Women short-changed in superannuation balances, new data shows

Women are twenty per cent less likely to contribute discretionary funds to their superannuation accounts, leaving them poorly equipped for retirement.

The burgeoning difference in superannuation balances between Australian men and women has been exacerbated by coronavirus, leaving women ill-prepared for retirement.

When the federal government allowed Australians to access their superannuation last year to deal with the financial burdens imposed by lockdowns, men experienced an average 18 per cent reduction on their superannuation balance, according to data from Colonial First State.

Women’s super accounts plummeted by 21 per cent. Australians withdrew more than $36bn in early super release payments in 2020.

From April to December, over $1.48bn was released to almost 200,000 Australians at Colonial First State superfund, with 63 per cent ($930m) to men, and 37 per cent ($550m) to women.

General Manager of CFS, Kelly Power, said women’s super accounts fell dramatically more than men because women had a “materially lower” account balance in the first place.

“If you‘re starting with a low account balance on average, and then you take that flat dollar amount of $10,000 or that $20,000 out, it will more meaningfully reduce the amount,” Ms Power said. “The $10,000 figure is not proportionate to the amount of money in the account, so when we know women start with lower balances it will hit them significantly harder.”

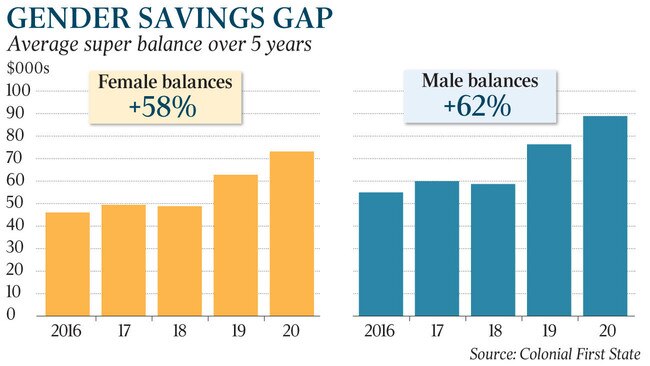

Women’s superannuation account balances on average have risen by 58 per cent since 2016, compared to 62 per cent for men.

The gap in the amount between the genders continues to widen dramatically, in a trend which saw an 18 per cent difference between men ($88,934) and women ($73,139) recorded in 2020, up from 16 per cent in 2016.

Ms Power said it was a “really large issue” that could be attributed to a number of factors.

“The first is that typically women take career breaks to take time out of the workforce to take care of children. During that period in many cases they‘re not paid super, because they are on parental leave or they’re not being paid at all,” she said. “The second, is from a guarantee perspective, superannuation is calculated as a percentage of your wage, so the gender gap in Australia more broadly contributes to the difference.”

Australian women are also 20 per cent less likely to contribute discretionary funds into their superannuation than men, which Ms Power said is most likely due to women having a lower amount of disposable income.

“It could also be as a result of not knowing as much about superannuation. We see that being aware and being informed is a real issue as well,” she said.

Women who received financial advice had a superannuation balance averaging 263 per cent higher than those who did not seek help.

As 34 per cent of women are living in poverty by the time they are 60 years old, Ms Power said “educating and engaging” young Australian women is “critical”.

“Knowledge is the pathway to action. We want more Australians to engage with their super and take positive action,” she said.

“Unless we put steps in place to ensure there is an awareness of this issue, and that women understand what is available to them in terms of additional contributions, it will become an even bigger problem.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout