Windfall $16bn oil, gas tax boost

Oil and gas tax revenue is projected to almost triple in 2022-23, fuelled by record LNG exports and soaring commodity prices.

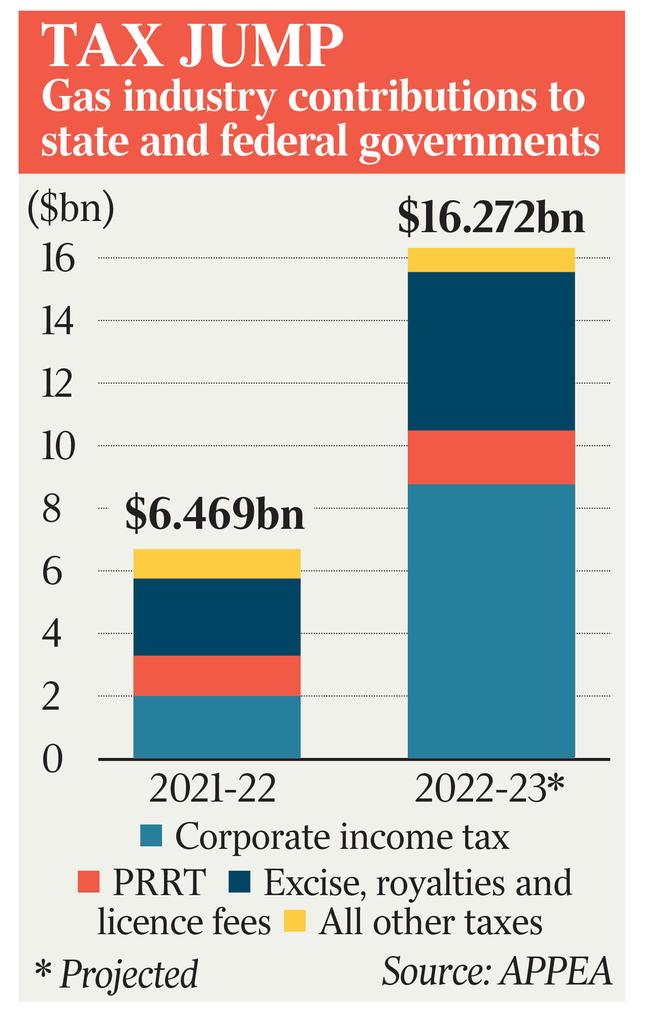

Oil and gas companies are on track to deliver a windfall $16.2bn in taxes, excise and royalties to federal and state governments, including $1.85bn under the petroleum resource rent tax regime earmarked for a major shake-up by the federal government.

Fuelled by record LNG exports and soaring commodity prices, the oil and gas industry is projected to almost triple its contributions to governments in 2022-23, up from $6.47bn the previous financial year.

New figures released by the Australian Petroleum Production & Exploration Association on Thursday reveal a budget-boosting surge in corporate income tax, rising from $2bn to $8.8bn.

Excise, royalties and licence fees will soar from $2.7bn to almost $5bn, with all other taxes increasing to $652m.

The tax and royalties update, providing a real-time forecast for the first time, comes 19 days before Jim Chalmers hands down his second budget on May 9.

Amid growing concerns across the oil and gas sector of a major resources tax overhaul in the budget, the federal Treasurer on Monday said the government wants to “make sure that the PRRT arrangements are up to scratch”.

Dr Chalmers, who this week confirmed he had received Treasury’s review into the PRRT but would not say whether changes would feature in the budget, said “the Australian community, I think shares those concerns”.

Dr Chalmers on Friday will host an energy investor roundtable in Brisbane with 33 of the nation’s biggest investors, major banks, global asset managers, super funds and energy and climate leaders to discuss reducing barriers and encouraging investment in clean energy projects.

He and Climate Change Minister Chris Bowen will flag major additional net zero transition investment in the budget, on top of more than $24bn already pledged by the government.

Under current settings, the PRRT taxes profits generated from the sale of marketable petroleum commodities including shale oil, liquefied petroleum gas, stabilised crude oil and sales gas.

It also captures offshore and onshore petroleum projects, excluding the Joint Petroleum Development Area.

Speaking at the National Press Club on Wednesday, Woodside Energy chief and APPEA chair Meg O’Neill warned the government against any “overreach” in the budget.

Ms O’Neill said the government must consider the long-term and “preserve Australia’s ability to attract the next generation of investment, jobs and energy supply”.

APPEA forecasts that its exporting members, who also produce domestic supply, will contribute more than $15bn to governments this financial year, up from $5.67bn.

Commonwealth projections released this month showed that LNG exports would hit $91bn in 2022-23, before easing to $45bn by 2027-28 as peak prices fall and volumes stabilise.

APPEA chief executive Samantha McCulloch said the record tax and royalties boost, which is subject to prices and foreign currency rates, would “fund construction of about 11 new public hospitals or 160 new schools, or cover annual healthcare for about 1.6 million Australians”.

Ms McCulloch said the tax windfall was helping governments fund “policies like disability support and paid parental leave as well as infrastructure like roads, schools and hospitals”.

“Gas companies are among the biggest taxpayers in Australia yet face compounding regulatory interventions that risk energy security, investment and future revenue streams to governments,” she said.

“The PRRT is delivering growing returns to taxpayers alongside other payments the industry makes in royalties, corporate income tax and other fees.”

An APPEA financial survey said the industry’s “estimated direct spending on Australian goods and services would grow to $45bn this financial year, up from $29.9bn previously”.

Ms McCulloch said in addition to direct payments, oil and gas companies were supporting 80,000 jobs and almost $500bn in annual economic activity.

She said more than $300bn had been invested in LNG projects between 2010 and 2020 and the “return on that investment is clear to see”.

“With changing economic conditions, including higher-than-forecast prices, the taxation profile of the LNG industry is changing and the sector is on a faster path to make up the losses accumulated during construction, bringing forward timeframes for tax payments,” she said.

“This further shows how the tax system – with long-term settings encouraging investment in major multibillion-dollar, high-risk nation-building projects – is working, stimulating investment, job creation and delivering for Australians.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout