Property prices ‘to fall in Sydney and Melbourne next year’

Property prices in Sydney and Melbourne may fall in 2025 while Australia’s smaller capital cities could again experience double-digit growth, according to a housing economist.

Property prices in Sydney and Melbourne may fall in 2025 while smaller capital cities could again experience double-digit growth, forecasts by a housing economist say.

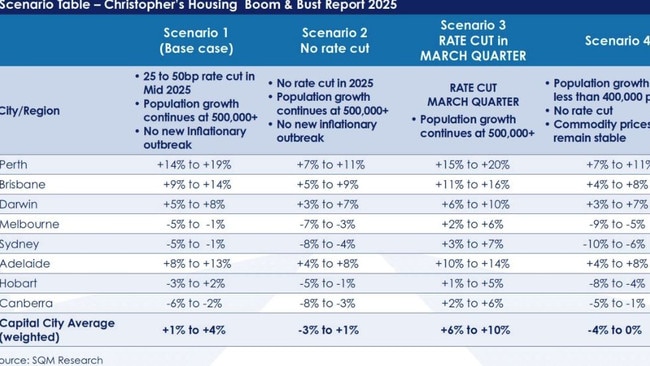

SQM Research’s annual Housing Boom and Bust Report suggests housing values at a national capital city level will experience weighted growth of 1-4 per cent, should buyer demand be buoyed by interest rate cuts in the second half of the year, population growth of more than 500,000, and no new inflationary pressures.

In the first of four scenarios, dubbed the “base case” by SQM managing director Louis Christopher, prices in Sydney and Melbourne are likely to fall between 1 per cent and 4 per cent, while strong growth is expected to continue in Perth (up 14-19 per cent), Brisbane (up 9-14 per cent) and Adelaide (up 8-13 per cent).

Canberra could record the largest falls of 2-6 per cent, with Hobart also down 2-3 per cent. Darwin may see gains of 5-8 per cent in this scenario.

“We are anticipating a cut in interest rates starting from mid-year,” Mr Christopher said. “For 2025, we are not anticipating much of a change in these current trends.”

In the second scenario, which would occur if interest rates remained on hold all year, strong migration continued and there was no change to inflation, prices would be more subdued.

Prices nationally could land between a 3 per cent fall or rise just 1 per cent. Sydney may then fall up to 8 per cent, with Perth the only city to crack double-digit gains.

If rates are cut in the first three months of the year and population growth continues – as per scenario three – prices are forecast to rally with national rises of 6-10 per cent, with gains across all capital cities. Melbourne, where prices have slipped in recent months, could rise as much as 2-6 per cent, while Perth and Brisbane could lift 20 per cent or 16 per cent respectively.

“Once interest rate cuts occur, we are expecting a speedy bounce in demand for Sydney and Melbourne in particular, which both are experiencing underlying housing shortage relative to strong population growth rates,” Mr Christopher said. “This may well mean there is a good window for buyers at this time for our two largest capital cities.”

In the least likely scenario, were population slows below 400,000, rates are not cut and commodity prices remain stable, prices in Sydney could tank by as much as 10 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout