Rich Aussies not getting much richer from inheritances

An astounding $1.5 trillion in inheritances and gifts have actually reduced the relative gap between the rich and poor.

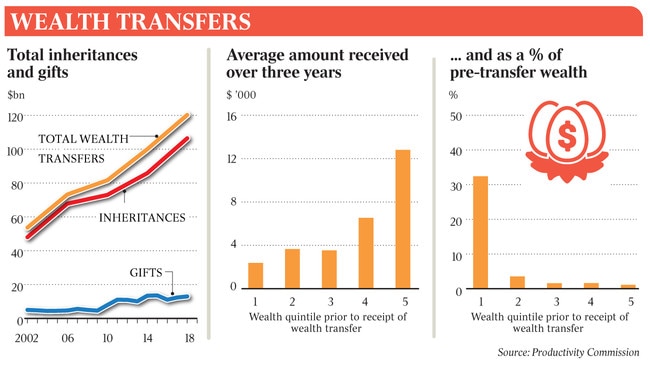

Booming property wealth and superannuation balances over the past 16 years have helped to double the value of inheritances to $100bn but, surprisingly, this has not widened the gap between the rich and poor, the Productivity Commission has found.

Soaring home prices have raised fears of entrenched intergenerational inequality, as property owners are able to pass on this wealth to their kids – or provide loans and guarantees while still alive – thereby locking out the children of renters who are unable to get the same leg-up.

But a new research paper from the PC found no evidence that the so-called “bank of mum and dad” was a widespread phenomenon, and that inheritances – which accounted for 90 per cent of the massive $1.5 trillion in wealth transferred between 2002 and 2018 – tended to benefit the less well-off relatively more.

Productivity Commissioner Catherine de Fontenay told The Australian: “There is a lot of concern around baby boomers passing on a lot of wealth. Does that mean wealth inequality is going to get worse? It was a surprise to find there was no evidence to suggest that was true.”

Dr de Fontenay said the key to the surprise finding was that while the average bequests received by the least wealthy Australians were only around a quarter of that given to the richest, it made a far larger difference to their lives.

For the already wealthy, receiving a bequest was likely “not going to change the trajectory of their life”, Dr de Fontenay said.

“For someone who has very little wealth, it might allow them to buy a house later in life. Wealthier people receive more inheritances and gifts on a dollar-for-dollar basis but less as a percentage of their existing wealth.

“When measured against the amount of wealth they already own, those with less wealth get a much bigger boost from inheritances on average, about 50 times larger for the poorest 20 per cent than the wealthiest 20 per cent.

“Hence wealth transfers tend to reduce the share of wealth held by the richest Australians and our projections show this is likely to continue. This might be a surprise to some, but it has been found in every other country … studied.”

By 2050, the value of wealth transferred every year was projected to quadruple, the research paper said, but if history was any guide, this would once again tend to weigh against relative wealth inequality. The study showed that so far, each generation has been wealthier on average than the previous one at the equivalent age, although baby boomers have done particularly well over the past two decades.

Dr de Fontenay said children tended to enjoy a similar relative wealth position to that of their parents, but inheritances were not the main driver of this. Instead, the academic research suggested other things handed down from parent to child were more important, such as education, networks, values and other opportunities.

The PC also tackled the issue of homeowning parents helping their children enter the property market, either via gifts or loan guarantees, saying it “could not find strong evidence of large transfers from ‘the bank of mum and dad’ despite popular belief”.

Private sector surveys by consumer finance groups – based on a small number of recipients, the PC noted – have claimed that lending by parents to help children buy homes was worth between $35bn and $92bn a year. The PC essentially debunked these claims. The total value of reported gifts from parents to children was about $14bn in 2018-19, but “similar to inheritances, there were many relatively small gifts and fewer very large ones”, the report stated.

In 2018-19, the median gift was about $1000, while the average was about $8000.

The PC also estimated the actual wealth transfer of loan guarantees provided by parents was only about $13m a year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout