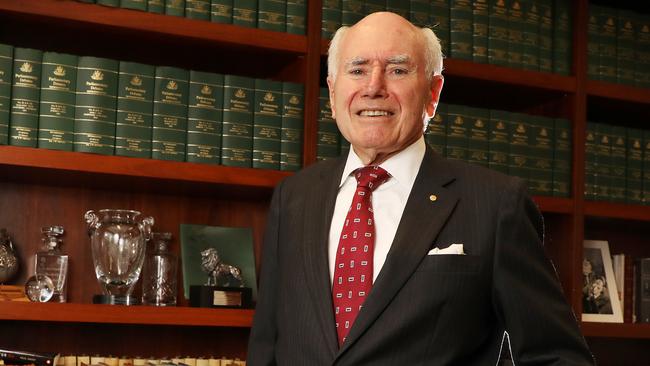

Save family tax breaks, says John Howard

John Howard has blasted claims family tax benefits are ‘middle-class welfare’ as a ‘very convenient pejorative slogan’.

John Howard has blasted claims family tax benefits are “middle-class welfare” as a “very convenient pejorative slogan”, arguing Labor and Coalition governments have been wrong to cut the $19 billion-a-year payments to families with children.

Mr Howard, prime minister for almost 12 years until 2007, said he was “unhappy” about changes to welfare payments that had sapped assistance to stay-at-home parents while spending on childcare subsidies available to all families increased.

“Too much of burden of adjustment has fallen on single-income families,” he told The Australian. “We’ve been squeezing the benefits (to them) proportionately more.”

Introduced in 2000 along with the GST, FTB payment rates and eligibility thresholds have been successively reduced and tightened since 2009 by Labor and Coalition governments, such that expenditure on them is budgeted to fall from $19.3bn this year to $18.8bn by 2021.

The Abbott government’s cost-cutting audit commission said the benefits “represented a significant expansion in family payments in terms of the generosity of the payments, expanded eligibility and increased commonwealth expenditure”, recommending part B be abolished and part A be significantly cut, including lower payments for second and third children.

The Turnbull government last year froze payments for a further two years and cancelled a $2.3bn planned increase in payments.

Mr Howard said he had a “very strong view” that couples without children should pay more tax than couples with children on the same income. “The most important thing we do as a nation is raise the next generation,” he said.

Family Tax Benefit part A was paid to almost 1.46 million families with incomes up to $217,230 last year and part B to 1.16 million (mostly the same) families with income up to $127,618.

“Paid childcare is essential and desirable and should be as affordable as possible, but a family on modest income who wants the option of one parent at home full-time should get help for that,” Mr Howard said.

“It’s still a desired pattern for an enormous number of couples.”

Spending on childcare subsidies is expected to grow from $7.5bn this year to $10bn by 2021 as part of the government’s revamped childcare subsidy that cuts out for families earning more than $351,248.

“I’m not attacking childcare but there is still an element of childcare assistance which is completely non-means-tested,” he said. “If you’re going (do that) you should non-means-test entitlement when mum or dad stays at home.”

Families currently receive up to $7500 a year in childcare subsidies regardless of income.

Mr Howard, 78, also attacked claims his government’s fiscal policy was unsustainable as “one of the great myths spread by the Labor Party and foolishly picked up by some others”.

“We never received advice we had to have even bigger surpluses, we didn’t, and I don’t think Treasury people have ever alleged that advice was provided,” he said.

“The best budget in the last 25 years remains Costello’s first,” he noted, referring the 1996 budget, Mr Howard’s first as prime minister, under which government spending fell from 25.1 per cent to 23.9 per cent of GDP in a year.

Mr Howard’s view on the immigration debate, China, Donald Trump and whether Charles will make a good king will appear in The Australian tomorrow.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout