Coronavirus: PM says Australia could see lower interest rates but rejects cash rate will go negative

Scott Morrison says Australia could see lower interest rates in coming months but rejects that the cash rate would go negative.

Scott Morrison says Australia could see lower interest rates in coming months as the economy slows due to coronavirus, but he dismissed the idea that the cash rate would go negative, saying “the heavy lifting has to be done by fiscal policy now”.

“I’d be very surprised if we saw that situation in Australia,” the Prime Minister told 2GB’s Alan Jones on Friday morning.

“Based on my recent discussions with the (RBA) governor, Australia is in a strong position.”

Mr Morrison moved to reassure Australians, saying he will still be attending the NRL on Saturday despite coronavirus fears and urged the country to “keep calm and carry on.”

“I’ll be out supporting the sharks on Saturday night and I’m sure it’ll be a great game,” he said. “Until there is health advice — and we haven’t got that health advice at this point ... people should go about their daily life.

“It is important for our economy and just our general wellbeing that people get about their daily lives.”

Mr Morrison also defended the measures contained within his government’s $17billion stimulus package, including a payment of up to $750 for individuals on government benefits, saying the measure will get “people to spend in the economy because that’s what supports people’s jobs” and hinted at further, targeted support for China export-orientated businesses like abalone fishermen who have seen sustained declines in their business..

Mr Morrison also pushed back against criticism that the second-tier deeming rate was unrealistically high at 200 basis points above the cash rate, saying retirees could receive a better rate of interest by taking their money out of traditional bank accounts.

“I’d encourage people to talk to the financial advisors, because they could be doing better than that,” he said.

On Thursday night, in an address to the nation, Mr Morrison declared his government had a “clear plan’’ to see Australia through the coronavirus crisis as he released his $17.6bn stimulus plan to boost the economy.

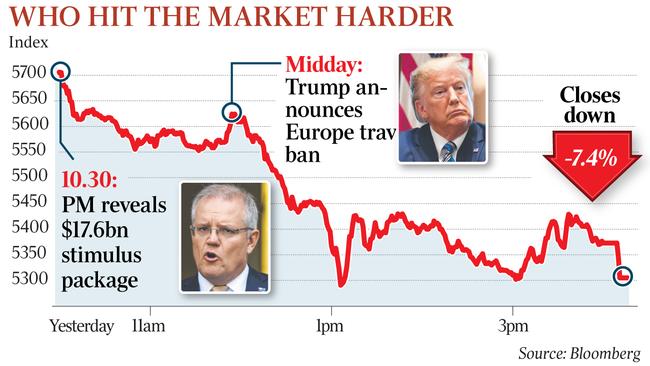

The Prime Minister’s reassurance, in the nationally televised address, came after Donald Trump’s suspension of all travel from Europe to the US to combat the spread of the coronavirus epidemic unleashed a wave of financial market turmoil.

Mr Morrison, who announced a stimulus package aimed at business and households, said the government was taking the crisis seriously and would “see Australia through”.

“I know many Australians are anxious about this and we do still have a long way to go,” he said. “But be assured we are taking action and we have a clear plan. The months ahead will present many challenges but we will respond to it.’’

The US President’s stunning bid to slow the spread of the virus sparked a wave of selling in early trade on European sharemarkets after another day of carnage wiped $127bn from the value of Australian shares. The ASX finished the day down 7.4 per cent following Mr Trump’s COVID-19 announcement.

Josh Frydenberg, who on Thursday unveiled the stimulus package, told The Australian the introduction of travel restrictions showed the coronavirus was “generating a momentum of its own”.

“And as more countries put in place travel restrictions, as more businesses put limits on staff movements, even domestically, then that is going to affect the economy,” Mr Frydenberg said.

The Treasurer said he had not put “limitations” on expanding the Morrison government’s stimulus measures and would actively monitor economic data to determine the impact of his phase one package aimed at avoiding Australia’s first recession since 1991.

Mr Frydenberg said he expected China, the epicentre of the COVID-19 outbreak, to roll out its own stimulus measures and flagged an economic boost for Australia if President Xi Jinping opted for a significant “infrastructure component”.

He said he was in close contact with international counterparts who were working on their own economic measures.

Dismayed European diplomats said they had been given no warning of the travel ban. Mr Trump’s edict, to close US entry for 30 days to people from the Schengen area — meaning Britain is outside the ban — was made when Europe was asleep.

European Council President Charles Michel was the first European leader to react, tweeting: “Economic disruption must be avoided.” Britain’s Chancellor, Rishi Sunak, was one of the first leaders to comment, criticising the US action as not being the right thing to do and noting that Britain would not be adopting a similar approach to ban Europe travellers.

The Australian government’s stimulus will provide $11bn in direct stimulus before June 30 through $750 cash payments to pensioners, eligible households and the unemployed, as well as tax breaks and cash grants to small and medium sized businesses. The funding allocated this financial year, estimated by Treasury to be the equivalent of 2.2 per cent of quarterly GDP, was welcomed by economists and industry groups.

Following Finance Minister Mathias Cormann’s admission that 2019-20 was “obviously not going to be a surplus year”, business urged the government to pursue tax and industrial relations reform as part of a long-term structural response to the economic impact of COVID-19.

Business Council of Australia chief executive Jennifer Westacott said “heavy lifting” in the budget was needed to ensure the recovery was permanent, as Australian Chamber of Commerce and Industry chief executive James Pearson said the budget provided “another opportunity to … consider broader structural reforms”.

Ahead of the Council of Australian Governments meeting in Sydney on Friday, the Prime Minister said he was working closely with state and territory counterparts who had been waiting for the commonwealth to announce its stimulus package.

Mr Frydenberg expects further G20 finance minister meetings would be convened in response to the COVID-19 economic shock.

“We haven’t limited ourselves as to what we may need to do in the future,” he said. “We’re now, through Treasury, eliciting more data to see what the impact of these measures will be having across the economy. That’s the EFTPOS data from some of the banks. That’s the increased ABS data. That’s the Treasury business liaison program. We’re going to watch and monitor this. We’re not putting limitations on ourselves as to what we may be required to do in the future. We’re continuing to monitor it closely.”

Mr Frydenberg, who urged Australians to spend their one-off cash payments on the “things that matter most to you”, pointed to the potential of a China recovery after receiving feedback from companies that people were “getting back to work in China”.

“The other interesting point is commodity prices,” he said. “They’ve held up. Ore is in the mid-80s. It’s held up.

“Why? One, because the steel mills have kept going. But two, there’s an expectation of a China stimulus. And the Chinese stimulus is often with a big infrastructure component. And Australian companies will be in a good position to benefit out of that.

“There’s definitely an assumption (from Treasury) that China will conduct a significant stimulus but the timing of that is uncertain because the timing of the spread of the virus is uncertain.”

Mr Morrison said $22.9bn would go out the door to stimulate the economy over the next two financial years and the hit to the budget bottom line would be $17.6bn over the forward estimates. “That’s 1.2 per cent of GDP. This is a significant investment. We have taken the decision to put this stimulus in place that has the obvious impact on the budget outcome for 2019-20,” he said.

“What we need to look carefully at over the next few years is how the broader global impacts will impact on the Australian economy out over the next three or four years.”

Anthony Albanese and his senior economic team, including Jim Chalmers, on Thursday night were assessing Labor’s response to the stimulus package but The Australian understands they would adopt a bipartisan approach. The government will present an omnibus bill including the cash handouts to parliament later this month, the final sitting week before the budget.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout