Them’s the tax breaks … costing $150bn

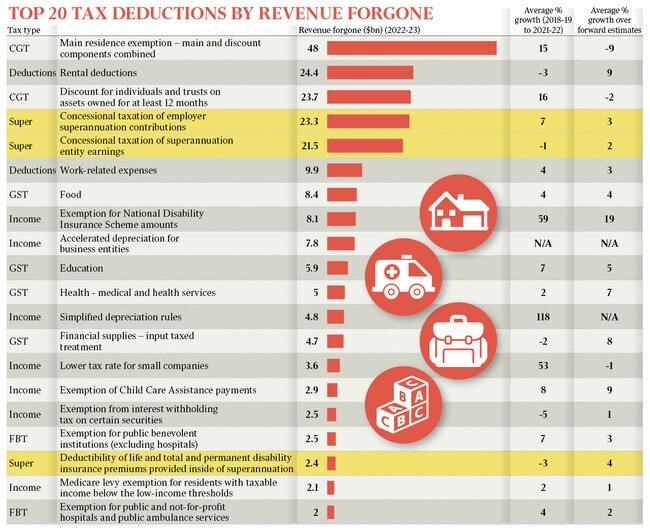

Tax breaks on the sale of the family home, superannuation, and for property investors are among the 10 largest tax concessions which cost the budget about $150bn in forgone revenue.

Tax breaks on the sale of the family home, superannuation, and for property investors are among the 10 largest tax concessions which cost the budget about $150bn in forgone revenue, according to Treasury analysis.

The release of the latest tax expenditures and insights statement coincided with the Albanese government’s announcement that the May budget would include a measure to double the tax on earnings for superannuation balances above $3m – a move expected to save $2bn a year once it comes into effect from mid-2025.

The tax data, which has been expanded to include distributional analysis of large tax expenditures and other key features of the tax system, comes as Jim Chalmers said the federal government had “been upfront and consistent about the challenges facing the economy and the budget”.

“As well as the cost of servicing a trillion dollars of debt, Australia also faces fast-rising expenditure in areas such as health, the NDIS, aged care and defence,” the Treasurer said.

The TEIS showed nearly $48bn in capital gains tax exemptions on the family home in this financial year – an amount that was expected to drop by 8-9 per cent on average over the four-year forward estimates period.

The statement for the first time detailed how rental deductions on investment properties would cost the budget $24.4bn in 2022-23 – making it one of the largest single tax concessions.

Rental deductions would grow at an average annual rate of 9.4 per cent over the forward estimates.

There were about 1.3 million taxpayers with negatively geared investment properties – or who posted rental losses – driving a forecast $3.6bn loss in tax revenue.

There was a further $23bn in revenue foregone on CGT discounts for individuals, such as property investors, and for trusts.

Independent economist Chris Richardson said the TEIS was “absolutely the best single place for the government to look in search for a better budget”.

The 15 per cent concessional rate on super contributions would cost an estimated $23.3bn in 2022-33, Treasury said, while concessional tax breaks on super earnings – including 15 per cent in the accumulation phase and zero for most savers in retirement – cost an additional $21.5bn.

The other major super concession was $2.4bn for the deductibility of life and total and permanent disability insurance premiums inside super, bringing the total in super concessions to over $47bn.

Dr Chalmers said the annual statement showed “the majority of … super tax breaks go to high-income earners”.

“For instance, over 55 per cent of the benefit of superannuation tax breaks on earnings flow to the top 20 per cent of income earners, with 39 per cent going to the top 10 per cent of income earners,” Dr Chalmers said.

Of the $17.2bn franking credits claimed by individuals, where shareholders are paid untaxed dividends, Treasury said about 88 per cent “were received by people with above median taxable income, including 68 per cent by people in the top taxable income decile”.

“Around one in five (19 per cent) of people receiving franking credits were in the top income decile. They received an average of $19,300 of franking credits,” the statement said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout