RBA governor Philip Lowe signals rates ‘pause’

Philip Lowe says the central bank is nearing the point where it will be ‘appropriate to pause interest rate increases’, raising the hopes of struggling homeowners.

An end to back-to-back rate rises could come as soon as next month, after Reserve Bank governor Philip Lowe said “we are closer to the point where it will be appropriate to pause interest rate increases”.

“We’ve done a lot in a short period of time. And at some point, it’s going to be appropriate to sit still and assess the collective effects of that,” Dr Lowe said.

The central bank boss said there were “four really important pieces of data that we’ll look at our next board meeting”, including monthly updates on employment, inflation, and retail trade, as well as the NAB business survey.

“If collectively they suggest that the right thing is to pause, then we’ll do that. But if they suggest that we need to keep going, then we will do that,” Dr Lowe said.

“So we’ve got a completely open mind about what happens at the next board meeting.”

The RBA board on Tuesday delivered its tenth straight rate increase, but Dr Lowe in his accompanying statement softened his language about the need for multiple further interest hikes and noted emerging signs of weakening growth and easing inflation.

The central bank boss on Wednesday morning reinforced that message in a speech to the Financial Review business summit, even as he warned that “if we don’t get inflation down fairly soon, the end result will be even higher interest rates and more unemployment”.

And Dr Lowe, in a question-and-answer session following his speech, made it clear that pause or not in April, the central bank’s job was not done.

“The underlying message has been the same: inflation is too high, we need to keep raising rates, and we will. When and how much remains to be determined.”

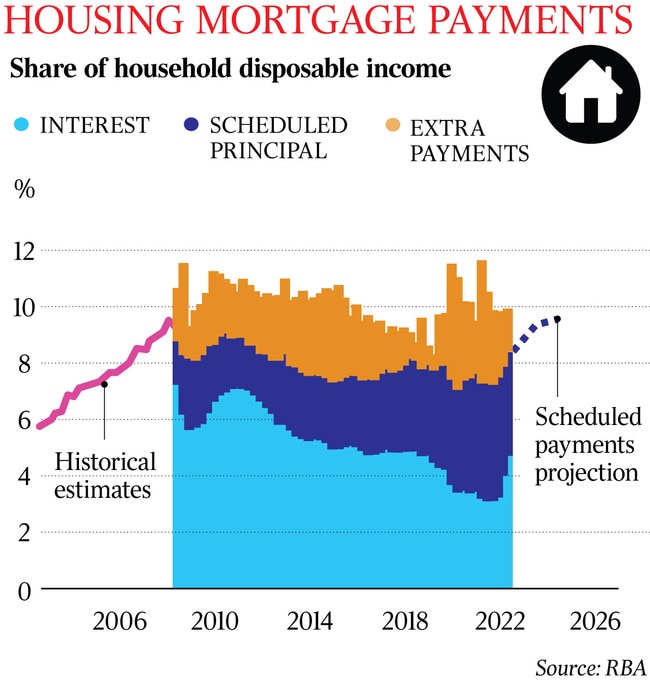

The 3.5 percentage-point increase in rates since May last year would push mortgage repayments as a share of households’ disposable income to a record high of nearly 10 per cent later this year, Dr Lowe said.

“At our board meeting yesterday, we discussed the lags in monetary policy, the effects of the large cumulative increase in interest rates since May and the difficulties that higher interest rates are causing for many households,” he said.

Monetary policy was “now in restrictive territory” and there was a “clear moderation” in household spending.

“The combination of cost-of-living pressures, higher interest rates and the decline in housing values is weighing on consumption.”

Dr Lowe repeated the central bank’s commitment to “do what is necessary to make sure that high inflation does not become ingrained”.

“The tool that we have to do this is interest rates. I acknowledge that the effects of higher interest rates are felt unevenly across the community.”

The RBA governor, who has come under heavy criticism for failing to anticipate last year’s inflationary surge, flagged that keeping the economy on an “even keel” while bringing inflation to heel was becoming increasingly difficult due to a range of conflicting signals from the economy.

“If inflation comes back to 3 per cent by mid ‘25, and we can keep the unemployment rate low 5 per cent, that will be a fantastic outcome,” he said.

The key jobless measure is at a near 50-year low of 3.7 per cent.

Dr Lowe said “our judgment, at least at the moment, is the benefits we would get from getting inflation back to 3 per cent six months earlier at the cost of a lot of job losses isn’t worth it”.

“That is our ambition (to tame inflation without a large increase in unemployment). It is still possible to achieve this, but we do need to be prepared for other outcomes as well, including a sharper rise in unemployment,” he said.

“Given the world we are living in, there are many sources of uncertainties at present and we could be knocked off that narrow path.”

“On the positive side, households’ wage and salary income increased by more than 10 per cent over the past year, people have been finding jobs, and a large stock of additional savings was accumulated over the pandemic period.

“On the other side, though, interest payments are increasing quickly at a time when inflation is also high; based on the interest rate increases that have already occurred (including yesterday’s),” he said.

Dr Lowe said that with the monthly inflation gauge falling from 8.4 per cent in December to 7.4 per cent in January, “ we now have the first sign that the slower rate of goods price inflation in global markets is being transmitted to Australia”.

“In January, clothing prices declined and the prices of household furnishings fell for the first time in quite a while. This is just one monthly figure, of course, so we will be looking for further evidence of a deceleration in goods price inflation over the months ahead,” he said.

“In contrast, the prices of many services are continuing to rise briskly. Over the summer, strong demand for travel, accommodation and entertainment contributed to large price increases in these sectors. Rents are also rising rapidly, with rental vacancy rates at very low levels in many parts of the country.”

As Dr Lowe flagged the potential for a rates “pause”, the US Federal Reserve chair Jerome Powell overnight opened the door to a larger 0.5 percentage-point interest rate increase this month and said officials were likely to lift rates higher due to a re-acceleration in the economy and inflation.

Dr Lowe said the American experience was a “cautionary tale” and that “the main global issue though is still inflation”.

“Headline inflation has peaked in most economies and is now coming down due to the resolution of supply side problems, softer demand for goods and a decline in some commodity prices”.

There was “still uncertainty about how quickly inflation will come back down”.

“In many countries, the prices of services are still increasing quickly and wages growth is above the rate that is consistent with sustainable achievement of inflation targets. Reflecting this, in underlying terms, inflation is proving to be uncomfortably persistent.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout