Reserve Bank lifts rates to 0.35pc as inflation spikes

Rates rise more than expected as the Reserve Banks moves to tackle inflation, under the spotlight of an election campaign.

Reserve Bank governor Philip Lowe has declared “the time was right” to deliver the nation’s first rate hike since 2010, increasing rates to 0.35 per cent from the record low of 0.1 per cent in the middle of an election.

“The economy has proven to be resilient and inflation has picked up more quickly, and to a higher level, than was expected,” Dr Lowe said, less than two weeks after official data showed consumer prices grew at 5.1 per cent over the year to March – a shock result and the highest since the introduction of the GST.

“There is also evidence that wages growth is picking up. Given this, and the very low level of interest rates, it is appropriate to start the process of normalising monetary conditions,” he said in a statement accompanying the RBA board’s decision.

Dr Lowe also signalled that this process would “require a further lift in interest rates over the period ahead”.

“The board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time,” he said.

“The board will continue to closely monitor the incoming information and evolving balance of risks as it determines the timing and extent of future interest rate increases.”

Dr Lowe will give a speech at 4pm and answer questions from journalists and economists, and Tuesday’s announcement will thrust the central bank into the middle of an election campaign which is predominantly being fought on cost-of-living issues.

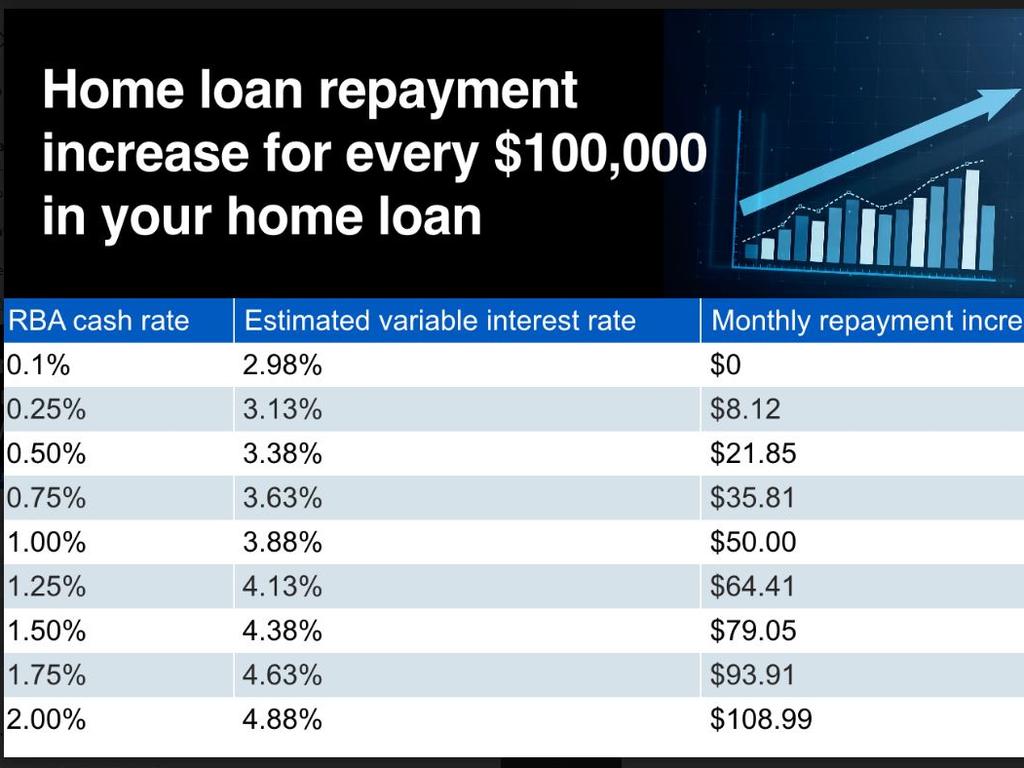

With an estimated more than 1 million households about to experience a rise in rates for the first time, Opposition treasury spokesman Jim Chalmers was quick to use today’s announcement to attack the government’s economic credentials amid what he called a “full-blown cost of living crisis”.

“After almost a decade of this Liberal-National Government, the costs of essentials are out of control, real wages are falling, and now interest rates are rising by a quarter of a per cent,” Dr Chalmers said.

The vast majority of analysts and investors had expected a rate increase today, but the decision to raise rates by 0.25 percentage points has caught out the experts – most of whom had tipped a 0.15 percentage point increase to bring the RBA’s cash rate target back to its usual quarter of a percentage point increments.

Explaining the decision, Dr Lowe said “inflation has picked up significantly and by more than expected, although it remains lower than in most other advanced economies”.

The RBA now anticipates inflation will reach 6 per cent in 2022, and core consumer price growth – which the central bank targets to keep within 2-3 per cent over the medium term – will blow out to 4.75 per cent, from 3.7 per cent now.

“This rise in inflation largely reflects global factors. But domestic capacity constraints are increasingly playing a role and inflation pressures have broadened, with firms more prepared to pass through cost increases to consumer prices. A further rise in inflation is expected in the near term, but as supply-side disruptions are resolved, inflation is expected to decline back towards the target range of 2 to 3 per cent,” Dr Lowe said.

“The bank’s business liaison suggests that wages growth has been picking up. In a tight labour market, an increasing number of firms are paying higher wages to attract and retain staff, especially in an environment where the cost of living is rising.

“While aggregate wages growth was subdued during 2021 and no higher than it was prior to the pandemic, the more timely evidence from liaison and business surveys is that larger wage increases are now occurring in many private-sector firms.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout