Robodebt royal commission vindicates victims of failed automated debt recovery scheme

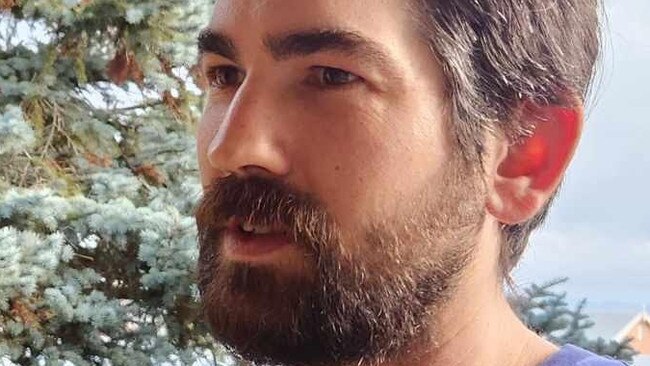

When Axel Shervashidze received a Robodebt notice of $4000 in September 2018, he said he felt like he’d been kicked in the chest by the automated debt recovery scheme.

When Axel Shervashidze received a Robodebt notice of $4000 in September 2018, he felt like he’d been kicked in the chest by the automated debt recovery scheme.

The then Victoria University student was getting by on Austudy payments supplemented by casual work stacking supermarket shelves and didn’t have a huge amount of savings in the bank.

“It was a bit devastating and just a real kick in the chest,” said Mr Shervashidze, who now works full-time in a liquor store in regional Victoria.

“At that point I really didn’t have a huge amount of financial savings, they were going to try to get blood from stone … so it was devastating in that sense because (I thought) this is just going to send me back.”

Mr Shervashidze sought help from the office of the late Victorian Labor senator Kimberley Kitching who helped him dispute the debt, which was revised down to $1000.

But on the same day Mr Shervashidze was told the original debt noticed had been wrongly inflated by $3000, he received a threatening letter from a debt collection agency.

“The whole process was me being treated like a criminal when I made a mistake unwittingly,” he said.

Mr Shervashidze is one of 380,000 victims across Australia of the unlawful Robodebt recovery scheme that used an automated system of income leveraging.

On Friday the royal commission into the botched scheme delivered findings into the scheme, with chair Catherine Holmes SC declaring victims were made to feel like “second-class citizens, criminals, and dole cheats”.

“In essence, people were traumatised on the off-chance they might owe money,” she said.

“It was a costly failure of public administration, in both human and economic terms.”

In the far southeast Melbourne suburb of Frankston, Felicity de Somerville said she felt vindicated by the royal commission’s report and said being caught by Robodebt had felt akin to being in an abusive relationship.

“There was always a part of me that felt like I was to blame,” she said. “You do feel very guilty and you feel very embarrassed that you’ve been a drain on society.

“I’m thankful I’m learning how to love and respect myself again.”

Ms de Somerville, who now runs her own nursing business, said the day she received the Robodebt notice will forever be seared in her memory.

She had gone to pay for her then one-year-old daughter Ciarra’s medical appointments and medications only to discover about $11,500 had been seized from her account. “They left me not just destitute but in debt,” she said.

“Despite my ongoing compliance and co-operation, their lack of empathy … it almost felt like sadistic pleasure in my pain.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout