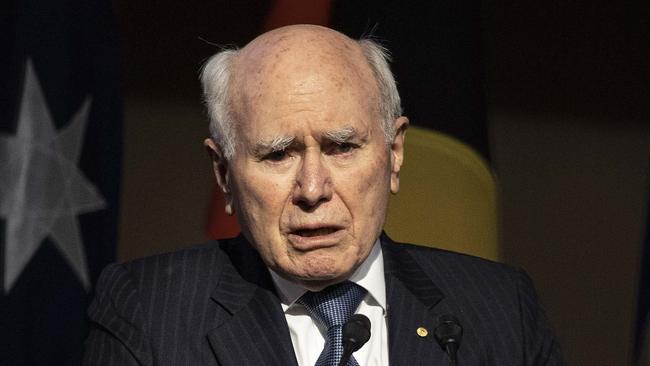

Super-charged attack will unsettle middle Australia, says John Howard

The former PM says the Albanese government’s proposed reforms to super are driven by a belief that people’s retirement savings are a political ‘honey pot’.

John Howard has described the Albanese government’s proposed reforms to superannuation as an attack on middle Australia driven by an ideological belief people’s retirement savings are a political “honey pot” for Labor and unions.

The former prime minister’s strike against the proposed changes to super, which the government maintains are minimal, comes as Peter Dutton vowed that one of the first acts of a future Coalition government would be to overturn Labor’s planned legislation to enshrine a purpose for super that would prohibit early access to funds for purchasing a first home.

“One of our first acts in government will be to overturn the legislation, which has been driven by ideology and not by super fund members’ best interests,” the Opposition Leader said.

“Ultimately, the test here is that if you have worked hard and put your money into your super, then the principle should be deriving the best benefit for you and your family. Investment decisions about where your money goes shouldn’t be made according to the objectives of a cash-strapped Labor government. It should be maximised for your needs.

“Labor is more interested in pleasing union bosses than doing the right thing by Australian taxpayers.”

The Prime Minister this week has repeatedly hosed down concerns about the government’s intentions following hints from Jim Chalmers that concessional tax rates would be targeted for large super balances, with the possibility that balance caps were also being contemplated – a proposal that received support from some of the large super funds.

The Treasurer also flagged the government’s ambitions to leverage the $3.3 trillion held in super funds to invest in government-backed nation-building projects, while proposing to legislate an objective for superannuation that would “preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way”.

This would prevent the Coalition from implementing in the future its policy to allow early access to a portion of super for first-home buyers – a policy it took to the last election. Mr Howard told The Weekend Australian he believed the Albanese government’s plans were politically and ideologically motivated in their design by placing prohibitive restrictions on future governments. He also accused the Albanese government of breaching an election commitment, with Dr Chalmers and Assistant Treasurer Stephen Jones both signalling strongly that the government would target tax concessions for the largest balances, which could save the budget $1.5bn a year.

“They see it as a honey pot for the government,” Mr Howard said. “This is going to cause a lot of unease within the whole community and particularly people who have invested in superannuation. This is very unsettling to middle Australia, it really is.

“We were told they weren’t going to do anything. And it’s all very well to say ‘we will just skim a bit off the top’. Well, that’s just the first chapter in a very long book.

“We don’t know what they are about except in terms of increasing the tax take, we know that for certain. And once you throw that hand grenade into the crowd, you don’t know how many casualties there will be.”

Mr Howard said he could see no merit in seeking to narrowly define a purpose for super, likening it to a bill of rights that placed limits on freedoms rather than expanding rights.

“Of course it’s politically motivated and it could mean that any future government that wanted to do something that could be argued was inconsistent with that objective would not only be constrained but possibly prevented from doing it if they don’t have the parliamentary numbers.

“Why have limitations on something that means different things to different people?”

Mr Albanese on Friday repeated his claim his government had no plans for “major changes”. He said this remained consistent with Labor’s pre-election pledge. “We want to see the objectives of superannuation enshrined,” he said. “And the objectives of superannuation are about people’s retirement incomes.

“There are exceptions in which people have been able to use their superannuation, but that’s the objective. That is what we have said, that is what we are doing. I’ve ruled out major changes to superannuation.”

Mr Howard also accused the industry super funds of being politically motivated. “If you look at these industry funds and who they are chaired by, it’s almost like a House of Lords for Labor politicians,” he said.

Dr Chalmers has argued the budget was forecast to owe more to super tax concessions than the aged pension within 30 years and that the super system needed to be made sustainable. Others have also questioned whether a person with a balance of more than $3m needed a tax break.

Mr Howard said he was a strong supporter of a policy to allow early access to super for home ownership. “The view that a lot of people, including me, have is that it is people’s money, not the government’s money, and I think that is something that has been lost sight of,” he said.

One of the early architects of the industry superannuation system and former ACTU assistant secretary, Garry Weaven, has warned constant changes risked “undermining the whole basis of super”.