To my mind, a very big red flag was waved in respect of the Whyalla steelworks when the owner, Sanjeev Gupta, flew into the city for a few hours in 2021 on his private jet and declared that “Whyalla is my spiritual home”. I thought at the time: yeah, right.

There is nothing innately wrong with Gupta’s business model – buying B-grade assets cheaply using a lot of debt and working the cycle to make money. Other companies do it and succeed.

But Gupta’s model also involved a quite explicit strategy to hoover up government subsidies by embracing green objectives, a ploy that many governments found very attractive. He even sought to securitise these subsidies as well as future orders to raise more debt, with Greensill his willing partner. It was an extremely risky strategy that has now ended in tears, at least for the Whyalla steelworks.

When Gupta bought the under-administration Arrium assets – once upon a time, OneSteel – in 2017, the steelworks were not the jewel in the crown. Rather, InfraBuild and the Tahmoor coalmine were much stronger assets in the group, financially speaking. Over the years, the Whyalla steelworks has never consistently made money, although the hedge of the iron ore mine it owns has proven very valuable at times.

While it is unusual for a state government to initiate a company being put into administration – and passing special legislation to boot – there is logic to the move. It’s hard to see how the steelworks had any future with Gupta in control. There are a lot of unpaid creditors (the state of South Australia is in fact one of the smaller ones).

An under-maintained plant partly explains why the blast furnace which uses coking coal blew up last year. Gupta’s plans to shift to an electric arc furnace were just that – plans.

Let’s be clear here that the state government doesn’t know how to run a steel mill, so the best hope is that a buyer can be found quickly and that the various sweeteners that both the state and federal government will offer up can get a deal over the line. Both governments will dress it up as a green transformation, but the reality is that virtually any buyer will be acceptable.

It’s hard to see BlueScope being interested in the steelworks – it is old and high-cost. Whyalla produces long products to a domestic market – think construction, railways – while BlueScope specialises in flat products with a very large factory in the US. BlueScope might be interested in the magnetite mine because this ore is more suitable for electric arc furnaces. But the ore requires further processing before it can be used to make steel.

Apart from the politics and assisting workers and the town, the case for saving the Whyalla steelworks – and avoiding a wipeout – is national sovereignty. There is an argument for retaining a domestic steelmaking capacity. In the past, long steel products were typically not traded as they are bulky and low value. But this is changing, with long products now being exported from China, in particular. Over the past several decades, China has invested vast resources in developing a steel industry using coking coal as a key ingredient.

It is said that the steel industry worldwide accounts for around 7 per cent of all greenhouse gas emissions. But whether there really is an appetite for customers to pay a price premium for green steel is uncertain at this point.

This won’t put off either the state or federal governments, although a possible bailout (nosebleed) figure of $2.4bn that is being floated is ridiculous for an asset that is effectively worth nothing.

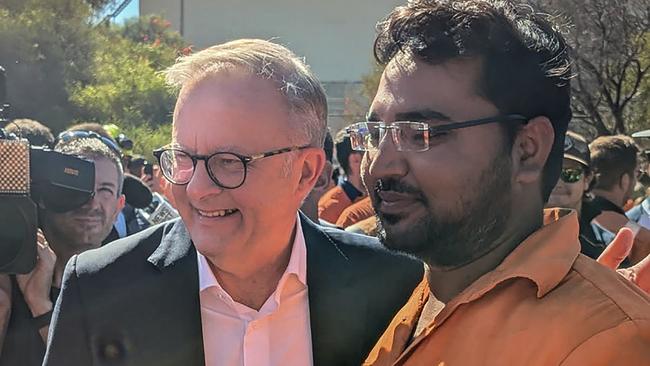

Just listen to the unsubstantiated statements of Industry Minister Ed Husic: “We need to make steel in a sustainable way. That means reducing the emissions involved … If we get that right, that is going to be a huge opportunity for the country as well, not just satisfying what we need, but also other countries that are keen to get steel made with lower emissions.”

That’s another, “yeah, right” from me.

The one upside at this point is the official abandonment of the $600bn green hydrogen project for the Whyalla precinct that the Malinauskas government had been promoting.

Along with virtually every other green hydrogen project in the country, this is now in the failed project file.

Without cheap and affordable electricity, there is no hope for the Whyalla steelworks using an electric arc furnace. Renewable energy won’t get you there. At least the South Australian government is recognising the central role that gas must play if the steelworks have a future without ongoing massive government subsidies.

There is a great deal still to play out but whatever route is taken, it looks like an expensive deal for long-suffering taxpayers.

By the time an administrator is appointed to run an ailing company with the aim of achieving a sale to pay off creditors and possibly salvage something for shareholders, a lot of red flags have been waved.