‘Retrograde step’: Labor’s retreat signals ‘death knell’ for reform, says ACCI’s Andrew McKellar

Anthony Albanese’s changes to legislated stage three tax cuts are the ‘death knell for tax reform’, the head of one of the biggest business groups says.

Anthony Albanese’s changes to legislated stage three tax cuts are the “death knell for tax reform”, the head of one of the biggest business groups says.

Australian Chamber of Commerce and Industry chief executive Andrew McKellar said the government’s integrity and transparency had been called into question.

“There is a modest reform in the (legislated) stage three tax cuts – if they are to be affected, as we have seen reported may be the case, that would be a major backwards step in terms of the ambitions for tax reform in this country. It would be a death knell for tax reform,” he said.

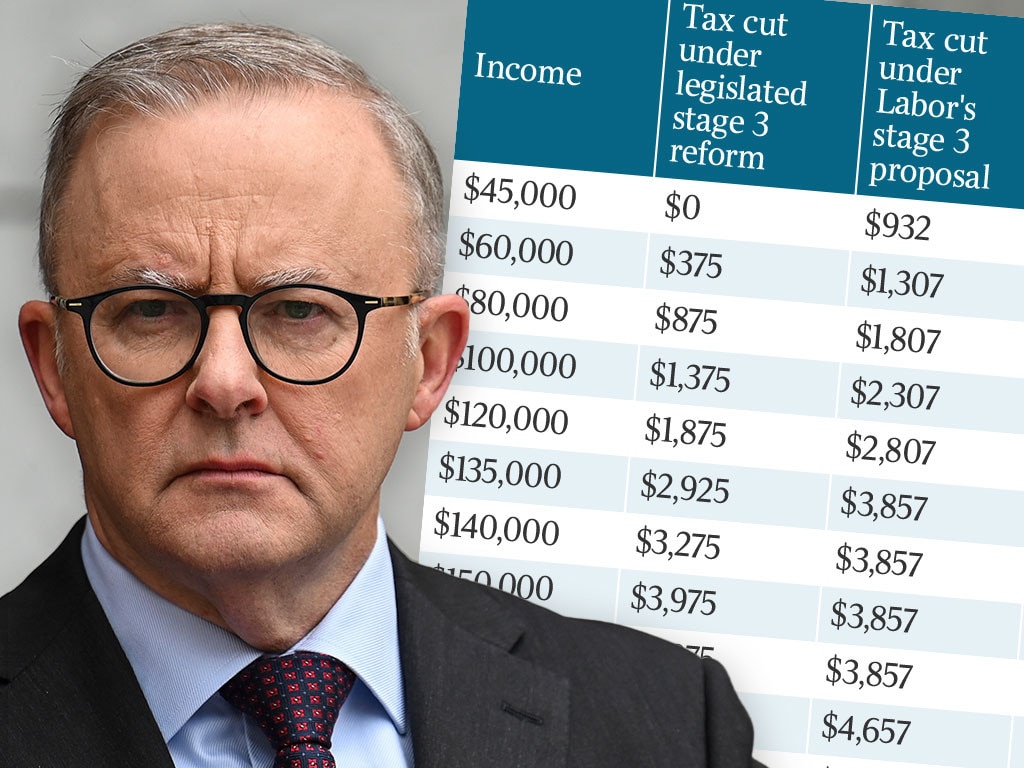

Mr McKellar said retaining the 37 per cent tax rate for workers earning $135,000 and above meant people would continue to pay higher tax.

“We want to flatten out the tax system, we want to simplify it, we want to reform it,” he said.

“Tinkering with it now is a retrograde step. It sends the wrong signal. It’s not a courageous move. It’s a weak move. It’s a very regrettable move and I think it’s one that really should not be taken.”

Australian Industry Group chief executive Innes Willox said Labor’s proposed changes would ensure the tax system lacked simplification, bracket creep continued to grow and middle Australians earning more than $150,000 would lose out.

“We still have a complicated four-tier tax system that discourages aspiration and disincentives the majority of people from wanting to work harder and earn more,” Mr Willox said.

“If the top tier moves from $180k to $190k, it’s a minimal change. The data I’ve seen tells us over 700,000 people have moved into that (45 per cent) tax bracket since it was introduced in 2009.

“If you indexed it, you’d end up with it at about $260k.”

“When you look at these modifications of tax cuts, I would have thought they could have achieved more by raising the tax-free threshold above $18,200,” he said.

“If they were trying to benefit people on low incomes, raising the tax threshold might have had a bigger impact. What this ended up as (is) very minimal. I don’t think it will have much impact at all.”

Mr Turner, who co-founded Flight Centre in 1982 and remains the company’s chief executive, said the changes would likely make little difference for consumers coping with high inflation and higher interest rates.

“The benefits are so small, particularly in relation to current inflation,” he said. “The impact on inflation or on people’s spending patterns is going to be negligible.”

That also meant, he said, that he did not expect the changes would impact his business.

“Most of the people who travel reasonably extensively are middle to higher income earners and the amount of benefit that they are getting is pretty minimal … so we don’t see any negative or really positive effects from what’s been announced,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout