Reserve Bank considered rate pause after seven rises since May

The central bank considered not hiking rates at its December meeting, further evidence it is closer to the end of its policy tightening cycle.

The Reserve Bank board at its December meeting discussed for the first time whether to pause this year’s aggressive rate hikes, but also recognised an uncertain outlook left open the potential for an accelerated policy tightening in 2023.

The minutes show that at the December 6 meeting, the RBA board members discussed a wide array of options, including keeping the cash rate target steady at 2.85 per cent, lifting it to 3.1 per cent, or delivering a jumbo hike to 3.35 per cent.

Ultimately, members agreed to a further 0.25 percentage point increase, and flagged there was more work to do to tame inflation, which despite a tick lower to 6.9 per cent in October remains at around 30-year highs.

“The board expects to increase interest rates further over the period ahead,” the minutes read, noting “there was considerable uncertainty about the outlook”.

Nonetheless, analysts saw the consideration of a pause as further evidence the central bank was closer to the end of its cycle of rate rises.

CBA head of Australian economics Gareth Aird said “this is a new development”, and that the minutes supported his view of a final rate rise in February.

“Over the course of the tightening cycle to date, the board had not considered the case to leave policy unchanged. The disclosure today that the board considered leaving monetary policy on hold in December means the RBA is close to pausing in the tightening cycle,” Mr Aird said.

Capital Economics senior economist Marcel Thieliant said the board weighing up leaving rates on hold in December “suggests that it won’t hike rates much further, though we still expect the cash rate to reach 3.85 per cent by April”.

In deciding against a pause, the RBA board minutes note that “even with further increases in the cash rate as incorporated into the November forecasts, inflation was expected to take several years to return to the target range”.

“Incoming information had not warranted a reassessment of that broad outlook. Moreover, members noted that no other central bank had yet paused.”

How households would respond to the steepest series of rate hikes since the 1990s remained a key question, as was the impact of a deteriorating global situation that could see the United States, the United Kingdom and parts of Europe fall into recession in 2023.

With the future so balanced, the RBA board appeared intent on keeping all options on the table.

“Recognising this uncertainty (about the outlook), members noted that a range of options for the cash rate could be considered again at upcoming meetings in 2023,” the minutes read.

“The board did not rule out returning to larger increases if the situation warranted.

Conversely, the board is prepared to keep the cash rate unchanged for a period while it assesses the state of the economy and the inflation outlook.”

The tone of the board meeting minutes was broadly unchanged from the previous month: there had been a “substantial” increase in borrowing costs this year that would flow through to reduced household spending and slower growth in 2023.

But inflation still remained “too high”, and the jobs market was “very tight”.

Similarly, while there were signs that the inflationary pulse was easing, it was too early to conclude a strong trend, the minutes state.

“The board would also continue to play close attention to the price-setting behaviour of firms and the evolution of labour costs, given the importance of avoiding a price-wage spiral.

“The board is seeking to keep the economy on an even keel as it returns inflation to target, but these uncertainties mean that there are a range of potential scenarios. Members agreed that the path to achieving the needed decline in inflation and achieving a soft landing for the economy remained a narrow one.”

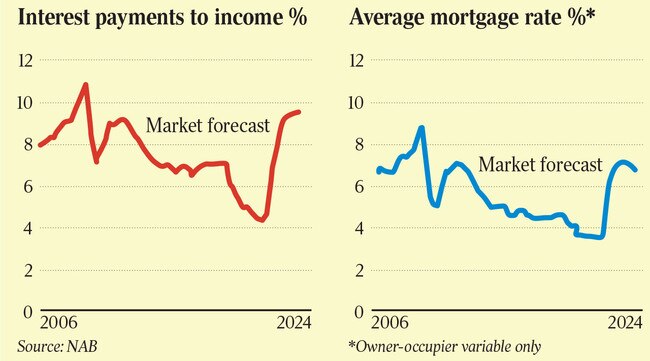

Board members also discussed evidence that required mortgage repayments as a share of household income were expected to reach their highest since 2008, but that Australians across all income levels had continued to build up buffers in aggregate over the four months to September.

“As a share of income, expected required payments in 2023 would also be close to the average level of actual mortgage payments – both required and excess mortgage payments – in 2022,” the minutes read.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout