RBA lifts interest rates, pain takes off

Jim Chalmers tells households that inflation will get worse before it gets better and rates will continue to climb after the 0.5pc rise.

Jim Chalmers has told households that inflation will get worse before it gets better and interest rates will continue to climb after the Reserve Bank announced a 0.5 percentage point increase in the cash rate, adding $200 a month to a $750,000 mortgage.

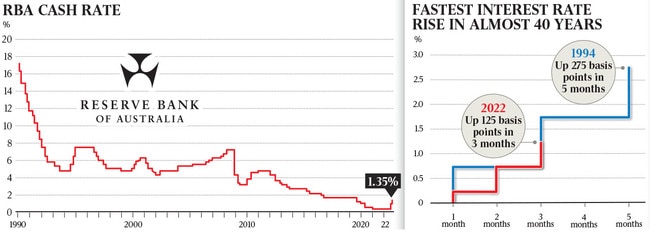

The Treasurer called for households to show “characteristic Australian resilience’’ after the RBA’s third rate hike in as many months which have taken official rates to 1.35 per cent from 0.1 per cent.

RBA governor Philip Lowe flagged more pain ahead for mortgage holders, saying the board “expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead”.

Dr Lowe said strong demand, a tight labour market and capacity constraints justified a second consecutive double rate hike – the sharpest monetary policy tightening since 1994.

“The size and timing of future interest rate increases will be guided by the incoming data and the board’s assessment of the outlook for inflation and the labour market,” he said.

Anthony Albanese, returning to Australia from a NATO meeting in Madrid and a visit to Ukraine said families were “doing it tough” and argued the increase in the official cash rate was “another blow”.

“We have plans to deal with cost of living pressures – plans for cheaper childcare, plans to roll out cheaper energy … But also the support that we’ve had for minimum wage increases,” the Prime Minister told 6PR radio.

“We supported the … low and middle income tax offset measures that came into being just this week, on the first of July. That of course will put more money into the pockets … of low and middle income wage earners.”

Although there are growing fears that rapid-fire rate hikes in Europe and the US will trigger recessions, Dr Chalmers said the Treasury and Reserve Bank did not predict that higher rates would drive the Australian economy into reverse.

“The way I look at it is that our economy is growing, but so are our challenges,” the Treasurer said. “I am confident in the long-term prospects for the Australian economy so long as we do our best to manage together this difficult combination of circumstances.”

Ahead of a full economic update when parliament returns later this month, Dr Chalmers revealed Treasury anticipated that inflation would moderate in 2023.

“A number of our challenges in the economy will get harder before they get easier, but they will get easier,” he said.

“Inflation will get worse before it gets better, but it will get better. We have to navigate some really tricky conditions in the near term (but) I am confident that a better future and better days lie ahead.”

Dr Chalmers said the upcoming jobs summit – due to be held in late September – would be focused on addressing the chronic shortage of skilled workers, and the Albanese government was not ruling out an increase to the 160,000 annual cap on the number of permanent skilled migrants.

“In addition to training and childcare and other options, obviously migration has got a role to play,” he said.

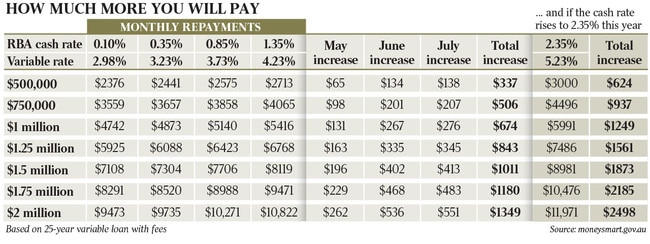

Economists said they expected a further half a percentage point move when the Reserve Bank meets next month, and that the key cash rate would reach 2.35 per cent by the end of this year, before pushing to 2.6 per cent in early 2023.

AMP Capital chief economist Shane Oliver said the RBA’s back-to-back jumbo rate hikes were consistent with the stepped-up pace of tightening from central banks in New Zealand, Canada and the US recently “as they all try to get ahead of the surge in inflation and to contain inflation expectations”.

“This and the low starting point explain why the cash rate is being increased at the fastest pace since 1994,” Dr Oliver said.

Australian Industry Group chief executive Innes Willox warned that higher borrowing costs would compound the pressures facing industry, and called on the RBA to take a measured approach.

“If we raise rates too rapidly it could crunch business and consumer confidence, at a time when businesses are struggling with large wage increases, labour and skills shortages and rising energy costs,” Mr Willox said.

“This emphasises the importance of addressing supply constraints across the Australian economy. Productivity-raising reforms and resuming skilled migration are essential in this inflationary environment.

“It is also critical that the recent large increase in award wages does not flow more broadly into wages and add to inflationary pressures that lead to even higher interest rates.”

Experts said banks were sure to pass on the official RBA move in full to variable home loan rates.

After Tuesday’s increase, a household with a $750,000 loan would pay $500 more in monthly interest since April when the RBA cash rate was at a record low of 0.1 per cent, according to RateCity analysis.

Dr Chalmers said: “We do appreciate that the skyrocketing cost of essentials like groceries and petrol and electricity, and other essentials as well, is putting extreme pressure on household budgets – and that this interest rate rise today will add to the pain that people are feeling”.

The Treasurer would not commit to any additional and immediate cost-of-living relief in the October budget, beyond implementing pre-election commitments such as a large boost to childcare subsidies from mid-2023, and a $12.50 reduction in the cost of prescription medicines from the start of next year.

Dr Chalmers reiterated that motorists should not expect the 22.1c-a-litre petrol price excise cut – implemented by the previous Coalition government in the March budget – to continue beyond its September end date.

“Our ability to respond to a lot of these challenges is constrained by the fact that there is a trillion dollars of debt in the budget and we need to take that challenge seriously,” he said.

Inflation has surged to a multi-decade high of 5.1 per cent over the year to March, supercharged by a massive increase in fuel costs. Cost-of-living pressures have since been compounded by another lift in petrol prices, an east coast power crisis, and most recently another devastating NSW flood that is set to drive food prices even higher.

With the squeeze on household finances intensifying, Dr Lowe highlighted that “one source of ongoing uncertainty about the economic outlook is the behaviour of household spending”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout