Targets on super-sized public service perk

Tony Abbott’s chief cost-cutter says 15.4 per cent super contributions for public servants, politicians “doesn’t stack up”.

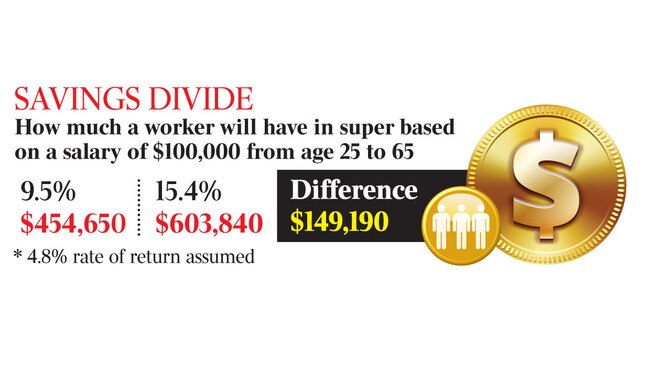

Tony Shepherd, chairman of the Abbott government’s landmark cost-cutting taskforce, has questioned whether federal public servants and politicians should enjoy 15.4 per cent employer superannuation contributions when most other workers receive only 9.5 per cent.

Mr Shepherd told The Weekend Australian yesterday it was “probably an oversight, to be blunt” that his 2013 Commission of Audit, which recommended drastic cuts to welfare, didn’t examine the extra super contributions enjoyed by the nation’s federal public sector workforce. Estimates suggest the difference in super contributions costs taxpayers about $1.6 billion a year.

“There really needs to be a review: the argument for having a higher rate of superannuation in the public sector doesn’t stack up now,” Mr Shepherd said.

He pointed to the faster growth in public-sector salaries, compared with the private sector.

“It was only drawn to my attention later. Treasury were advising us during the audit and funnily they didn’t put it forward,” he said.

Total cash wages paid to federal government employees (including all agencies and universities, but excluding the military) were $21.07bn last financial year, implying government super contributions of about $3.8bn, or $1.6bn more than a 9.5 per cent contribution rate would have required.

Universities typically pay staff 17 per cent superannuation.

Former NSW Labor treasurer Michael Egan said public servants were often well paid compared with the private sector. “It was a bit rough on taxpayers to say public servants should be paid more super than everyone else,” he said.

Public-sector wages have consistently grown faster than private-sector wages since 2013, rising 2.4 per cent last year compared with 1.9 per cent in the private workforce. The average total remuneration for mid-level managers (classification EL2) was $169,918 in the federal public service in 2016.

A spokesman for the Commonwealth Superannuation Corporation, which oversees eight federal public-sector schemes, said super contributions were paid at a rate of 15.4 per cent on “the entire salary even if that salary is over $54,030 a quarter”. By law employers need pay compulsory super only on salaries up to $216,000 a year.

“In the old days the public servants had a far better pension, but they didn’t get paid as much; I don’t know whether that comparison is valid anymore,” Mr Shepherd said.

Across Australia public sector workers earned $92,000 a year on average last year, according to the ABS, compared with $82,900 for those in the private sector.

Finance Minister Mathias Cormann said the Howard government’s decision to shut defined benefit superannuation in July 2005 in favour of a 15.4 per cent employer contribution had “saved taxpayers a lot of money by materially reducing future unfunded public sector super pension liabilities”.

Senator Cormann said the rate of superannuation didn’t affect workers’ total pay. “A higher percentage in the context of an overall remuneration package going into super means less money going into take-home pay,” he said.

Opposition Treasury spokesman Chris Bowen said lifting the super rate for all workers would reduce the disparity.

“The Abbott-Turnbull government has already delayed the SG increase twice, costing working Australians billions of dollars in future retirement income,” Mr Bowen said.

The super guarantee rate is scheduled to rise to 12 per cent from 9.5 per cent by 2025.

Community and Public Sector Union secretary Nadine Flood said it was “revolting” to consider lowering the super rate for public-sector workers. “All workers should receive super of at least a rate of 15.4 per cent,” she said.

Daryl Dixon, an authority on superannuation, said the argument public servants earned less was “rubbish”. “We run a business in Canberra,” he said. “Firms can’t pay these sorts of wages the public sector pays.”

Former Labor leader Mark Latham, who pressured the Howard government to end defined benefit superannuation schemes, said MPs had been “outraged” by their abolition. “Some smarties on both sides of parliament worked out they could salvage something by making the scheme for new MPs comparable to the APS, ie 15.4 per cent,” he said.

“I had also wanted to get rid of defined benefits super for judges but our shadow AG hit the roof, alerted the legal profession, and they started lobbying hard. I had enough trouble getting the modified policy through for MPs.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout