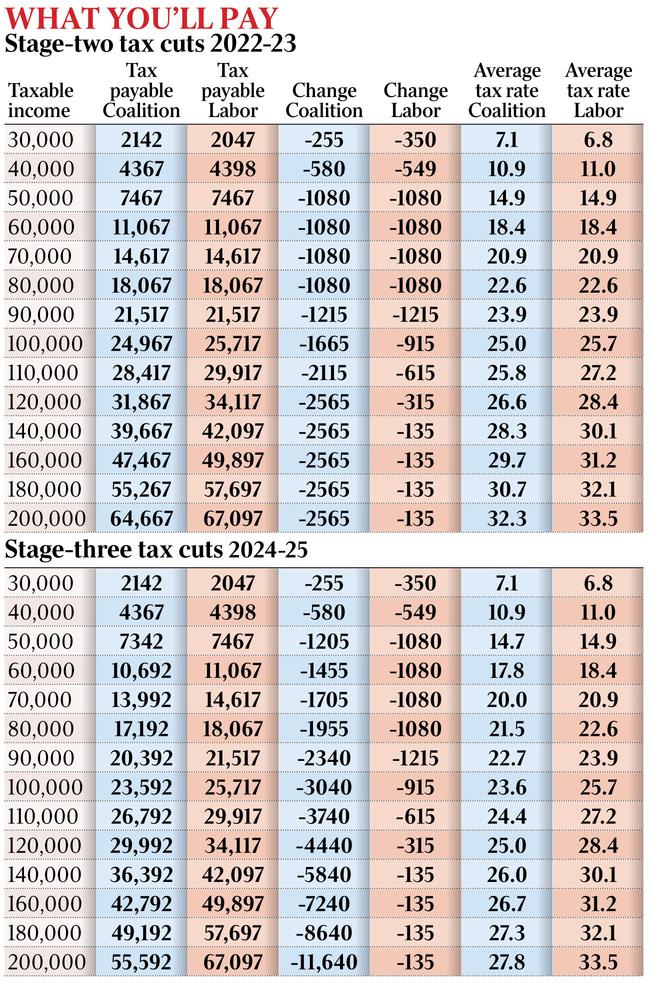

A similar trend but not as pronounced is revealed in 2022-23 showing that wage earners above $90,012 — about $79,000 in the current financial year — are better off under the Coalition than Labor. This includes much of the middle-income range.

The tables released by the Coalition yesterday contradict claims that stage two and stage three of the Morrison government’s tax cuts do not assist middle and low-income Australians.

In 2024-25, the gains under the Coalition compared with Labor are substantial. At $80,000 income, the tax gain under the government compared with Labor is $875 yearly, at $100,000 it is $2125 yearly and at $140,000 it reaches $5705 yearly.

By opposing stage two and stage three of the government’s tax plan — and refusing to offer any comparable Labor reform to the rate scale — Labor is consigning middle-income earners to higher marginal rates and higher taxes. This gives the Morrison government a potent electoral weapon.

Labor’s gamble is that the public will accept its claim that stage two and three are on the never-never, two elections away and should be discounted. Yet the entire utility of the government’s package depends upon three stages that sees the average wage earner on a marginal rate of 30c in the dollar.

Under Labor in 2021-22, average full-time wage earners move into the second-highest bracket of 37 per cent.

Labor’s claim that the bulk of the tax cut funds go to high income earners is correct — but this reflects the progressive nature of the system where high income earners are paying far more tax in the first place.

Under the government’s completed package, the better-off continue to pay the overwhelming bulk of taxation, with the top 1 per cent of taxpayers paying 17 per cent of total tax and the top 20 per cent of taxpayers paying 60 per cent of total tax. It is hard for Labor to sustain its “never-never” argument when the stage two tax cuts in 2022-23 come at the end of the next parliamentary term. By any measure, that is relevant. It is even harder for Labor to sustain this argument when it is pledged to repeal the stage two and stage three of the $144 billion legislated tax cuts from the previous budget.

In the immediate 2018-19 year under Labor, workers earning less than $48,000 will be better off than under the Coalition. Labor estimates this at 3.6 million workers. The superior Labor benefit, for a worker on $40,000 a year, is about $70 a year or about $1.50 a week. In summary, the threshold points in the table released by the government yesterday are: in 2022-23 an income of $90,012 above which people are better off under the Coalition and in 2024-25 an income of $39,105 above which people are better off under the Coalition.

The government tables highlight the extent to which Labor is prepared to back its strategy that the public wants more funds spent on services, notably health and education, as opposed to tax cuts.

The extent to which it is prepared to expose itself on the tax cut front is substantial.

The magnitude of Labor’s huge gamble on tax policy is revealed by tables released yesterday showing in 2024-25 all wage earners on more than $39,105 are better off under the government than Labor, with the government’s benefits extending across the low and middle income range.