State bonanza as home prices, stamp duty creep upward

State governments have reaped up to $60bn in windfall property transfer taxes during the past two decades.

State governments have reaped up to $60bn in windfall property transfer taxes during the past two decades as capital city home prices tripled and stamp duties grew at an even faster clip.

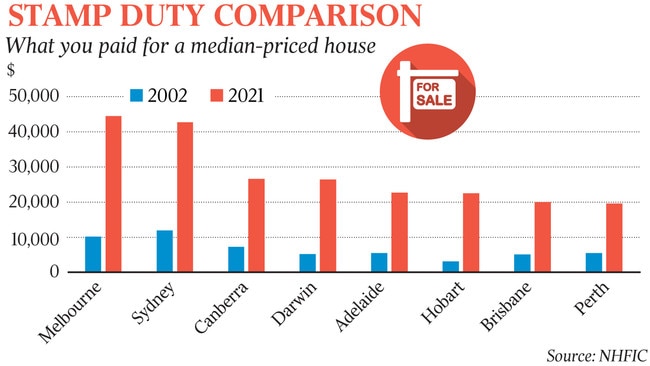

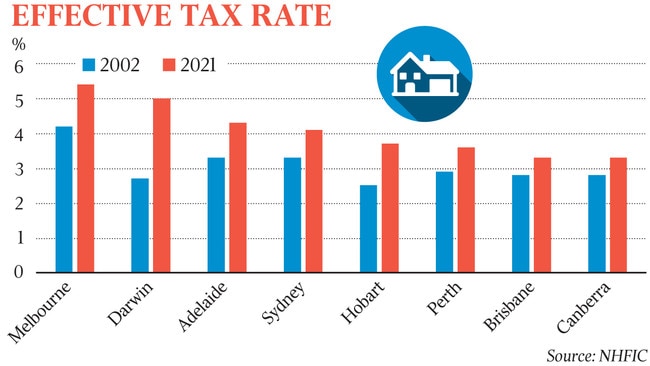

According to new research by the National Housing Finance and Investment Corporation, Australia is a bracket-creep state. Effective rates of stamp duty have risen across all jurisdictions since 2002, reducing worker mobility, keeping people in homes that don’t suit them and causing revenue volatility.

Stamp Duty Reform: Benefits and Challenges, released on Tuesday, details how when states and territories don’t adequately adjust duty rates and thresholds to offset rampant home-price inflation, the effective rate of tax creeps up across time. In Melbourne and Adelaide, that increase has been 29 per cent and 30 per cent, respectively.

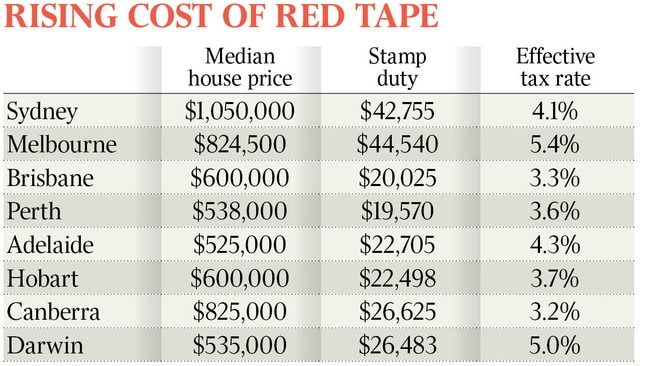

In Melbourne, where the median dwelling price was $824,500 in the March quarter, transfer duty was $44,540, or an effective tax rate of 5.4 per cent, the highest in the land. In 2002, the effective tax rate was 4.2 per cent. If that rate applied today, a Melbourne buyer would pay $9900 less duty for a median-priced residence.

For a $1m-plus median-priced Sydney home, the rise in effective duty from 3.3 per cent to 4.1 per cent means today’s buyer is slugged an extra $8100.

The paper found “adjustments to transfer duty regimes by the states have not kept pace with rising house prices, resulting in a revenue windfall that is difficult to replace”.

“The findings suggest that transfer duty revenue growth is difficult to contain unless policymakers proactively adjust tax design, which is currently not the case in Australia,” the paper says.

The Morrison government’s housing affordability adviser urges states and territories to follow the lead of NSW and the ACT, which began phasing out transfer duty in 2012.

NSW Treasurer Dominic Perrottet is pushing ahead to replace stamp duty with a land tax he argues will make home ownership more accessible, create jobs and boost economic growth.

A spokeswoman for Mr Perrottet said reform “would lift the onerous burden of stamp duty from first-home buyers so that more people can get into the property market”.

“It would also free up mobility, enabling people to buy and sell their homes as their work or lifestyle needs change, rather than being put off by the upfront cost of stamp duty with each change of address,” she said.

“We think the federal government has a role to support productivity reform and that’s why we’ve asked them to set up a productivity fund to incentivise all states to undertake productivity reform, particularly those that were highlighted in the commonwealth Productivity Commission’s Shifting the Dial report.”

Federal Housing Minister Michael Sukkar said: “There has been a perfect storm of rising state taxes, increasing regulatory imposts and unresponsive planning rules that have led to declining housing affordability.

“Any move to reduce these costs of home ownership would be welcomed. However, any tax reform must be funded through state budgets.”

NHFIC head of research Hugh Hartigan said “for all states and territories, except the ACT, a typical household would be better off paying a broadbased land tax than stamp duty for housing at most price points”.

“Households are paying more and paying it upfront when they are looking to upsize or downsize their housing arrangements,” he said. “The paper highlights that there are advantages of shorter phase-in periods when transitioning from stamp duty to a broadbased land tax because house price growth is more likely to be contained than over a longer transition.”

To address equity issues in a shift to land tax, the paper canvasses crediting households that recently paid duty and allowing asset-rich, cash-poor retirees to defer their land tax liabilities until their property is sold.

In today’s dollars, assuming 4.4 per cent turnover each year in the nation’s 10.6 million housing stock (or 466,400 homes) and an average rise in the effective duty rate of just over 0.8 percentage points on a median dwelling price of $780,000, the states have reaped a windfall of almost $60bn across 20 years.

In its May budget, Victoria raised stamp duty on property transfers worth more than $2m. Before the pandemic Victoria was considering abolishing the tax.

The NHFIC analysis shows Victoria has the most to gain from reform, as its transfer duty imposes a deadweight loss of 0.34 per cent of state final demand, or about $1.6bn a year.

The ACT, which is phasing out stamp duty across 20 years, has the lowest effective rate of duty and the highest number of transfers during the past year.

While economists have backed land taxes on equity and efficiency grounds, some critics argue the move is a greedy “tax grab”.

The experience in the ACT highlights the difficulty of maintaining a revenue-neutral transition across the longer term.

In the ACT municipal rates were increasing by 5.6 per cent a year in the lead-up to the 2012 reform. However, during the first seven years of the phase-out, rates grew by an annual average of 14.6 per cent.

The NHFIC said a short phase-out period cost taxpayers less and provided more certainty about the revenue to be replaced, while a long transition cost taxpayers more with less revenue certainty.

“Home buyers purchasing property just before the reform commences may need to be compensated and this could cause a large fall in revenue,” it said.

“Broadening the tax base also means an additional tax burden falls on households who own their home with no mortgage and investors, many of whom probably paid duty many years ago.

“A broadbased land tax imposes an additional cost on households that on average would be around 75 per cent of current municipal rates. However, this will be offset by the likely positive short-term impact on prices from removing duty.”

The report says a household in NSW will have to pay a broadbased land tax for more than 14 years to be worse off, which is greater than the 12.4-year average holding period of a property.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout