Stamp duty’s ‘double-edged sword’ to cut deep into states’ budget repair bids

Moody’s says states’ over-reliance on stamp duty revenue will make it more difficult to pursue budget repair as the property market cools.

Global ratings agency Moody’s says states’ over-reliance on stamp duty revenue through the pandemic property boom will make it more difficult to pursue budget repair as the property market cools.

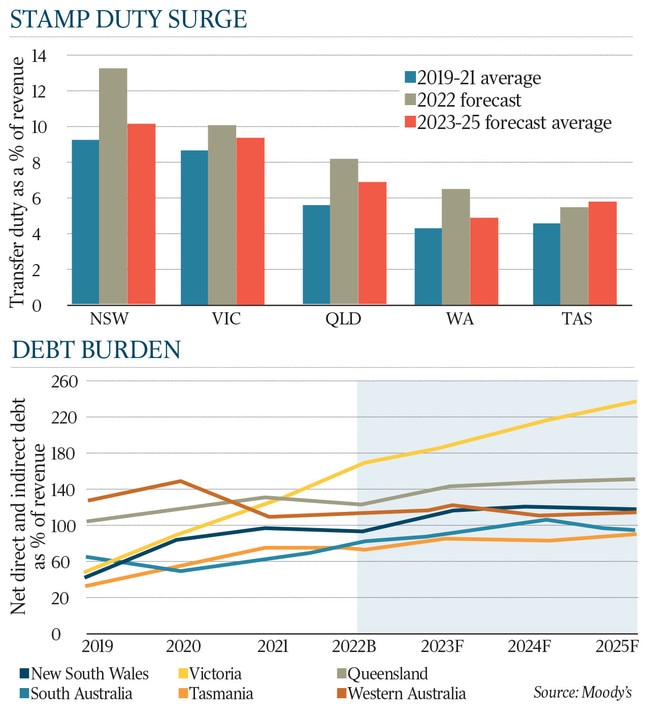

A report from Moody’s said transfer duties would be an estimated 13.2 per cent of NSW’s revenues in 2021-22, according to the state’s mid-year budget, against an average of less than 10 per cent over the three years to 2020-21.

In Victoria, stamp duties are budgeted to make up 9.8 per cent of state revenues this financial year against under 9 per cent on average over the previous three.

The drop-off in transfer duties will be most evident in NSW, with average annual transfer duties expected to decline to just above 10 per cent of total state revenues over the three years to 2024-25.

“Given this elevated revenue concentration, the transaction-dependent nature of transfer duties heightens the exposure of state revenue to any sustained weakening in housing affordability or house price corrections,” the report said.

Moody’s analyst John Manning said the surge in transaction tax income out of the roaring property market was a “double-edged sword” for state and territory treasurers.

Separate data from digital property settlement platform PEXA revealed Australians spent more than $688bn on property in 2021 – a 57 per cent increase on 2020. There were 834,000 home sales in 2021, or 32 per cent more than the year before, the figures showed.

Frenzied activity in the property market through 2021 was underpinned by a 21 per cent jump in prices – the fastest growth in 30 years. Booming stamp duty revenues had provided “strong revenue support through challenging operating conditions, but at the same time it has added to revenue concentration,” Mr Manning said.

With economists and households now expecting rates to rise this year, analysts predict a cooling in the property market, and potentially price falls of as much as 10 per cent in 2023.

Mr Manning said this would not only drive states’ stamp duty revenues down, it would also weigh on overall economic activity – and therefore other tax income – if falling net wealth triggered consumers and businesses to spend less.

“Importantly, the GST pool remains vulnerable to a slowdown in discretionary spending that could arise from a continued deterioration in housing affordability.” the report said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout