Surplus safe with fast-track tax cuts, new study says

The Coalition could bring forward its tax cut plan without sacrificing surpluses, according to new analysis.

The Coalition could bring forward its tax cut plan without sacrificing surpluses, according to analysis that slams government modelling for ignoring how changes in marginal rates can be a disincentive to work.

In a new research report, the free-market Centre for Independent Studies accused the Treasury of “dumbing down” the tax debate.

It concluded that the first stage of the government’s $158bn tax package, which began in July, has damaged the economy by increasing marginal income tax rates for those earning between $90,000 and $126,000.

“The low- to medium-income tax offset tax changes will actually decrease GDP and the economic efficiency of the tax system,” John Humphreys, the report’s author, concluded.

The findings emerge as a cloud hangs over the effectiveness of the first stage of the government’s six-year plan. Retail sales and business and consumer confidence have stagnated since July, when $8bn in non-refundable tax credits became available to Australians earning between $48,000 and $90,000.

The clawing back of the $1080 Low and Middle Income Tax Offset payment from those earning more than $90,000 requires their effective marginal income tax rate — which affects decisions to work and save — to increase from 39 to 42 per cent.

Dr Humphreys has argued that the later phases of the government’s tax package — reducing the main 32.5 per cent rate to 30 per cent and scrapping the 37 per cent bracket — would reduce revenue by $145bn over 10 years.

This is 38 per cent less than the $245bn estimated by Treasury. These changes are not due to take effect until 2024-25, while in 2022 the top threshold of the 19 per cent tax bracket will increase from $37,000 to $45,000.

“When marginal tax rates change, at least some people will change some of their behaviour some of the time … The Australian Treasury continues to rely on a static tax model that makes the absurd assumption of zero behaviour changes,” Dr Humphreys said.

“It would be possible to bring forward the structural tax reform while still maintaining a budget surplus. The starting date for the structural reforms is disappointingly late.”

Dr Humphreys called on the government to bring forward the final stages of the tax plan to 2020.

“We can start experiencing the economic benefits as quickly as possible, though the downside is relatively small budget surpluses this and next year,” he said.

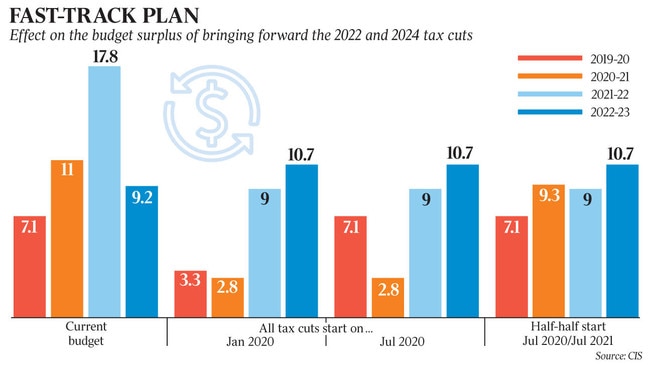

On his estimates, the forecast $7.1bn and $11bn surpluses forecast for this financial year and next would fall to $3.3bn and $2.8bn were the full tax cut plan to come into effect from January.

Steven Hamilton, a visiting economics professor at the Australian National University and a former Treasury official, said overseas governments had “for many years incorporated behavioural responses into their revenue forecasting, and in many cases these adjustments can be substantial”.

The Australian Treasury’s methodology assumes a 100 per cent rate of income tax would not alter taxpayers’ behaviour.

Professor Hamilton said the $1080 LMITO was “very messy” tax policy designed to quarantine tax cuts from people on higher incomes. “Because the tax cuts are clawed back as incomes rise, they discourage people in that range from earning additional income,” he said.

Dr Humphreys said that the LMITO would reduce revenue by $35bn over the next four years, rather than the $31bn forecast by Treasury, because of the disincentives to work.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout