Victoria warned to rein in spending, refrain from adding taxes

The warnings come as global ratings agency S&P signals that almost $250bn of an expected $600bn in Australian state debt, or 42 per cent, is expected to be attributable to Victoria by 2027.

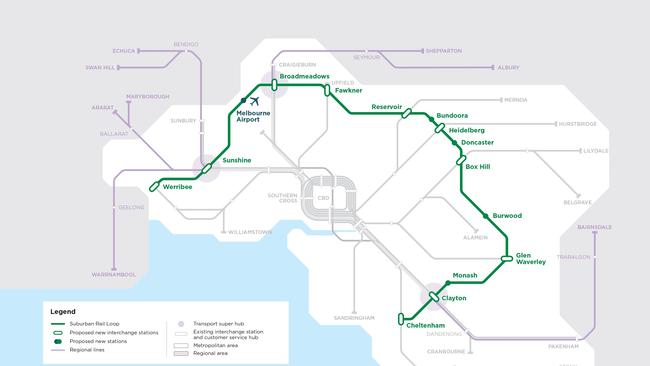

Victorian Premier Jacinta Allan must pull the brakes on spending on the Suburban Rail Loop and other big-ticket items in Tuesday’s budget, and avoid significant tax increases that could affect her state’s already perilous credit rating, top economists warn.

The message comes as global ratings agency S&P signals that Australia’s collective state debt is now rising proportionately faster than for most subnational peers in advanced economies – with almost $250bn of an expected $600bn in Australian state debt, or 42 per cent, expected to be attributable to Victoria by 2027.

Writing in The Australian, S&P director and lead analyst Martin Foo draws a distinction between states such as Queensland and Western Australia, which were able to pay down debt in 2023 courtesy of strong mining royalties, and Victoria and NSW, “which have been borrowing heavily and remain mired in cash deficits”.

“According to our projections, heavy borrowing streaks will continue into future years for the two most populous states,” Mr Foo writes. “As a result, Australia’s collective state debt is now rising proportionally faster than for most subnational peers in advanced economies, including Canadian provinces and German states.”

Mr Foo blames the rising debt on a nationwide “infrastructure binge” on road, rail, health and energy projects, involving a combined capital investment of $348bn over four years.

“In inflation-adjusted terms, this is about 1.7 times the size of the Marshall Plan that rebuilt post-war Europe,” he says.

He also points to the soaring costs of projects due to inflation in the price of labour and raw materials, unforeseen geotechnical obstacles, and “a tendency to commit to projects prematurely before they’re fully scoped”, as well as waning budget repair discipline as public service headcounts and cost-of-living subsidies increase.

“Finally, Australia’s intergovernmental architecture does not impose any firm statutory or constitutional budget rules. Australian states are free to set their own fiscal targets. These are non-binding and, in many cases, quite relaxed,” Mr Foo writes, citing the example of Victorian Labor, which set a target of explicit reduction of net debt as a share of state product when it came to power in 2014, before setting a ceiling of 12 per cent of GSP in 2019, “vaguely aiming to ‘stabilise (debt) in the medium term’ in 2023, with net debt now estimated by the state government to be at 21 per cent of GSP”.

Economist Saul Eslake said last year’s Victorian budget – the first after Labor was re-elected in 2022 – would have been the optimum time to make difficult decisions, as voters either would have forgotten about them by the next election, or would already be starting to see the benefits of the tough measures.

Mr Eslake said that after imposing a range of payroll and property taxes aimed at repaying $31.5bn of debt attributed to the Covid pandemic over the next decade in the 2023-24 budget, Victoria was running out of options to raise revenue without compromising its attractiveness for employment and investment.

“They missed that opportunity. They’ve got to do more in a shorter period of time than if they had moved with alacrity after they won the 2022 election,” he said.

“We’ve really got to look to the expenditure side for a meaningful contribution to getting Victoria on a credible path back to a surplus, and that needs to include both operating expenditures and capital expenditures.”

The independent economist said the state’s “hyper ambitious” infrastructure spending program could be scaled back, as it was one of the most significant drivers of Victoria’s debt levels. He said while current projects should not be cancelled, those in the pipeline could be deferred or reviewed altogether, and the government could justify this by explaining a delay could help budget pressures and also relieve upward pressure on labour costs seen in the private sector.

“Almost certainly (Tim) Pallas will boast on budget day that the so-called net operating balance … will return to surplus a year ahead as previously stated in 2025-26, and that’s good, but it’s not good enough,” Mr Eslake said.

“Because what you need to focus on is either the fiscal balance, or the cash balance.”

RMIT Emeritus Professor of Public Policy and Social Economy David Hayward agreed the government should rein in spending for large projects in the pipeline, amounting to about $90bn, and it should not announce new projects, such as capital spending on schools, health facilities and new roads, which could save it billions of dollars. Dr Hayward also criticised the December mid-year budget update. “Staggeringly, they announced $1bn of extra spending, which is probably a record amount in a budget update, most of it being spent on the housing statement,” he said.

“I don’t know whether it was a kind of farewell to premier Andrews, but it is now time to get the budget repaired.”

Dr Hayward said he wanted to see the new capital spend in 2024-25 fall from about $1.5bn this year to about $1bn.

NAB chief economist Alan Oster echoed calls to reduce spending in the upcoming budget.

“They need to look carefully at their spending plans … I think they have to make cuts,” he said.

“You can’t tax your way out of these things, unfortunately.

“I think they are very dependent on property taxes, and the problem with what they’ve done is by putting some of the other taxes on that, they’ve basically made that market less buoyant than the other markets around the place.”

Ms Allan refused to speculate on the content of the budget but said the government was “very aware, very attuned to … the cost pressures that Victorian families and households experience”.

“We acknowledge that many are doing it tough right now, the ongoing impact of the pandemic, the inflationary pressures, the interest rate rises, are all putting pressures on households and businesses, but they’re also putting pressure in other areas of our economy as well,” Ms Allan said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout