Red-hot property prices may hurt some, but high unemployment is worse: RBA

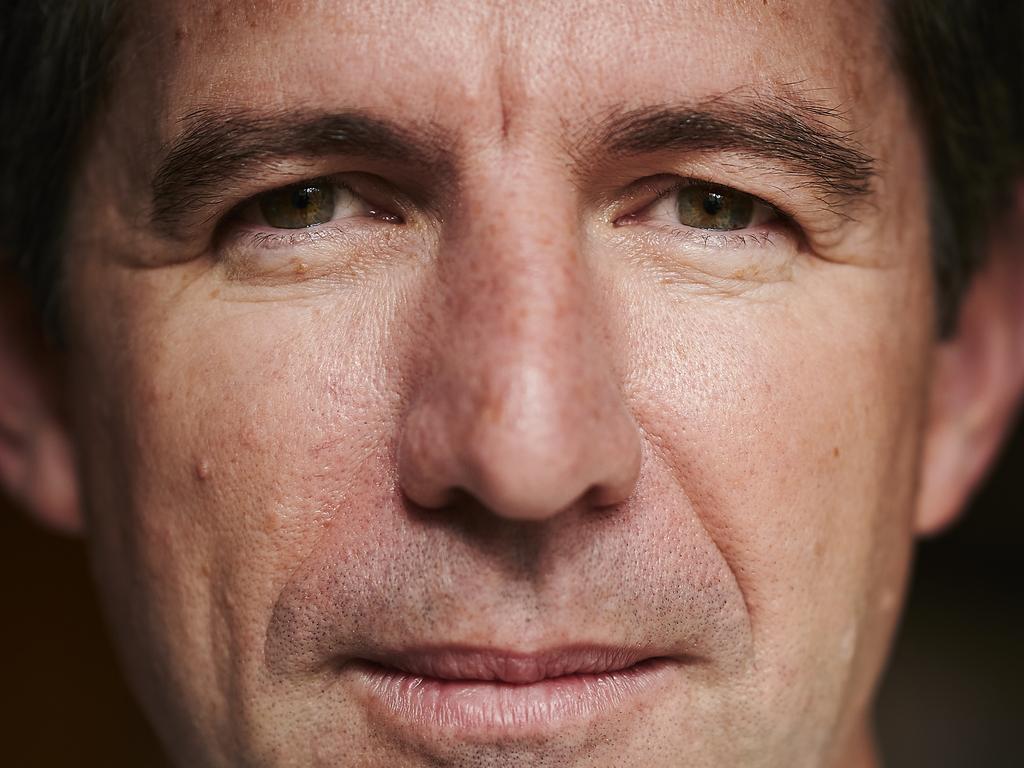

RBA deputy governor Guy Debelle feels the pain of non-homeowners in a property boom but argues unemployment imposes higher costs on the community.

The Reserve Bank says expansionary monetary policy is pushing up house prices, hurting non-homeowners and raising concerns in parts of the community, but it will still keep interest rates ultra-low until 2024.

In a speech on Thursday evening, RBA deputy governor Guy Debelle said while house prices may not rise as fast without monetary stimulus, unemployment would definitely be “materially higher” without it, and that other tools can be used to address the distributional consequences of a red-hot property market.

“The recovery in the Australian economy has significantly exceeded earlier expectations, reflecting the sizeable fiscal and monetary policy support, as well as the favourable health outcomes,” Dr Debelle said.

“But significant monetary support will be required for quite some time to come”.

In the Shann memorial lecture, Dr Debelle explained that rising housing rices “are part of the transmission of expansionary monetary policy to the economy”.

“They help encourage home building, along with government grants such as the HomeBuilder policy, which boosts activity and employment. There is plenty of evidence of that here in Perth,” he said.

“The Bank recognises that rising housing prices heighten concerns in parts of the community. Housing price rises can have distributional consequences. That is certainly an issue that needs to be considered, and there are a number of tools that can be used to address the issue.

“But I do not think that monetary policy is one of the tools. Monetary policy is focused on supporting the economic recovery and achieving its goals in terms of employment and inflation.

“It is important to remember that while housing prices may not rise as fast without the monetary stimulus, unemployment would definitely be materially higher without the monetary stimulus. Unemployment clearly has large and persistent distributional consequences”.

According to property researcher CoreLogic, national property prices rose by 6.8 per cent in the three months to April.

Dr Debelle noted the size of the economy was now back to its pre-pandemic level, due to particularly strong household spending off the back of vast fiscal support and rapid jobs growth.

“This has been a remarkable episode where households’ incomes have risen at the same time as the economy has been through a historically large recession,” he said.

“That reflects the large support provided to the household sector by fiscal policy through JobKeeper and JobSeeker, and more recently by the very strong employment growth.

“Outcomes in the Australian economy have significantly exceeded even the optimistic expectations in terms of economic activity.

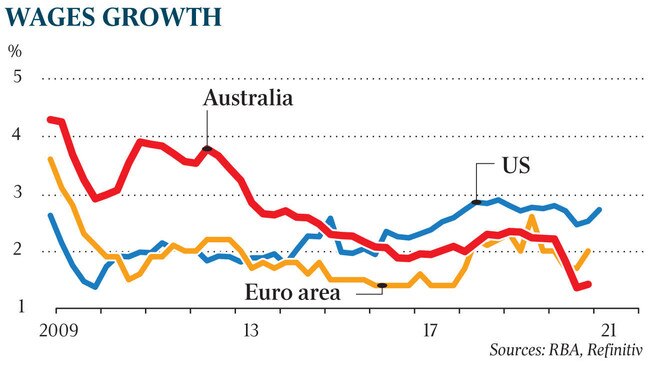

“But that is not the case on the nominal side of the economy in terms of wages and inflation. While the Australian economy has experienced better employment outcomes than most other countries, wages growth in Australia has been noticeably weaker than in many comparable economies, most notably the United States.”

Dr Debelle said consumer inflation was a little ahead of 1 per cent in the year to the March quarter, and the headline rate is likely to spike to above 3 per cent this quarter due to higher oil prices and the unwinding of pandemic child care discounts a year ago.

“But after these base effects wash through, we expect inflation to fall back to below 2 per cent,” he said.

During the Q&A session, Dr Debelle was asked about the possibility of emerging inflationary pressures given the robust strength of the economic recovery.

“It is a possibility, yes, a very low possibility,” Dr Debelle said.

While there had been reversals in wage freezes, he said “we haven‘t seen any evidence of a pick up in wages”.

“While we hear about wage pressures in some pockets, they are small pockets,” he said.

On Friday, the RBA will publish updated economic forecasts in its quarterly Statement on Monetary Policy.

Dr Debelle, who is a member of the RBA board, said the bank would “not increase the cash rate until actual inflation is sustainably within the target band of 2 to 3 per cent”.

“For that to occur, we will need to see further significant gains in employment and a lower unemployment rate,” he said.

“We will need a tighter labour market to lead to higher wage rises. In the board’s central scenario for the Australian economy, it does not expect these conditions to be met until 2024 at the earliest.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout