No plans to hike interest rates in 2022, says RBA

Reserve Bank governor Philip Lowe warns: ‘Borrowers need to be aware that rates will rise again – not quickly, and not next year; the most likely case is 2024, but it’s possible it’s 2023’.

Reserve Bank governor Philip Lowe says he has no plans to hike rates next year, despite predicting a booming post-Delta economy would drive a faster pick-up in wages and consumer prices.

In a key change to the statement accompanying Tuesday’s decision to hold rates steady at 0.1 per cent, Dr Lowe opened the door to a rate rise before 2024, which had previously been the bank’s “central scenario.”

In an unscheduled press conference after Tuesday’s meeting, Dr Lowe said the RBA’s more bullish economic outlook meant “borrowers need to be aware that rates will rise again – not quickly, and not next year; the most likely case is 2024, but it’s possible it’s 2023”.

“When people are making their borrowing decisions, they need to take that into consideration,” he said.

Dr Lowe’s comments followed days of intense speculation among investors that the central bank could be forced to tighten monetary policy as soon as early 2022.

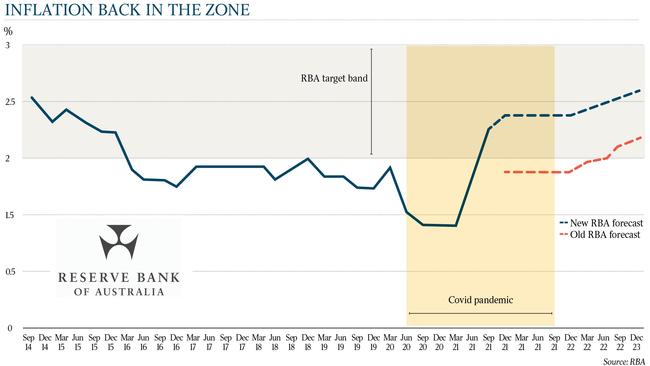

This was after consumer price data last week showed underlying inflation had hit 2.1 per cent over the year to September, reaching the central bank’s 2-3 per cent target for the first time since 2015.

The RBA governor, however, dismissed such speculation as a “complete over-reaction”.

“The latest data and forecasts do not warrant an increase in the cash rate in 2022,” Dr Lowe said, adding “things would have to turn out very, very differently than what we expect”.

“The factors that have kept wages growth low for decades would have to reverse and inflation would have to jump,” he said.

“I recognise that some other central banks are raising rates but our situation is different.”

Amid growing alarm around housing affordability as property prices boom through the pandemic, Dr Lowe said “if society is concerned about rising housing prices, the solution is not higher interest rates”.

He said lifting borrowing costs would lower property values, but it would come at the expense of higher unemployment and lower wages growth – what he deemed an unacceptable trade-off.

Instead, he said the answer was better addressed by looking at “structural” issues, such as the tax treatment of houses, how cities were designed and where Australians chose to live.

Dr Lowe said a post-Delta economic rebound was under way, and growth would surpass the RBA’s August projections, driving unemployment down faster and wages higher. “GDP is expected to record a solid gain in the December quarter, following the sharp contraction in the September quarter,” he said.

The central bank now expects growth to surge by 5.5 per cent next year, versus a previous estimate of 4.25 per cent, with the growth forecast for 2023 steady at 2.5 per cent.

“The resilience of the economy continues to be evident in the labour market,” Dr Lowe said. “A strong bounce-back in hours worked is under way, after a sharp fall during the lockdowns.”

Unemployment was expected to reach 4.25 per cent rather than 4.5 per cent by the end of next year, before falling to 4 per cent by the close of 2023 – an unchanged forecast from its August outlook.

“This would be a welcome development,” Dr Lowe said. “Australia has not experienced a sustained period of unemployment at levels this low since the early 1970s.”

Wages are forecast to increase by 2.5 per cent over 2022, from the current rate of 1.7 per cent. They are forecast to hit 3 per cent by the close of 2023, versus a previous estimate of 2.75 per cent.

Dr Lowe said the central bank now expected its preferred measure of inflation – which removes more volatile items such as food and petrol prices – would end 2022 at 2.25 per cent, well above the 1.75 per cent forecast from August.

The RBA will release its full updated economic outlook in Friday’s statement on monetary policy.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout