States on $500bn debt binge as borrowings top 1990s recession

State government debt will more than double, exceeding the peak level of borrowing as a share of GDP in the early 1990s.

State government debt will more than double to nearly $500bn within four years, exceeding the peak level of borrowing as a share of GDP reached in the early 1990s recession and leaving states exposed to credit rating downgrades.

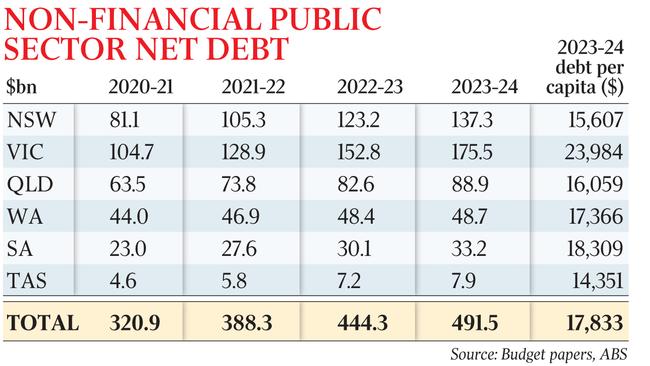

Borrowing by the six state governments, including their state-owned corporations, is on track to rise from $200bn in June this year to $491bn by June 2024, according to an analysis of state government budgets by The Australian.

As a share of GDP, combined state debt will rise to 23 per cent by 2024, above the previous peak of 20 per cent reached in 1992, according to analysis provided by the Centre for Independent Studies.

“Some of the debt increase is inevitable but states have made it much worse than they needed to, especially Victoria with its extraordinary range of discretionary social policy measures and so-called stimulus measures,” said CIS research fellow Robert Carling.

Victoria’s debt will swell to more than $175bn, or $24,000 per capita, while that of NSW will rise to $137bn, or $15,600 per capita.

“I wouldn’t be at all surprised if we see a few downgrades of credit ratings in the next year or two,” said Mr Carling, a former senior NSW Treasury official.

S&P Global ratings has repeatedly warned governments they face losing their AA and AAA ratings if their fiscal situation deteriorates. Queensland on Tuesday became the last of the state governments to hand down its budget, flagging total non-financial public sector debt of almost $89bn by 2024, up from $37.5bn in June.

Treasurer Cameron Dick trumpeted Queensland’s superior debt position to NSW and Victoria. “Queensland will have the lowest debt of east coast states, even if you include all the borrowings of our government-owned corporations and statutory authorities,” he said. “And unlike those states, Queensland has kept our public assets in public hands.”

S&P Global Ratings said Queensland was “on a solid path to fiscal recovery”, reaffirming the state’s AA+ rating as “stable”.

“For the first time in many years, Queensland’s debt levels will not be the highest in Australia,” it said in a statement.

Moody’s analysts on Tuesday night, however, also reaffirmed NSW’s AAA rating, and said the state’s “large and diverse economy remains resilient to coronavirus-related disruptions”.

“The rapid and sustained increase in the debt burden will constrain its operating profile over time, particularly in the event of future shocks,” Moody’s said.

Mr Carling said Victoria’s net debt as a share of its revenue would be 207 per cent by 2024, compared with 140 per cent for NSW and 118 per cent for Queensland.

“Western Australia at 66 per cent (is) by far in the best situation on these figures and that’s because of the royalties and the deal they have struck with government over the GST distribution,” he said.

The analysis follows warnings by S&P, revealed on Monday by The Australian, that Victoria could lose its AAA credit rating within weeks, owing to its “dire” public finances.

Chris Richardson, an expert in government budgets at Deloitte Access Economics, said rising debt was “better than the alternative of having less debt and higher and longer unemployment”.

“The economy has taken a big enough hit to keep interest rates at near-zero rates,” he said.

He noted that the annual interest cost of servicing the debt was not expected to rise much.

Deloitte analysis provided to The Australian found the forecast annual interest cost for the debt across all states except Victoria would remain below 5 per cent as a share of revenue by 2024 — lower than in the early 2010s.

Victoria’s debt-servicing costs would increase to just over 5 per cent, Deloitte said, based on government interest rate assumptions. Mr Carling said it was a “heroic assumption” given interest rates could rise sooner than the government expected.

“It’s sad that Victoria went through years and years of fiscal consolidation under Jeff Kennett and then Steve Bracks who led quite a disciplined Labor government, for all that effort has been blown in a few years,” he said.

The combined federal and state government debt burden was on track to exceed 61 per cent by 2024, according to Mr Carling.

Warren Hogan, an economist at UTS Business School, said deficits “well into the future” were a mistake when the economy’s performance was uncertain.

“All governments in Australia have taken a positive view of how their revenues will recover over the next few years which did not happen after the GFC,” Professor Hogan said. “If we see a weak revenue recovery again, government debt will be much higher than currently projected, leaving these governments very exposed to rising interest rates or another shock should it happen.”

Victoria, NSW and the ACT are the only AAA-rated states and territories. Queensland, SA and WA lost their AAA ratings in 2009, 2012, and 2013 respectively. S&P put the federal government, which is AAA, on negative outlook in May. “Australia’s governments are at risk of heading down the same path as Europe and the US with a greater exposure than these economies to an increasingly perilous world economy,” Professor Hogan said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout