia and what really aggravates people in the community is when they see maintenance being cut back, and cut backs at the steel works.

“We all believe that the money that is generated in Australia should stay here to improve assets in Australia.”

Mr Hughes said the past few months had been “very tough” in Whyalla as GFG sought to get the blast furnace operational amid job lay-offs and the non-payment to multiple contractors, affecting other local employers.

“The killer is the uncertainty,” he said. “People are working their guts out to get the blast furnace back online and while I’m confident it will happen, the question is how long.

“We understand that $250m has been raised by GFG but we still have contractors who are not of a mind to do anything with them until they can enter into binding agreements with GFG.

“We have also been given a guarantee there will be no further job losses but that does not cover casuals. We are expecting more of them to go. Not knowing what will happen is the real killer with it all.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout